Monopoly

Week 6

Krisna Gupta

15 March 2021 (updated: 2021-03-15)

Recap on last week

We've learned various types of costs

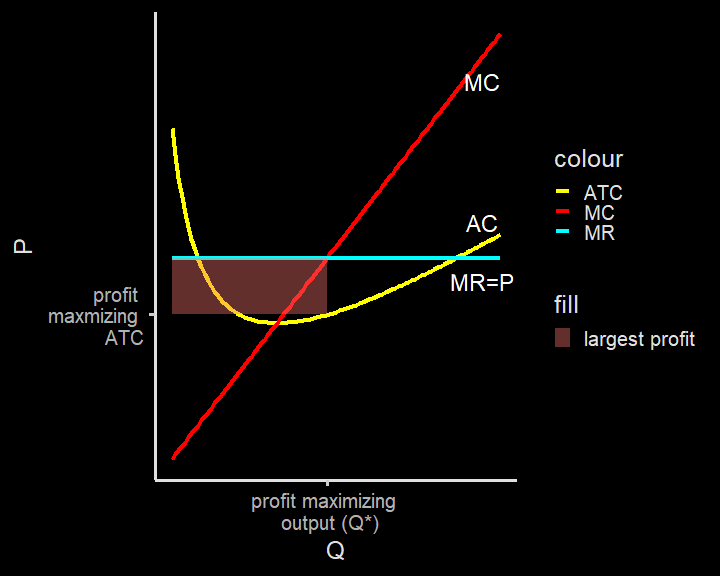

Two different levels of \(Q\):

- cost minimizing when \(MC=ATC\)

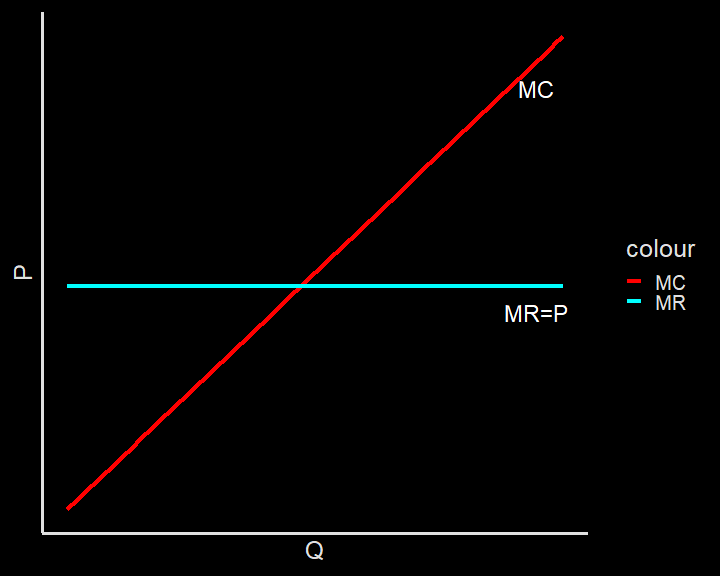

- profit maximizing when \(MC=MR\)

We've learned the condition in perfect market:

- \(P\) is independent of producer's decision

- hence: \(MR=P\)

Today

Entry and exit

What happens when the market is a monopoly

Price discrimination

Entry & Exit

Entry & Exit

To construct the overall supply curve, we need to look at what Liv would do in different price setting.

We have different level of Q. Time to learn different types of prices for supplier.

Two types of Prices:

- Break-even price = minimum ATC

- Shut-down price = minimum AVC

Break-even and Shut-down

Break even price is the price level where Liv is operating at the lowest profit.

- She might not want to produce at a loss.

If price goes below break-even price, shutting down may not be necessary.

In the short-run, fixed cost must still be paid regardless of Q produced. It's better to produce to cover some of the fixed cost.

Shut-down price is the price level where Liv can still cover her variable cost, and have something left to cover a fraction of the fix cost.

Liv's Cost Structure Again

| Q | FC | VC | TC | MC | AFC | AVC | ATC |

|---|---|---|---|---|---|---|---|

| 0 | 108 | 0 | 108 | 0 | Inf | NaN | Inf |

| 1 | 108 | 12 | 120 | 12 | 108.00 | 12 | 120.00 |

| 2 | 108 | 48 | 156 | 36 | 54.00 | 24 | 78.00 |

| 3 | 108 | 108 | 216 | 60 | 36.00 | 36 | 72.00 |

| 4 | 108 | 192 | 300 | 84 | 27.00 | 48 | 75.00 |

| 5 | 108 | 300 | 408 | 108 | 21.60 | 60 | 81.60 |

| 6 | 108 | 432 | 540 | 132 | 18.00 | 72 | 90.00 |

| 7 | 108 | 588 | 696 | 156 | 15.43 | 84 | 99.43 |

| 8 | 108 | 768 | 876 | 180 | 13.50 | 96 | 109.50 |

| 9 | 108 | 972 | 1080 | 204 | 12.00 | 108 | 120.00 |

| 10 | 108 | 1200 | 1308 | 228 | 10.80 | 120 | 130.80 |

Break-even & loss

| Q | MC | AVC | ATC |

|---|---|---|---|

| 0 | 0 | NaN | Inf |

| 1 | 12 | 12 | 120.00 |

| 2 | 36 | 24 | 78.00 |

| 3 | 60 | 36 | 72.00 |

| 4 | 84 | 48 | 75.00 |

| 5 | 108 | 60 | 81.60 |

| 6 | 132 | 72 | 90.00 |

| 7 | 156 | 84 | 99.43 |

| 8 | 180 | 96 | 109.50 |

| 9 | 204 | 108 | 120.00 |

| 10 | 228 | 120 | 130.80 |

Two different prices:

- shut-down price = 12

- break-even price = 72

Below $72, Liv is operating at a loss.

Above $12, Liv still manage to retain some of the fixed cost.

Up the industrial curve

Different producer may have different cost structure.

Marginal cost is important because it determine lowest ATC (the break-even price) and profit.

- MC is essentially the supply curve.

When price below break-even price, firms only exit in the long run.

- still produce while lowering fixed cost.

When price below shut-down price, firms exit immediately.

Profit max in perfect market

Long run profit in a perfect market

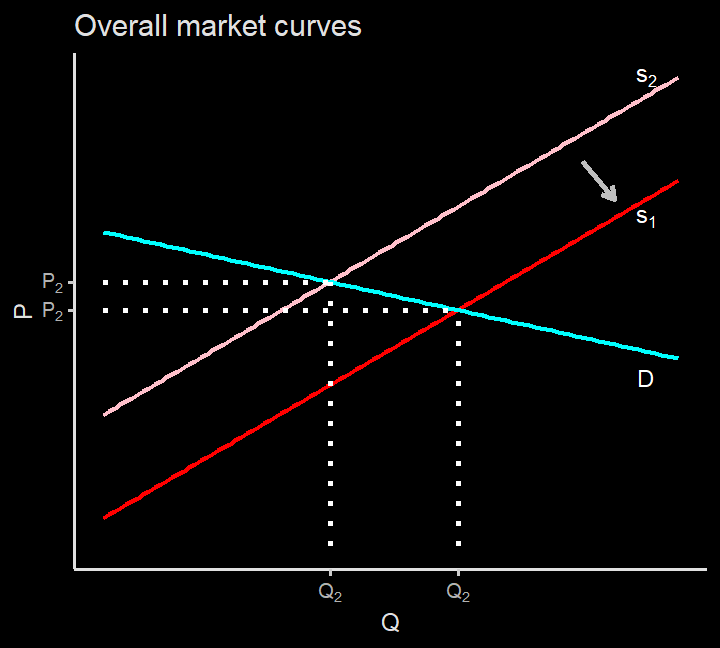

If an Industry is profitable, more firms will enter the market, push supply curve to the right. This push market price down

If an Industry is profitable, more firms will enter the market, push supply curve to the right. This push market price down

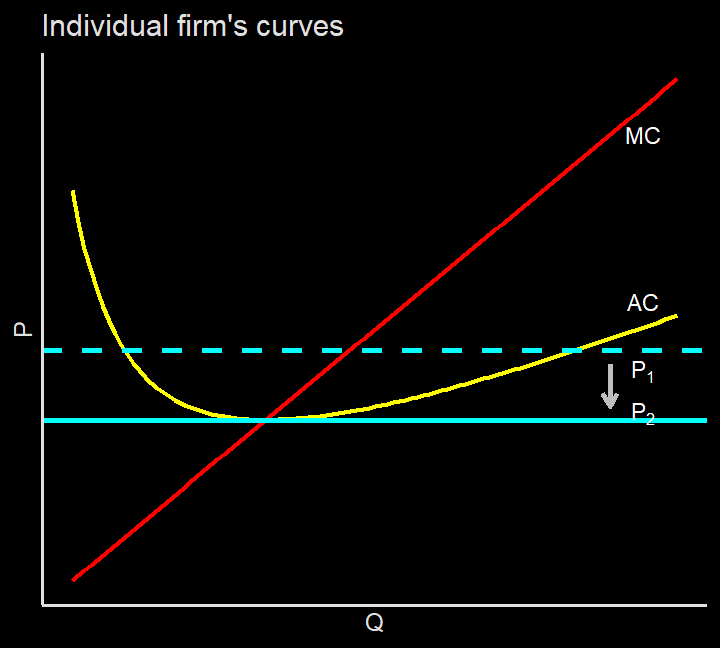

The firm now has to operate on a lower MR. In the long run, the number of firms will be just enough to sustain and no more profit left for entrant

The firm now has to operate on a lower MR. In the long run, the number of firms will be just enough to sustain and no more profit left for entrant

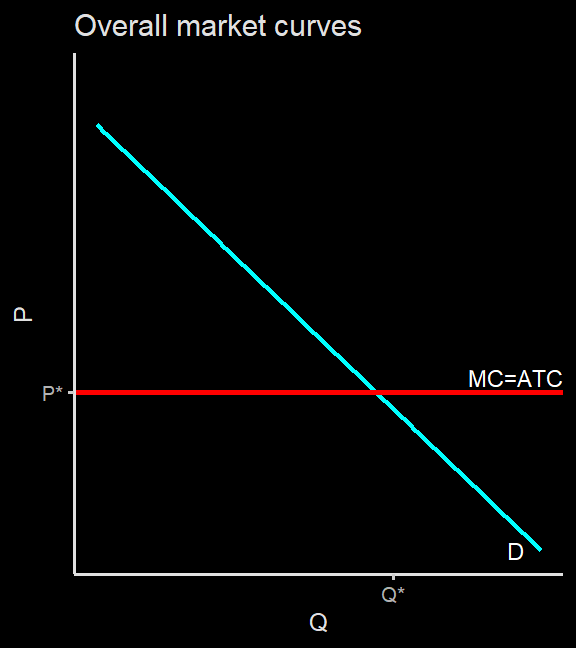

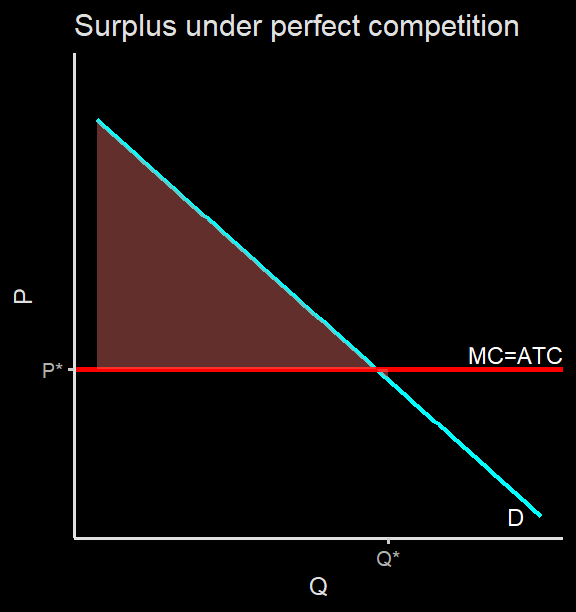

Long run profit in a perfect market

In the long run, only firms who can produce at lowest cost will stay in the market.

Overall market will have a straight line supply curve, where MC=ATC

note that PS=0 (zero pure profit for producer)

Perfect competition characteristics

Entry & exit is important for a perfect market characteristics.

An industry which have low shut-down price and break-even price tend to be more competitive.

- When these prices are low, more entrepreneurs can join in.

Low cost of entry and exit ensures a smooth adjustment of market.

Perfect competition

The cost of entry and exit is very relative and a little bit hard to judge whether it's "low" or "high".

Second characteristic is many producers with small market share

Market share is a measure on how much a firm gain revenue from a market.

Even when there are many producers, it is not competitive if the market is dominated by small number of sellers.

Perfect competition

When a market consists of many sellers, market won't react too much when there is only one or two firms enter and exit.

When a warteg is closed, nobody cares.

When a Electric Vehicle (EC) investor come in, it will be a headline.

Smartphone Market share in Indonesia

Source: StatCounter Global Stats - Device Vendor Market Share

High market share

When a market is dominated by small number of players, we say the market is concentrated.

Market concentration may be caused by a highly efficient firms:

- very low cost.

- superior quality at similar price.

It can also be caused by some characteristics special to the product.

- compatibility of complement

- exclusive content

compatibility of complement: OS, electric charging for electric cars, exclusive content: netflix vs prime, console wars, etc

Standardized product

Market tends to be more competitive when the product from a firm is undistinguished from other firm.

- buyers don't care from which firm they purchase their goods.

- firm have less control over price.

In general, firms who wish to capture more market have two strategies:

- lower cost.

- product differentiation.

Monopoly

Deviation from perfect competition

So far we have seen the importance of a perfect market:

- producer is a price taker.

We have seen that supply curve is essentially the marginal cost, which derives from the cost function.

Cost C(Q) is a positive function of Q.

- meaning, more Q leads to higher C(Q)

Deviation from perfect market

but price is independent.

- \(\text{profit}=Q*P\) which is a linear function.

- Marginal Revenue (MR) = price.

- firms compete by lowering C

Product differentiation may provide a firm to control their own price to some extent.

When a firm can control price, price is no longer independent of firms' decision

\(MR=MC\) still hold, but with control over price, a firm can now choose their MR

Deviation from perfect market

To see how this happens, we use monopoly as our first deviation from the perfect market.

Monopoly is the other extreme of a perfect market.

- most markets are somewhere in between.

As usual, learning how the extreme works often easier and intuitive.

Market structure

From extremely strong market power to no market power:

| type | differentated product? |

no. of producers |

example |

|---|---|---|---|

| Monopoly | not aplicable | 1 | electricity |

| Oligopoly | can be both | few | Internet Service |

| Monopolistic competition | yes | many | Smartphone |

| Perfect competition | no | many | fried rice |

Side note: What's a market?

Sometimes it is hard to define market. A Carrefour vs KPPU case is famous for debate about market definition: Did Carrefour compete against only wholesale like supermarket and hypermarket retailing, or also mini-markets and traditional markets?

Side note: What's a market?

How broad the definition of market should be? Smartphone is another excellent example. Samsung galaxy Note series can be argued to operate in a differentiated smartphone market thanks to its exclusive feature called S-pen. However, in the low-end smartphone market, it has little to no difference with other cheap smartphone, hence closer to a perfect market.

Monopoly

A producer is a monopolist if it is the only supplier of a good that has no close substitute.

An industry is a monopoly when it runs by a monopolist.

Monopoly operates by changing its production output and captures as much Producer Surplus as it could.

Normally, more producer would want to enter the market. Why they could not?

Why do monopolies exist

Generally, there are 5 reasons why monopolies (or oligopolies) exist

Control over scarce resource and input.

Increasing returns to scale industry.

Technological superiority.

Network externality.

Government-created barrier.

Control over scarce resource and input

De Beers is famous for having control over diamond. Indofood who controls flour production have a huge advantage in the instant noodle market.

Increasing returns to scale

When an industry have a very big fixed cost, a firm in that industry needs huge market share to maximize spread effect. Building internet infrastructure is expensive (tower, cable, etc) and a huge commitment.

A monopoly created and sustained by increasing returns to scale is called a natural monopoly.

Technological superiority

Intel managed to dominate the semi-conductor market thanks to its technological superiority over its competitor.

However, technology can be researched and (to some extent) stolen.

This makes technological superioriy less important compared to other reasons.

Do not mixed tech superiority with network effect.

Network effect

An industry has network effect when the value of a product and service in that industry depends on how much users it has

Network effect is very prominent in industries related to tech: Social media, Online games, Ride-sharing etc

Google's search algorithm might not be superior, but it has much larger data thanks to the amount of users of its service, browser and android phone.

Some said MacOS is better than Windows. But most developers make windows based apps.

Government-Created Barrier

The most important legally created monopoly these days maybe come from patents and copyrights.

Patents and copyrights are important to provide incentives (at least temporary) for people to create and innovate.

as soon as the patents and copyrights are over, it moves closer to a perfect market.

Could lead to a missed opportunity, however.

We also have Bulog, Pertamina and PLN.

How monopolist maximize profit

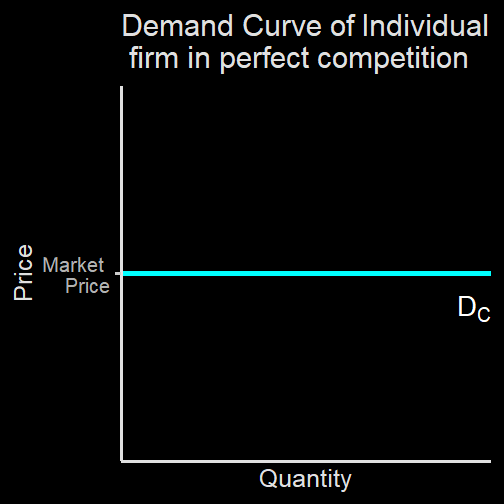

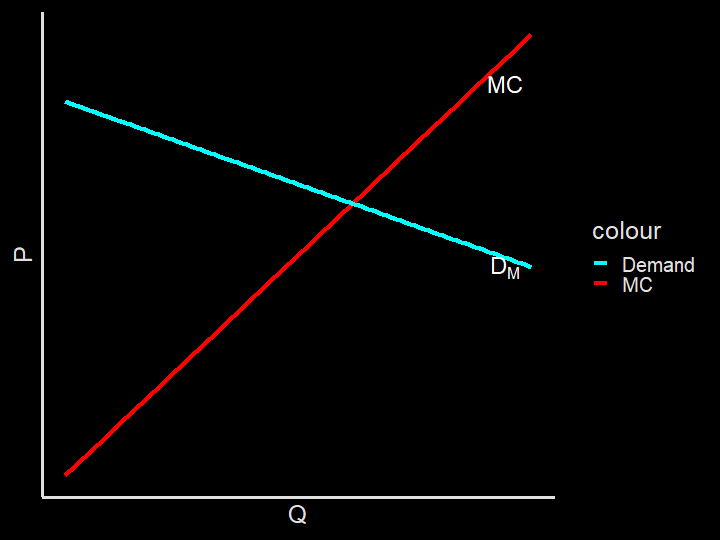

A firm operates in the perfect market face a flat demand curve

- this is because price is independent

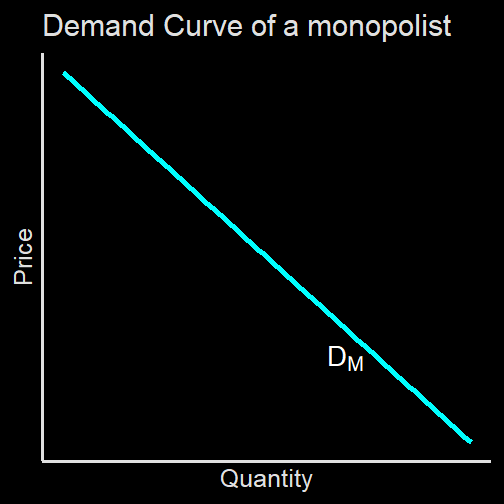

However, monopolist face a market demand curve instead of an individual demand curve.

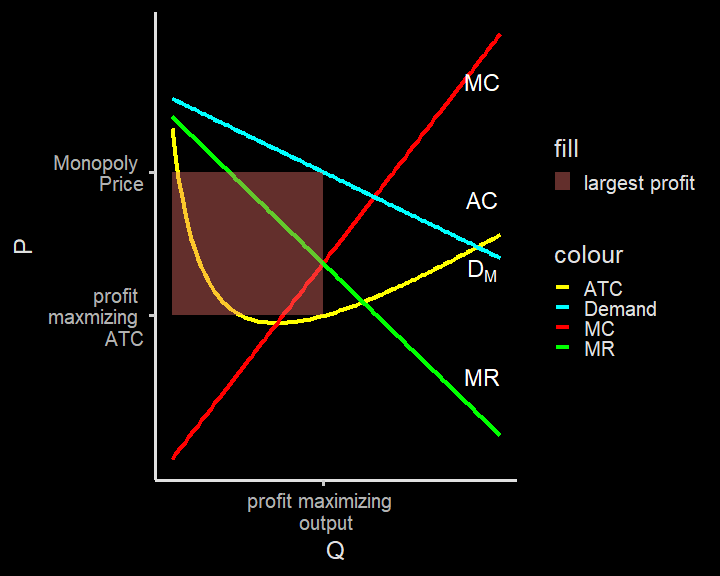

Monopolist maximize profit by setting \(MR=MC\), but they have control over their \(MR\)

How monopolist maximize profit

An individual producer face a straight line because its Q has no impact on P

An individual producer face a straight line because its Q has no impact on P

A monopolist face the whole market, hence its demand curve is equals to the market demand curve.

A monopolist face the whole market, hence its demand curve is equals to the market demand curve.

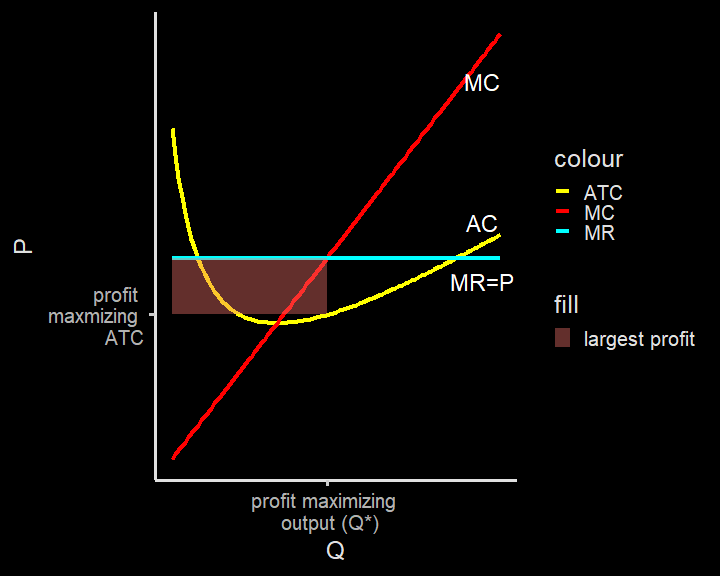

Profit max in perfect market

Profit max in perfect market (short run)

Monopolist individual demand curve = the whole market demand curve

Monopolist decision making

Monopolist decision making

Last week: Liv's MR = P because no matter how much she sell, price stays $100

For monopolist, when they produce more, price goes down, while producing less increases price.

increasing price decreases quantity bought (Quantity effect), while increasing margin per item sold (price effect)

- remember tax revenue?

Monopolist decision making

- Monopolist finds these the balance btween quantity effect and price effect by setting:

$$ MR = MC $$

The profit-maximizing price is called monopoly price, while the profit-maximizing quantity is called monopoly quantity.

Since there's no firm can join in, cost won't be reduced (very close) to zero at all.

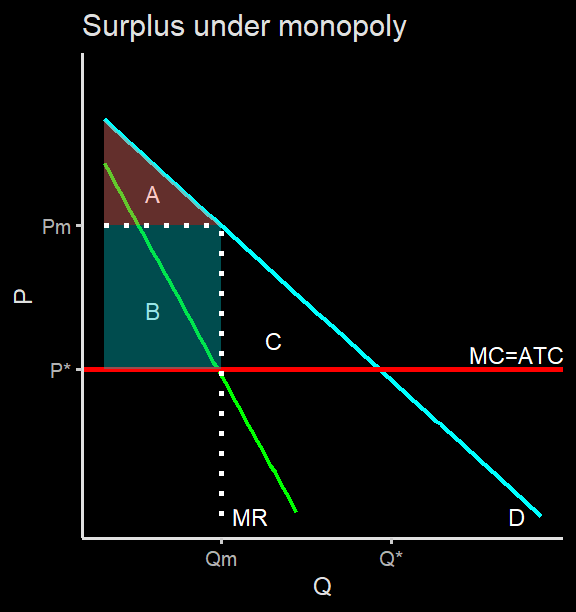

Why monopoly is bad

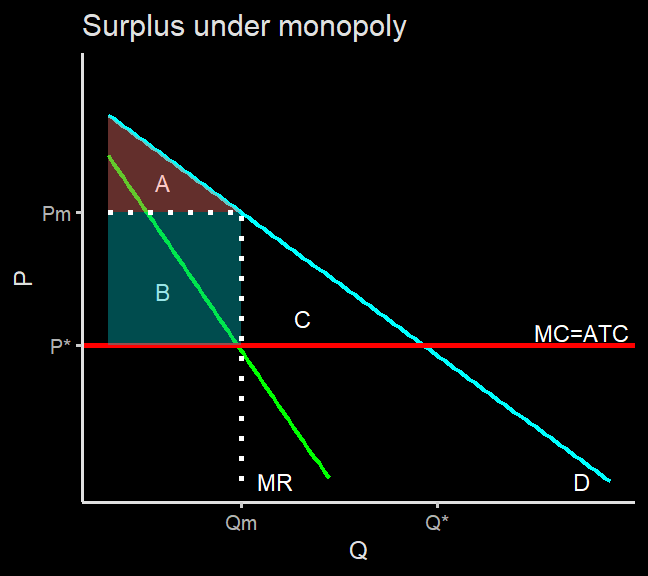

In the perfect market, the whole triangle is CS, where PS=0. Monopoly transfers some of this surplus to

In the perfect market, the whole triangle is CS, where PS=0. Monopoly transfers some of this surplus to

producer. Monopoly increases P and reduces Q, CS=A, PS=B, and DWL=C (loss transferred to no one)

producer. Monopoly increases P and reduces Q, CS=A, PS=B, and DWL=C (loss transferred to no one)

Dealing with monopoly

Many countries try to reduce monopoly (and oligopoly) by fine and avoiding a merger.

- Depends, some natural monopoly is hard to dealt with.

In Indonesia, the most prominent institution combating monopoly and oligopoly is KPPU(Komisi Pengawas Persaingan Usaha)

- Telco, airfare, food industries, among other cases.

There are few ways a government generally try to deal with monopoly

Dealing with monopoly

Public ownership, like Pertamina, PLN, Bulog and PT. KAI.

Price ceiling / floor. This can be useful when market is not perfect. For example, A minimum wage can be useful when employers are too powerful.

In general, it is really hard to deal with monopoly because there's a trade off.

- Drug patent leads to monopoly, but important to incentivies innovation.

Price Discrimination

Why price discriminate

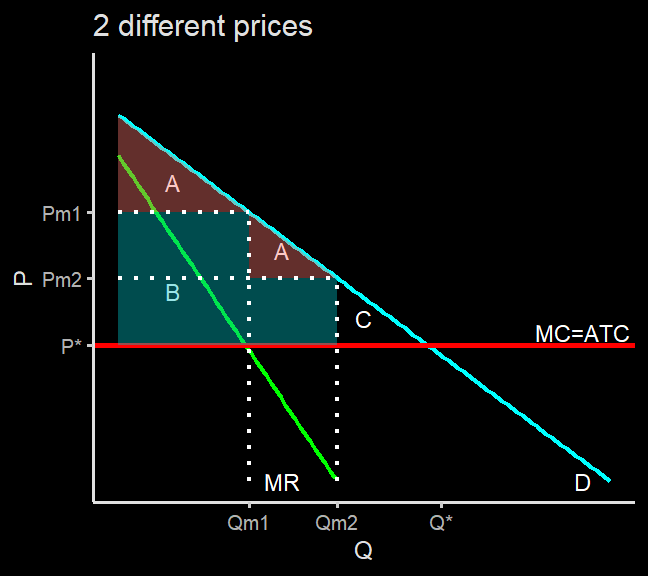

When a monopolist charge one price, it lost a chance to profit from people who can't afford that price.

If there is a way to charge different price to different types of customer, monopolist can capture more surplus.

This practice is called price discrimination.

Price discriminiation

Obviously, people won't buy the more expensive ones if the product are the same.

Some common techniques:

- Advance purchase restrictions: early bird airfare tickets

- Volume discount: less per unit cost if you buy bulk. eg: short, tall, grande, venti.

- Two part tariff: you pay a flat rate to enter, but pay per-unit cost to upgrade.

- Student price.

- Time price: Gojek is expensive when rains, hotelroom rent price during holiday season.

Price discrimination

Interestingly, price discrimination is less bad compared to single price monopoly.

Price discriminiation reduces DWL, adding a little bit of consumer surplus and producer surplus.

Still less ideal compared to a lower-single-price monopoly, let alone a perfect market

Price level from best to worst:

$$P^* > P_{m2} > P_{m1} + P_{m2} > P_{m1}$$

Next week

Next week we are going to learn other deviations from the market.

Oligopoly and externalities are the two most prominent market failure.