A quick look at Indonesia's current account and balance of trade using World Bank's API in Python

Indonesia has been always famed for its lack of depth and innovation in its financial market. Banks are powerful and aim mostly at consumer banking. Indeed, the role of foreign investment is quite central to Joko ‘Jokowi’ Widodo’s development policy, from building infrastructures and the same-price gasoline policy, both relies on SOE’s corporate bonds, to attracting FDI to provide jobs. The high influx of foreign investment of course leads to a current account deficit, which means increase the surge of imports. This is a basic GDP accounting where current account balance is $=S-I=X-M$.

Interestingly, minimizing Current Account Deficit (CAD) has been something Indonesian government set as their de facto policy targeting. Targeting CAD may be important(?) for stability, but might not be something you would want if you aim for growth. In this blog, I try to have a look at Indonesia’s CAD, what’s causing it, and a bit of insight from looking at it. My visualization relies on Python’s Seaborn and World Bank’s API manager, wbdata. My learning resources are Abdul Baqi’s blog and World Bank’s blog and documentation.

Using wbdata

install it first using:

pip install -U wbdata

We then import it and see what are the source.

import wbdata as wb

wb.get_source()

id name

---- --------------------------------------------------------------------

1 Doing Business

2 World Development Indicators

3 Worldwide Governance Indicators

5 Subnational Malnutrition Database

6 International Debt Statistics

11 Africa Development Indicators

12 Education Statistics

13 Enterprise Surveys

14 Gender Statistics

15 Global Economic Monitor

16 Health Nutrition and Population Statistics

18 IDA Results Measurement System

19 Millennium Development Goals

20 Quarterly Public Sector Debt

22 Quarterly External Debt Statistics SDDS

23 Quarterly External Debt Statistics GDDS

24 Poverty and Equity

25 Jobs

27 Global Economic Prospects

28 Global Financial Inclusion

29 The Atlas of Social Protection: Indicators of Resilience and Equity

30 Exporter Dynamics Database – Indicators at Country-Year Level

31 Country Policy and Institutional Assessment

32 Global Financial Development

33 G20 Financial Inclusion Indicators

34 Global Partnership for Education

35 Sustainable Energy for All

36 Statistical Capacity Indicators

37 LAC Equity Lab

38 Subnational Poverty

39 Health Nutrition and Population Statistics by Wealth Quintile

40 Population estimates and projections

41 Country Partnership Strategy for India (FY2013 - 17)

43 Adjusted Net Savings

44 Readiness for Investment in Sustainable Energy

45 Indonesia Database for Policy and Economic Research

46 Sustainable Development Goals

50 Subnational Population

54 Joint External Debt Hub

57 WDI Database Archives

58 Universal Health Coverage

59 Wealth Accounts

60 Economic Fitness

61 PPPs Regulatory Quality

62 International Comparison Program (ICP) 2011

63 Human Capital Index

64 Worldwide Bureaucracy Indicators

65 Health Equity and Financial Protection Indicators

66 Logistics Performance Index

67 PEFA 2011

68 PEFA 2016

69 Global Financial Inclusion and Consumer Protection Survey

70 Economic Fitness 2

71 International Comparison Program (ICP) 2005

72 PEFA_Test

73 Global Financial Inclusion and Consumer Protection Survey (Internal)

75 Environment, Social and Governance (ESG) Data

76 Remittance Prices Worldwide (Sending Countries)

77 Remittance Prices Worldwide (Receiving Countries)

78 ICP 2017

79 PEFA_GRPFM

80 Gender Disaggregated Labor Database (GDLD)

81 International Debt Statistics: DSSI

So many databases, but we will get what we want from World Development Indicators, number 2 on the above list. Now, let’s search current account balance in the database

wb.search_indicators('current account balance',source=2)

id name

----------------- ------------------------------------------

BN.CAB.XOKA.CD Current account balance (BoP, current US$)

BN.CAB.XOKA.GD.ZS Current account balance (% of GDP)

I will use one with % of GDP. I will take the current account balance only for Indonesia and only from 1981 to 2019. Don’t forget to create a datetime tuple to limit the year you’re taking.

import pandas as pd

import datetime

tanggal=(datetime.datetime(1981,1,1), datetime.datetime(2019,1,1))

a=wb.get_dataframe({"BN.CAB.XOKA.GD.zS" : "Current account balance (% of GDP)"}, country=["IDN"], data_date=tanggal, convert_date=True, keep_levels=True)

a=a.reset_index()

a.head()

| country | date | Current account balance (% of GDP) | |

|---|---|---|---|

| 0 | Indonesia | 2019-01-01 | -2.714101 |

| 1 | Indonesia | 2018-01-01 | -2.939161 |

| 2 | Indonesia | 2017-01-01 | -1.594657 |

| 3 | Indonesia | 2016-01-01 | -1.819151 |

| 4 | Indonesia | 2015-01-01 | -2.035042 |

Let’s visualize it with seaborn

import seaborn as sns; sns.set()

import matplotlib.pyplot as plt

plt.figure(figsize=(13.5,8))

graph1=sns.lineplot(x="date", y="Current account balance (% of GDP)",data=a)

graph1.axhline(0, color='black')

graph1.axvline(datetime.datetime(1998,1,1), color='red')

graph1.text(datetime.datetime(1999,1,1),-6, "Asian Financial Crisis",color='red',size='x-large')

plt.show()

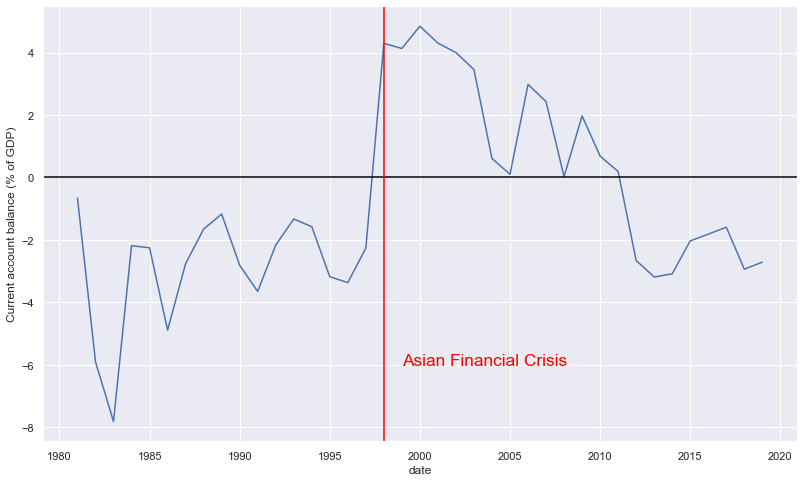

The above graph is Indonesia’s current account balance. I suppose it is clear to us that Indonesia were running a current account deficit since the collapse of oil price in the early 80s. Financial liberalization were then took place around the same period and was getting more progressive up until right before Asian Financial Crisis (AFC) in 1998. Indeed, running a mismanaged CAD is somewhat dangerous when the investment is not allocated efficiently. Those investment were not productive and Indonesia failed to earn enough foreign currency to pay back its debt. The economy was then crash, and perhaps haunt us until now. This is, perhaps, the reason why we hate CAD so much.

Indonesia was having a positive current account since then, but starting 2011, the CAD started to happen. Since then, CAD has been happening consistently up until now. The anti-import sentiment was return, and the government has been rising Non-Tariff Measures to combat it. In fact, according to ERIA’s publication, NTM shot up by almost 30% in numbers, from 2015 to 2018.

What causes our CAD?

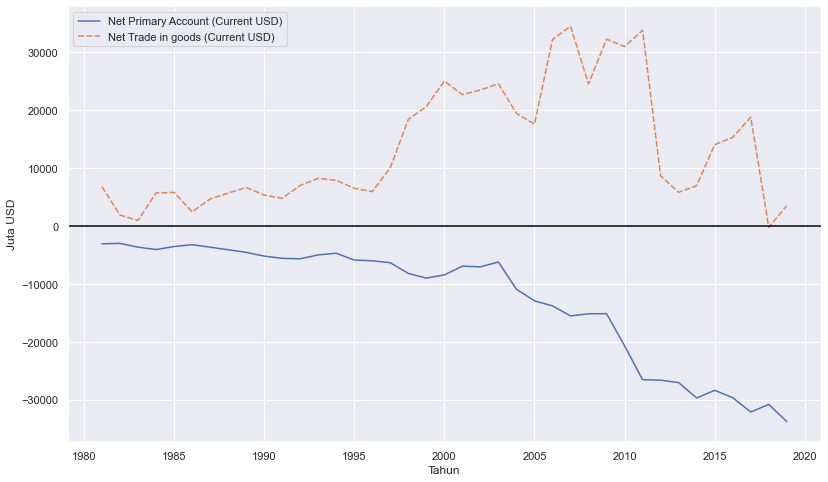

Interestingly, Indonesia’s trade balance (export - import) has always been positive. We have been exporting enough to offset our import. Our deficit was mainly driven by a negative net primary income. The negative net primary income was driven by interest payment from portfolio and FDI. Indonesia’s foreign investment inflow has largely been used to actually pay these interests. That’s one reason why Indonesian policy makers talk a lot on speeding up growth and improving export relative to import, because reducing net primary income deficit is much harder in the short run.

b=wb.get_dataframe({"BN.GSR.FCTY.CD" : "Net Primary Account (Current USD)"}, country=["IDN"], data_date=tanggal, convert_date=True, keep_levels=True)

b=b.reset_index()

b.head()

c=wb.get_dataframe({"BN.GSR.MRCH.CD" : "Net Trade in goods (Current USD)"}, country=["IDN"], data_date=tanggal, convert_date=True, keep_levels=True)

c=c.reset_index()

b["Net Trade in goods (Current USD)"]=c["Net Trade in goods (Current USD)"]/1000000

b["Net Primary Account (Current USD)"]=b["Net Primary Account (Current USD)"]/1000000

b=b.set_index('date')

del b['country']

plt.figure(figsize=(13.5,8))

graph2=sns.lineplot(data=b)

graph2.axhline(color='black')

graph2.set(ylabel='Juta USD',xlabel='Tahun')

plt.show()

Increasing export or reducing import?

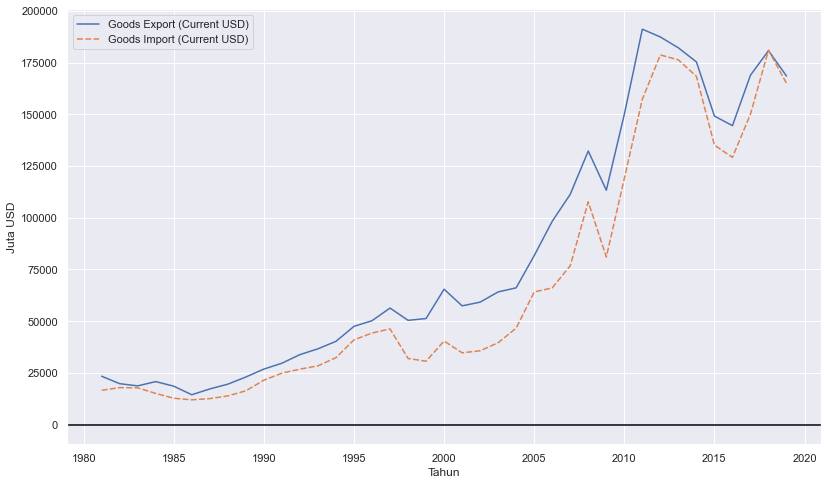

If we take a look at the graph below, Indonesia’s import follows its export closely.

b=wb.get_dataframe({"BX.GSR.MRCH.CD" : "Goods Export (Current USD)"}, country=["IDN"], data_date=tanggal, convert_date=True, keep_levels=True)

b=b.reset_index()

b.head()

c=wb.get_dataframe({"BM.GSR.MRCH.CD" : "Goods Import (Current USD)"}, country=["IDN"], data_date=tanggal, convert_date=True, keep_levels=True)

c=c.reset_index()

b["Goods Export (Current USD)"]=b["Goods Export (Current USD)"]/1000000

b["Goods Import (Current USD)"]=c["Goods Import (Current USD)"]/1000000

b=b.set_index('date')

del b['country']

plt.figure(figsize=(13.5,8))

graph2=sns.lineplot(data=b)

graph2.set(ylabel='Juta USD',xlabel='Tahun')

plt.show()

Improving export in the short run can be challenging, especially given the current global situation. Indonesia’s two main industries mining and plantation, are still performing quite well, but these two commodities are very sensitive to price volatility, and COVID-19 makes it worse.

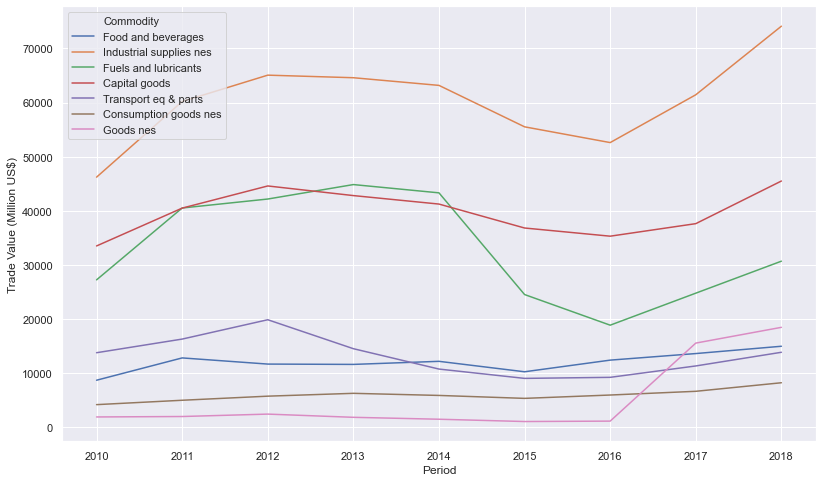

Unfortunately, trying to reduce import is also not ideal. Indonesian imports are currently consist of many industrial supplies and capital goods, needed for firms to operate. In fact, for firms operate in the Global Value Chain (GVC), imported inputs are crucial for them to be competitive in the global market. This is perhaps the reason why Indonesian import and export are moving together, because its exporting firms need imports to be able to export. Reducing imports can be bad both in the short run (industrial supplies) and in the long run (capital goods).

# This one's not using WBdata. I use UNCOMTRADE i used for my other project

import pandas as pd

import seaborn as sns; sns.set()

import matplotlib.pyplot as plt

c=pd.read_csv('data.csv')

c=c.rename(columns = {'Trade Value (US$)' : 'Trade Value (Million US$)'})

c['Commodity']=c['Commodity'].replace({'Capital goods (except transport equipment), and parts and accessories thereof':'Capital goods'})

c['Commodity']=c['Commodity'].replace({'Transport equipment, and parts and accessories thereof':'Transport eq & parts'})

c['Trade Value (Million US$)']=c['Trade Value (Million US$)']/1000000

plt.figure(figsize=(13.5,8))

g=sns.lineplot(x="Period", y="Trade Value (Million US$)", hue="Commodity",data=c)

g.legend(loc='upper left', ncol=1)

<matplotlib.legend.Legend at 0x1be0560a148>

Indeed, Indonesia face challenge again during this times. I personally think that reducing import is a bad move. What is important is to make sure its investment pays off and keep foreign inventor’s confidence high.