Specific factor and Income Distribution

ECES905205 pertemuan 3

2022-09-12

The Repeal of the Corn Law

- An effort to reduce food price

- tarif grains sampe 80%

- Repealed under Robert Peel ruling in 1846.

- pivotal for UK manufacturing transformation.

- Birth of the economist magazine

- Our model today explains this phenomenon.

Lerning outcomes

We’ve learned how trade gains both parties

Today we learn why trade is unpopular to some:

How trade generate winners and losers in the short run

Why, despite generating losers, trade is still good.

Specific factor model

2 Sectors i: Cloth (C) and Food (F)

3 factor j: Labor (L), Terrain (T), and Capital (K).

- Labor can move between sectors

- T can only used to produce F, K only C.

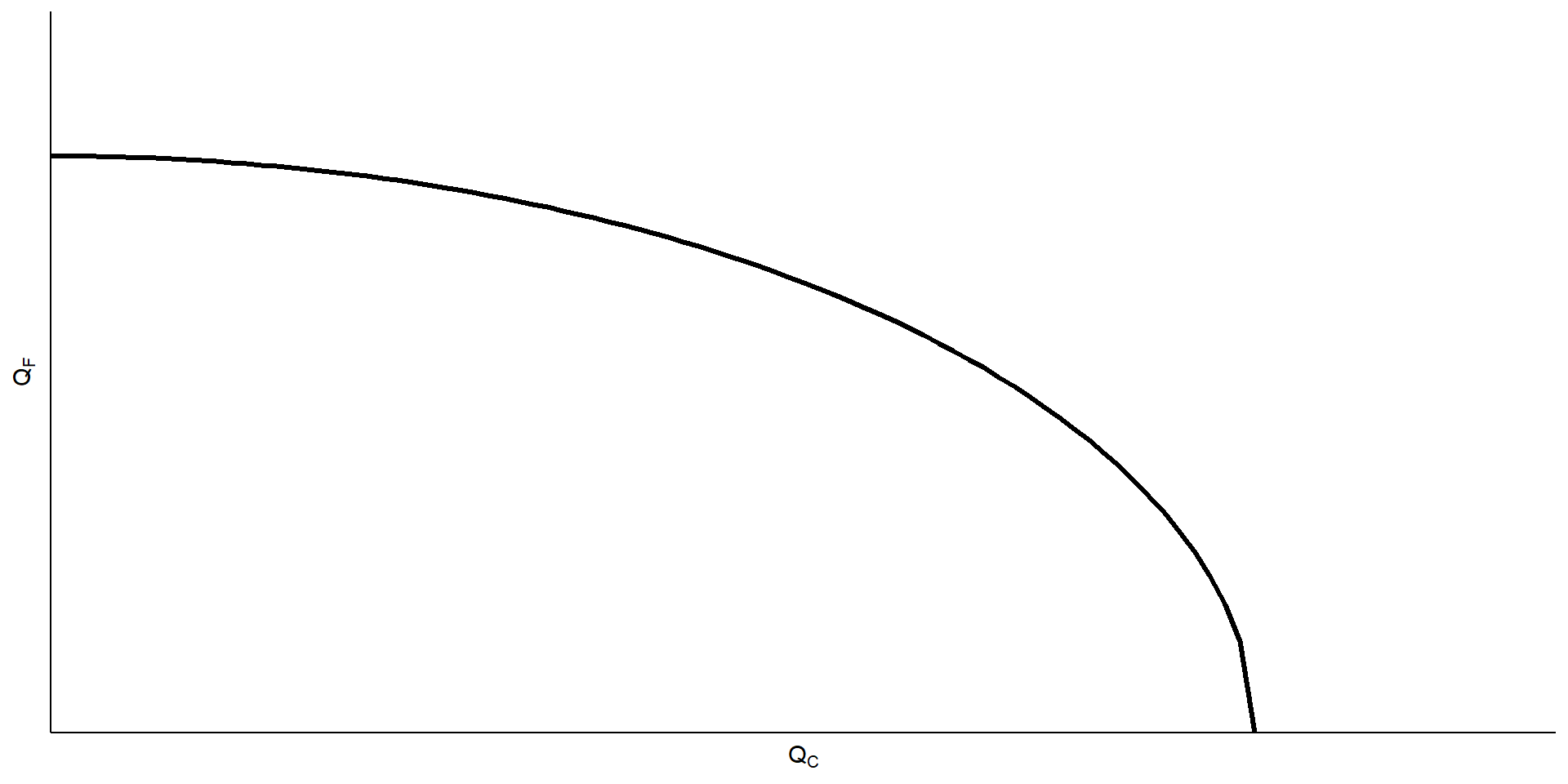

PPF

How does the economy’s mix of output change as labor is shifted from one sector to the other?

When labor moves from food to cloth, food production falls while output of cloth rises.

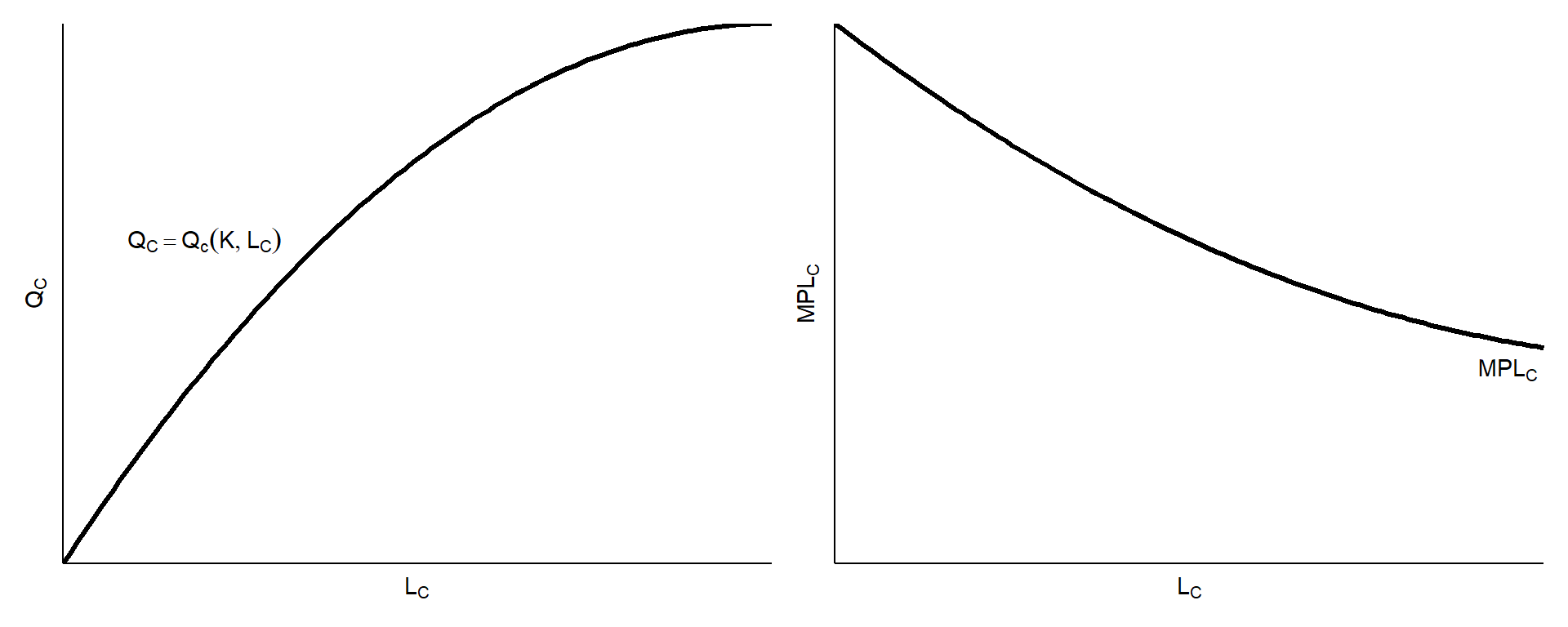

The shape of the production function reflects the law of diminishing marginal returns.

Adding one worker to the production process (without increasing the amount of capital) means that each worker has less capital to work with.

Therefore, each additional unit of labor adds less output than the last.

This is not like ricardian where production function is linear and MPL is constant.

PPF dan MPL

Production function and MPL

PPF

If an autarky wants to increase QC by 1 unit, it has no choice but to get labor from industry F

- That is, LC has to ↑ and LC has to ↓

However, changes in labor affects production differently in different starting point.

If LC goes up by 1, QC goes up by MPLC, which is decreasing as LC keeps on increasing.

- to produce 1 unit of C, need 1MPLC hours of labor.

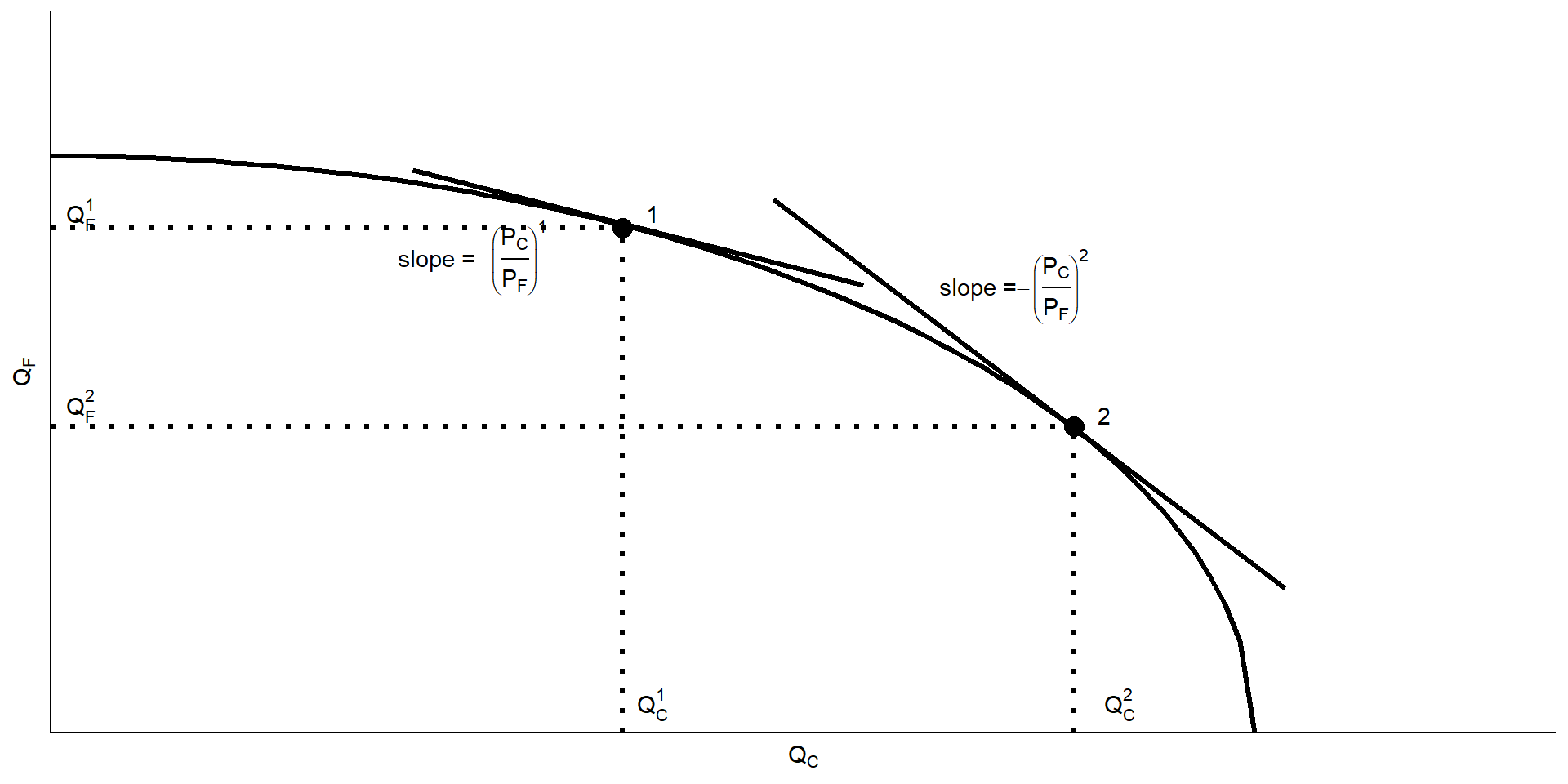

PPF

And while LF goes down by 1, QF goes down by MPLF, which is increasing as LF keeps on decreasing.

- To get labor to make 1 unit of C, F must down by MPLF

In other words, to increase QC by 1 unit, QF must go down by MPLFMPLC

opportunity costC=−MPLFMPLC=Slope of PPF

- We can show this using a 4-quadrant graph.

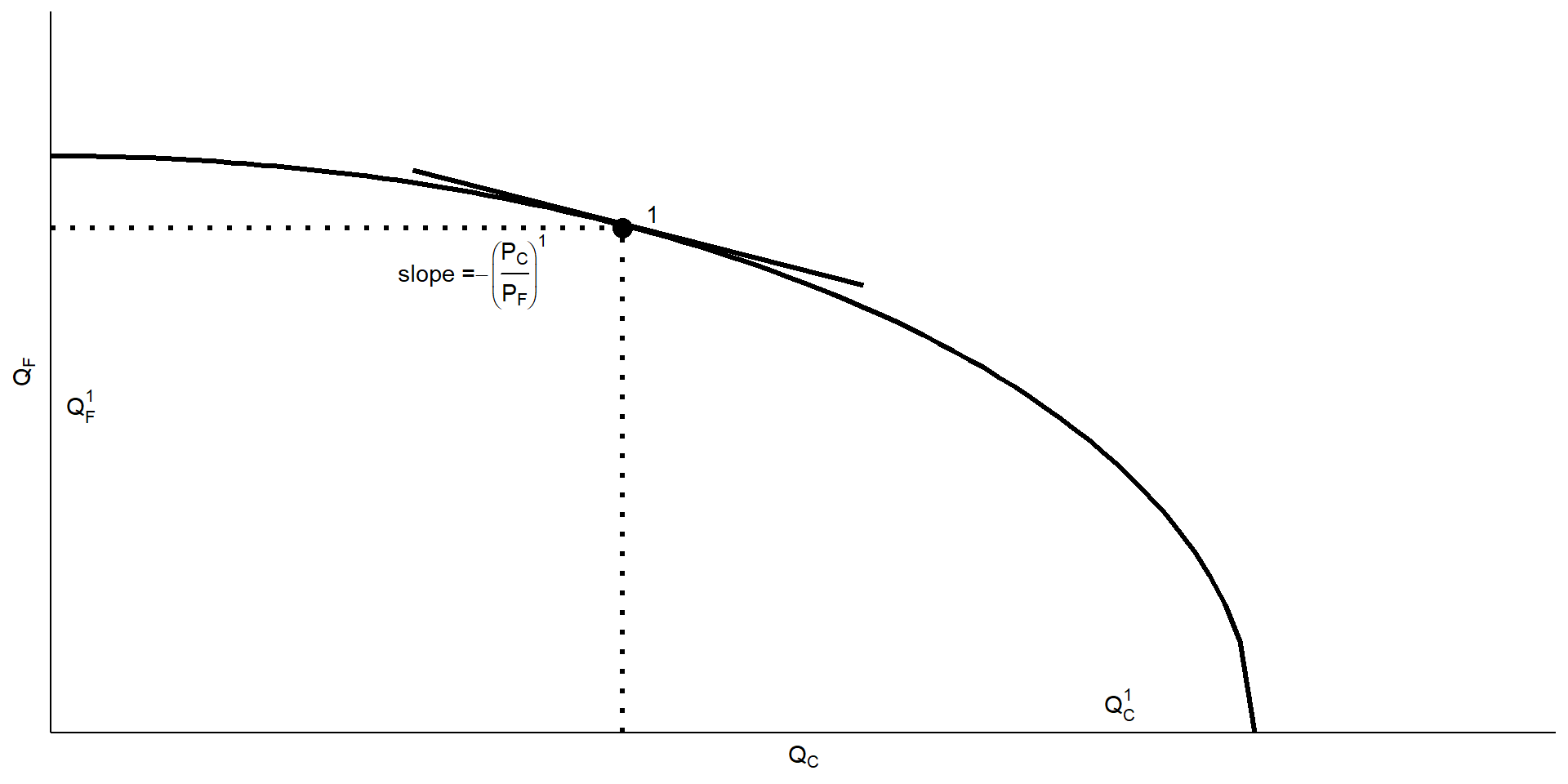

PPF

PPF

Why is the production possibilities frontier curved?

Diminishing returns to labor in each sector cause the opportunity cost to rise when an economy produces more of a good.

Opportunity cost of cloth in terms of food is the slope of the production possibilities frontier—the slope becomes steeper as an economy produces more cloth.

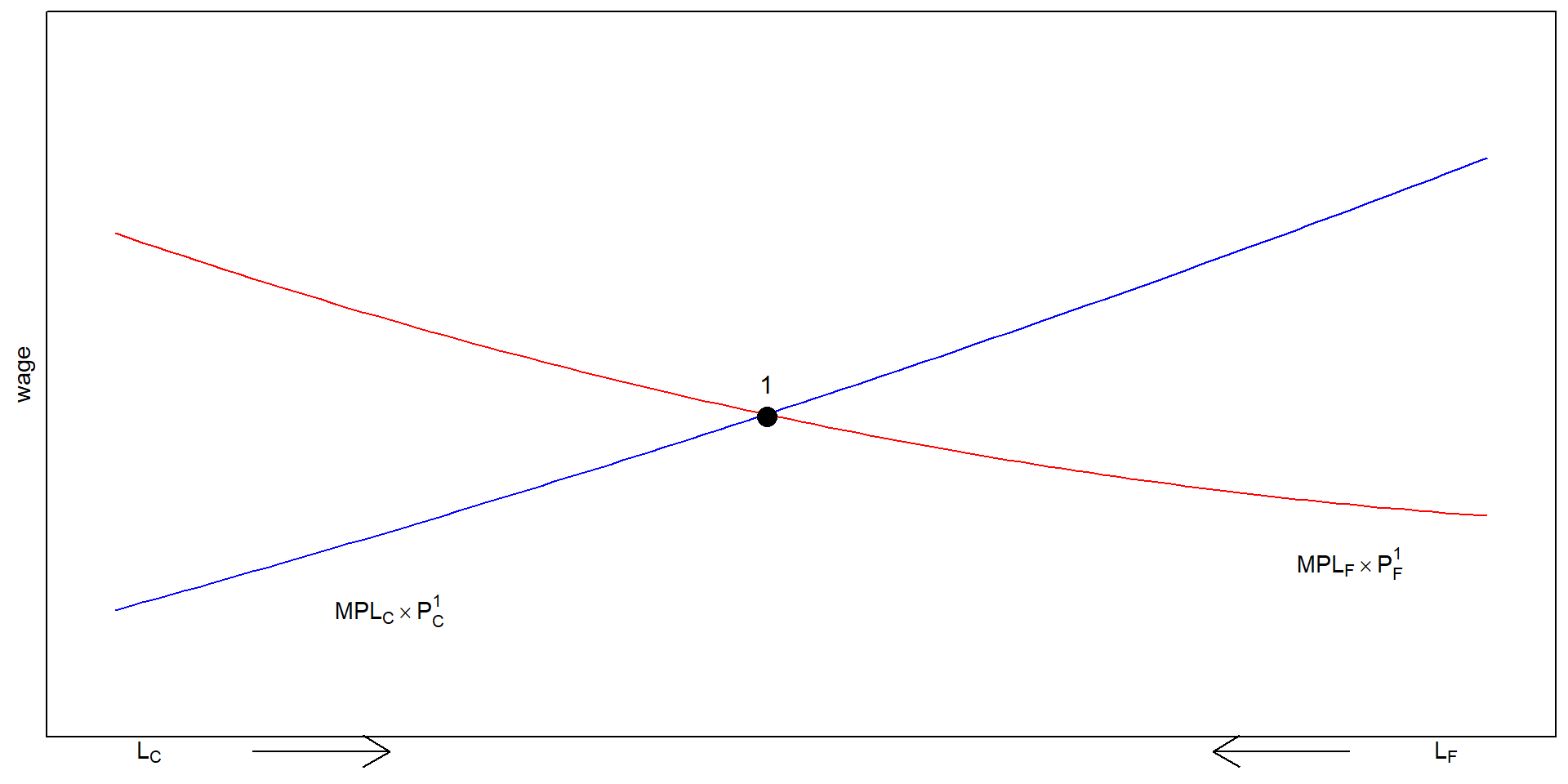

Labor allocation

In each sector, employers will maximize profits by demanding labor up to the point where the value produced by an additional hour equals the marginal cost of employing a worker for that hour.

A profit maximizing firms will want to employ until:

MPLC×PC=W

- The wage equals the value of the marginal product of labor in food manufacturing.

Labor demand

- The two sectors must pay the same wage because labor can move between sectors.

- Equilibrium wage is set by price ratio (which reflects demand) and Opportunity costs.

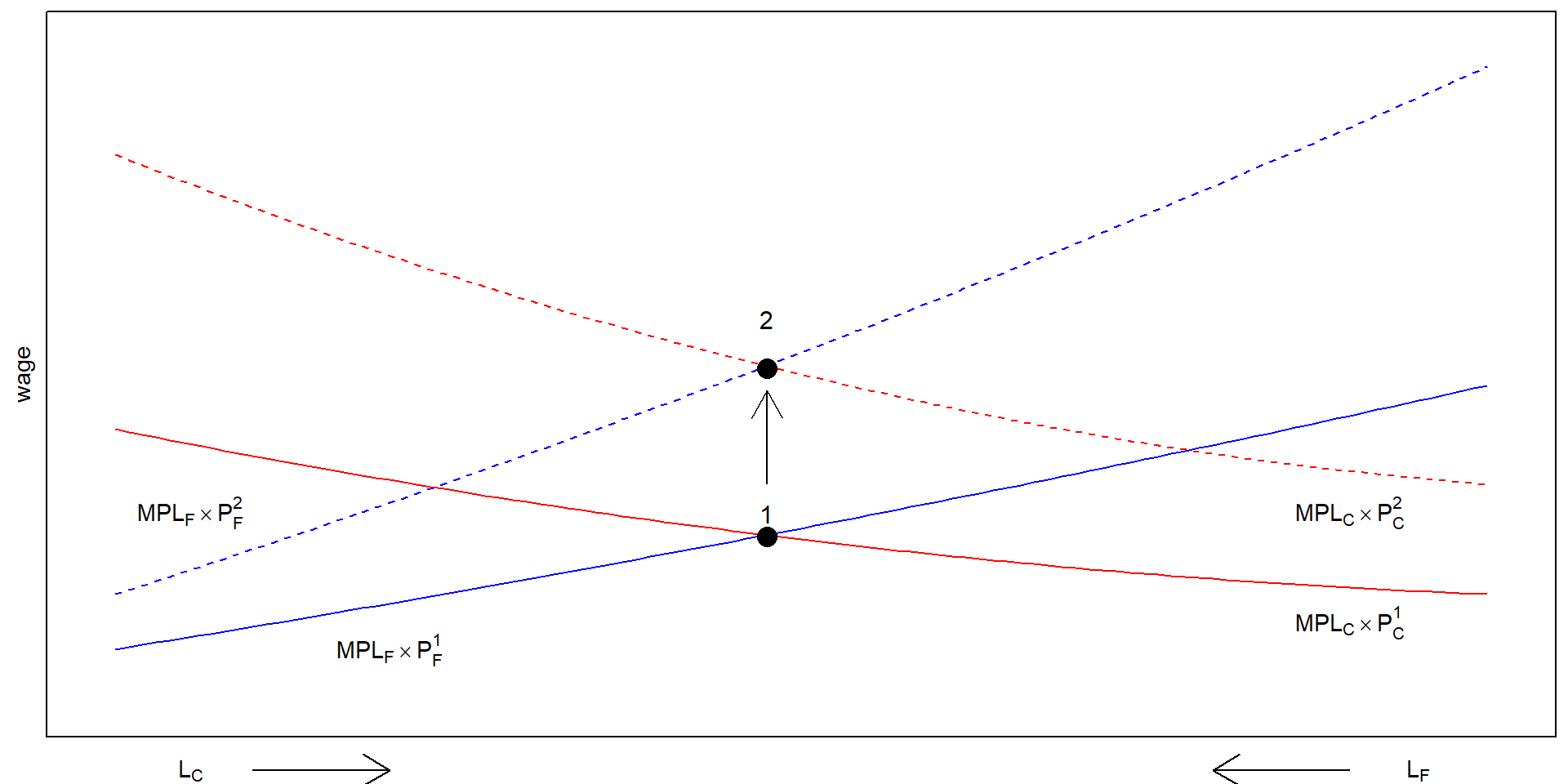

Labor market

Note that L is fixed. Left is C, right is F.

Production

Trade

Trade leads to changes in relative price: previously set by local demand endogeneously, now is exogenously given by the global market.

What happens to the allocation of labor and the distribution of income when the prices of food and cloth change?

Two cases:

- An equal proportional change in prices

- A change in relative prices

Increase in both price

- Let trade leads to changes in price as such P∗C=1.1PC and PF∗=1.1PF

- The movement of the labor demand curve MPLi×Pi will both go up by the same multiplier

- no changes in labor allocation.

- while prices both increase, wage increase by the exact same proportion.

- The real incomes of capital owners and landowners also remain the same.

Increase in both price

Change in relative price

- Katakanlah negara ini terekspose international trade.

- Di pasar internasional, P∗C=1.1PC tapi P∗F=PF

- Katakanlah PC naik 10%, tapi PF tetap.

- Terjadi perubahan rasio harga di mana PCPF↑

- Ada kenaikan LC dengan mengambil LF

- inget, L secara total tetap.

- gaji naik, tapi ga sebanyak kenaikan PC.

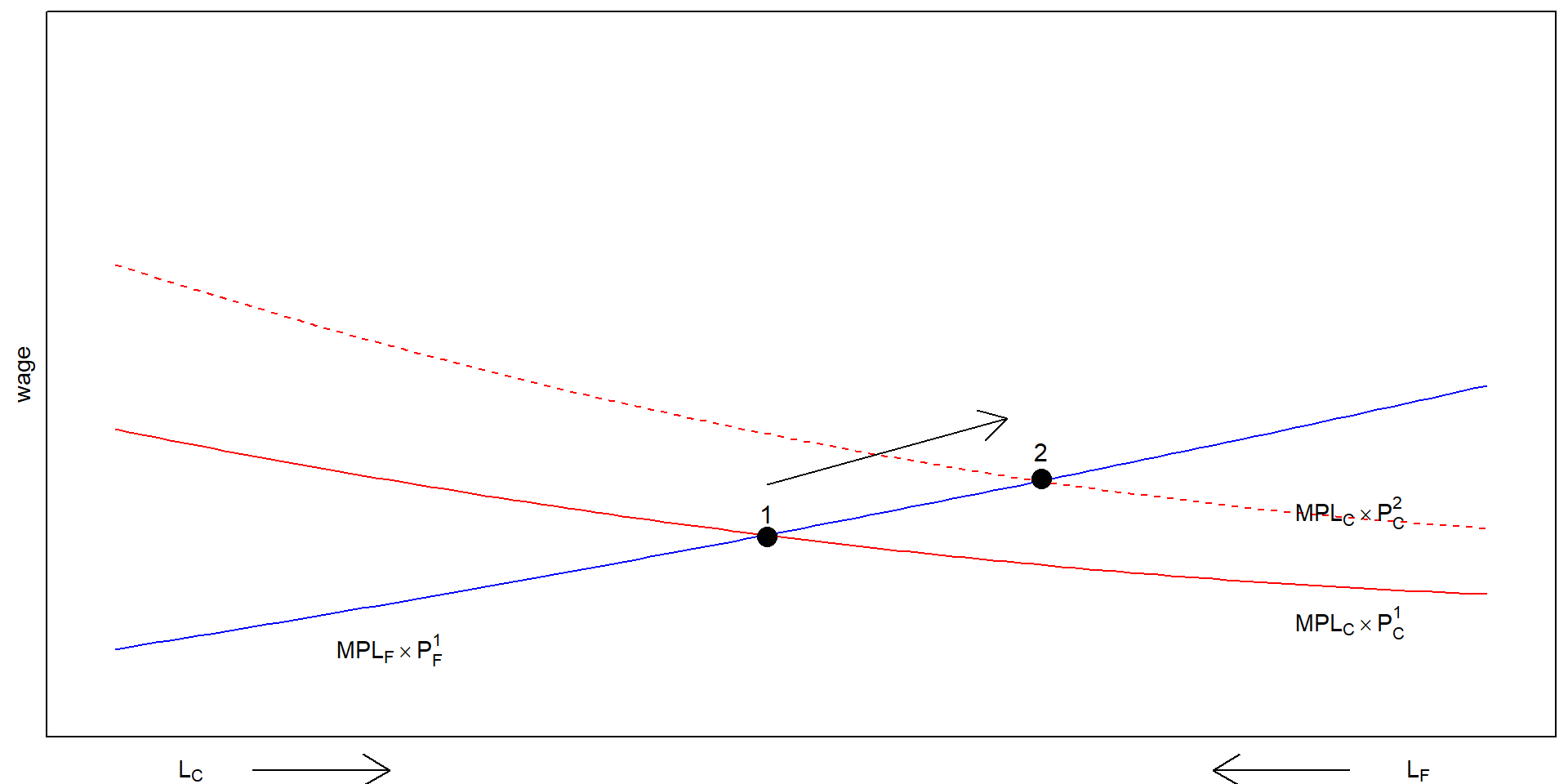

Change in relative price

New production allocation

Now what if the global market price PC 10% more than the local market while PF remains the same?

When only PC rises, labor shofts from the food sector to the cloth sector and the output of cloth rises while that of food falls.

W does not rise as much as PC since cloth employment increases hence MPLC falls.

New production allocation

New production allocation

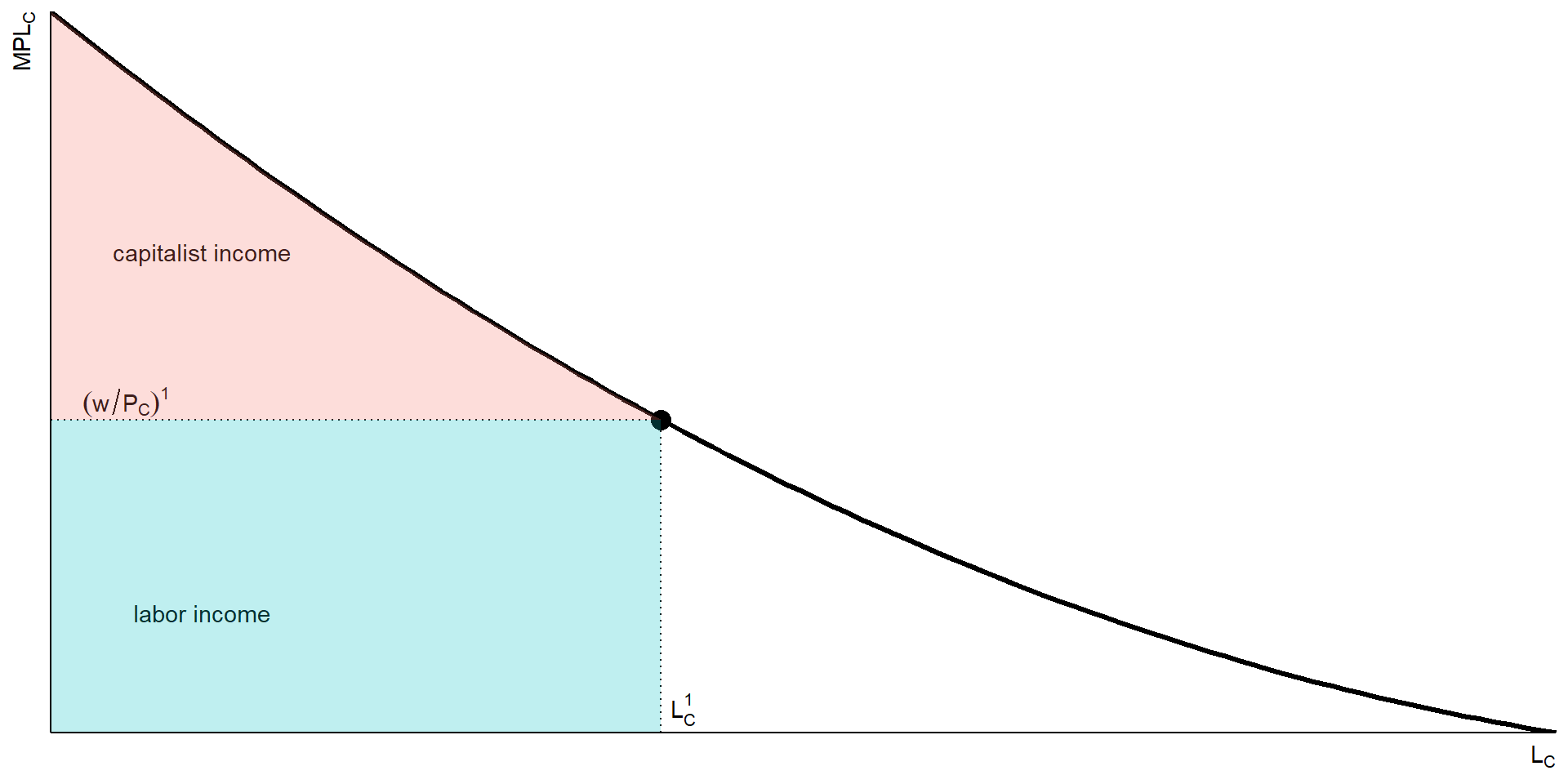

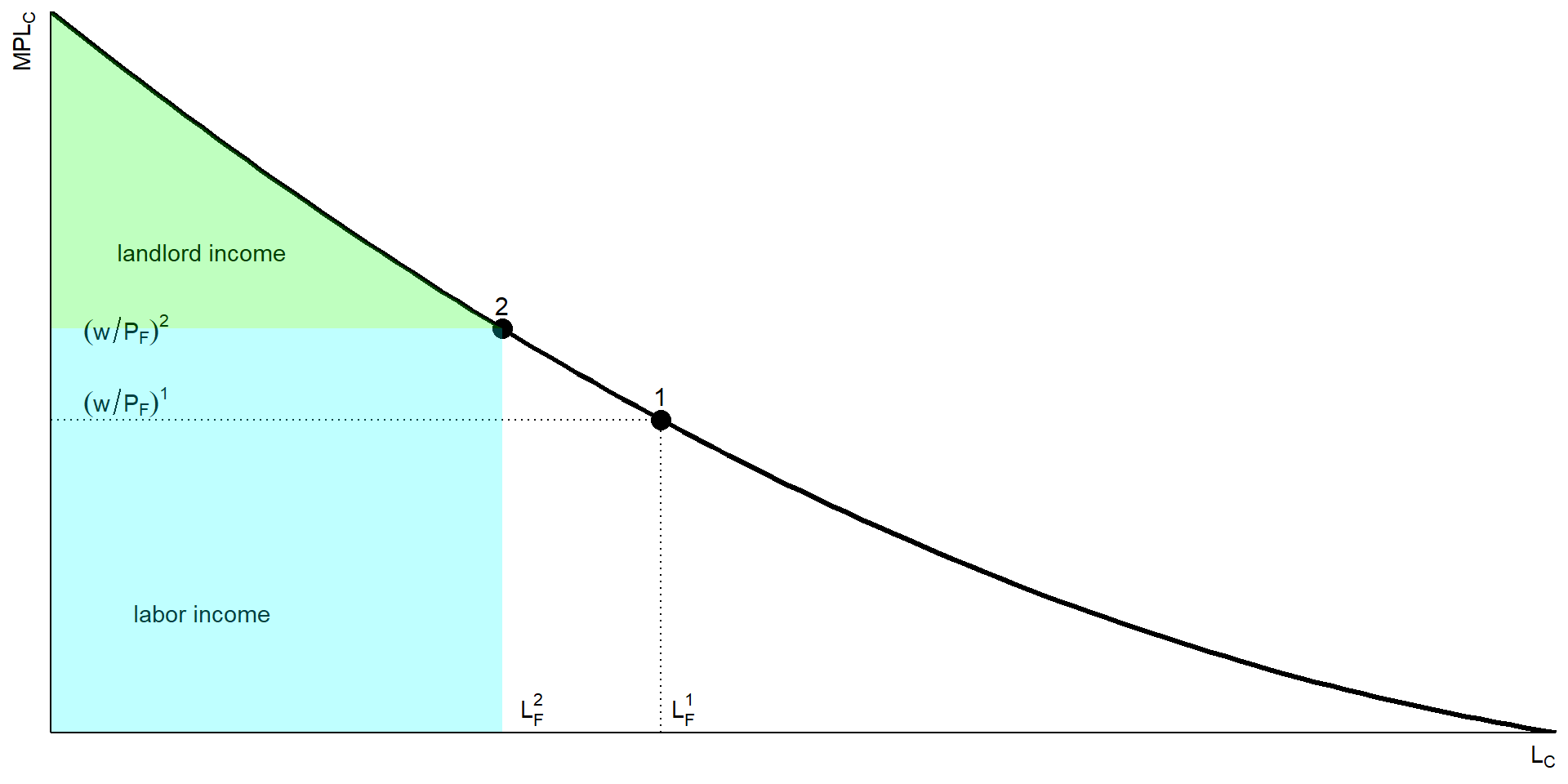

Understanding income distribution

- Changes in relative prices leads to changes in income distribution.

- This comes from disproportion changes:

ΔPC>Δw>ΔPF

wPC<wPF

Income distribution

Labors gain depends on their preference:

if C dominates their expenditure basket, then they lose.

If F dominates their expenditure basket, then they gain.

Specific factor owners are conclusive.

- Capital owners gain, Land owners loses.

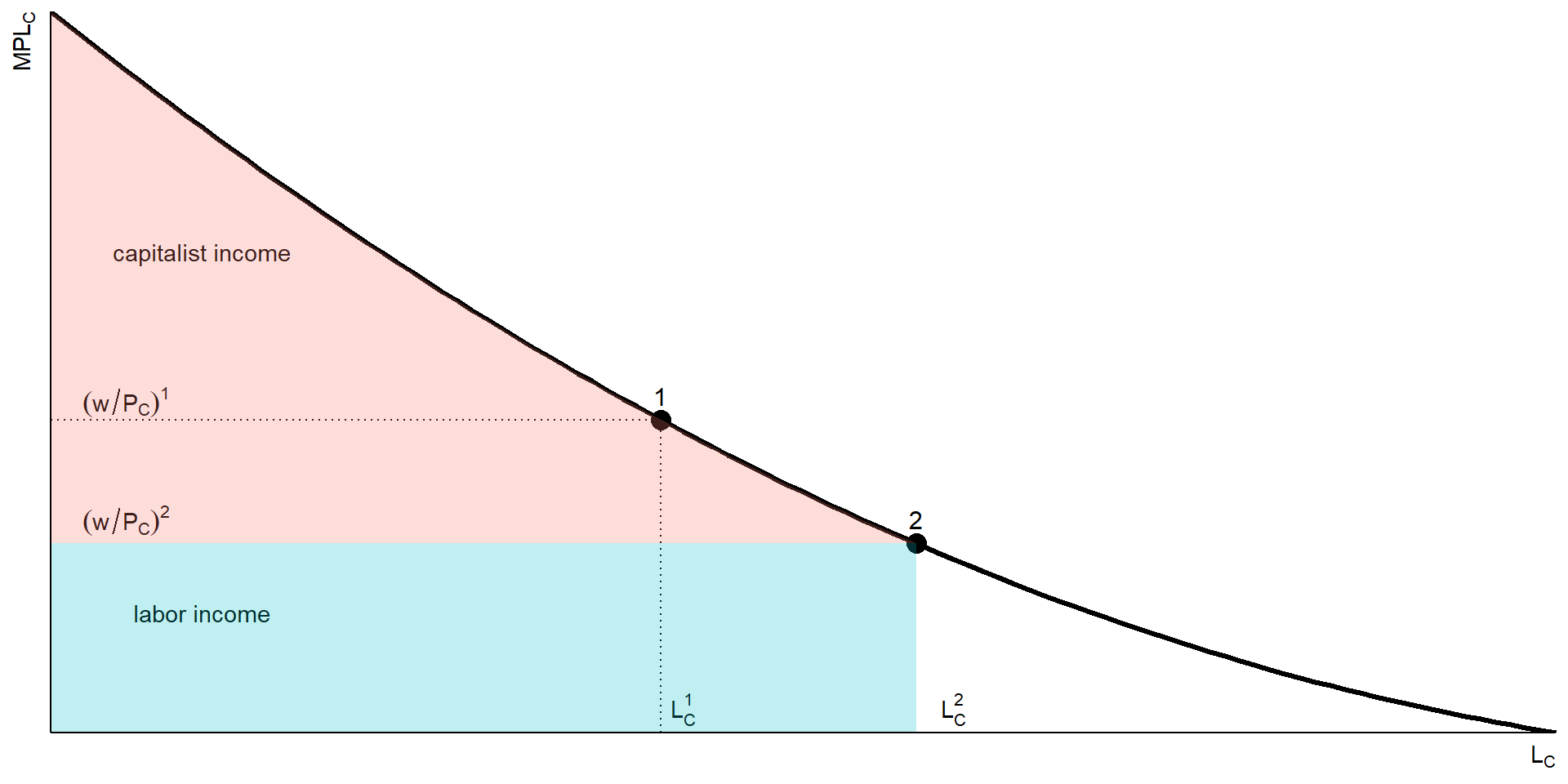

Cloth Sector

Increase in textile price

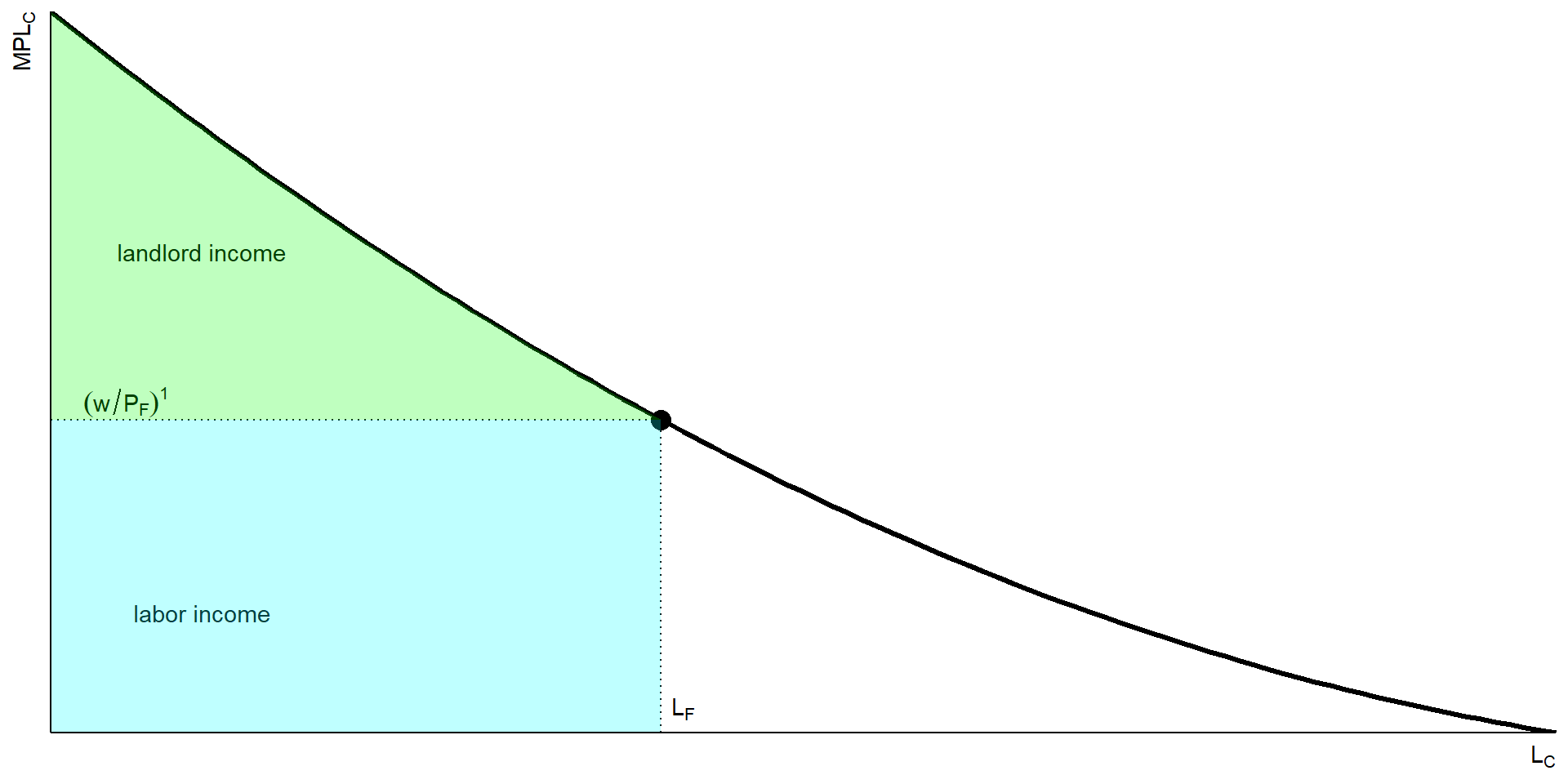

Food sector

Landlord surplus

Gains from trade

Trade benefits the factor that is specific to the export sector of each country but hurts the factor specific to the import-competing sectors, with ambiguous effect on mobile factors.

- Now, if trade benefit some and hurt some, can we still say gains of trade will always be positive overall?

Gains from trade

With no trade, then we must produce what we consume. That is:

DC=QC and DF=QF

- With trade, we don’t have to! As long as:

PC×DC+PF×DF=PC×QC+PF×QF

Gains from trade

A bit of algebra to get:

DF−QF=(PCPF)×(QC−DC)

That is, import of F equals relative price times export of C

How much we import depends on how much we export.

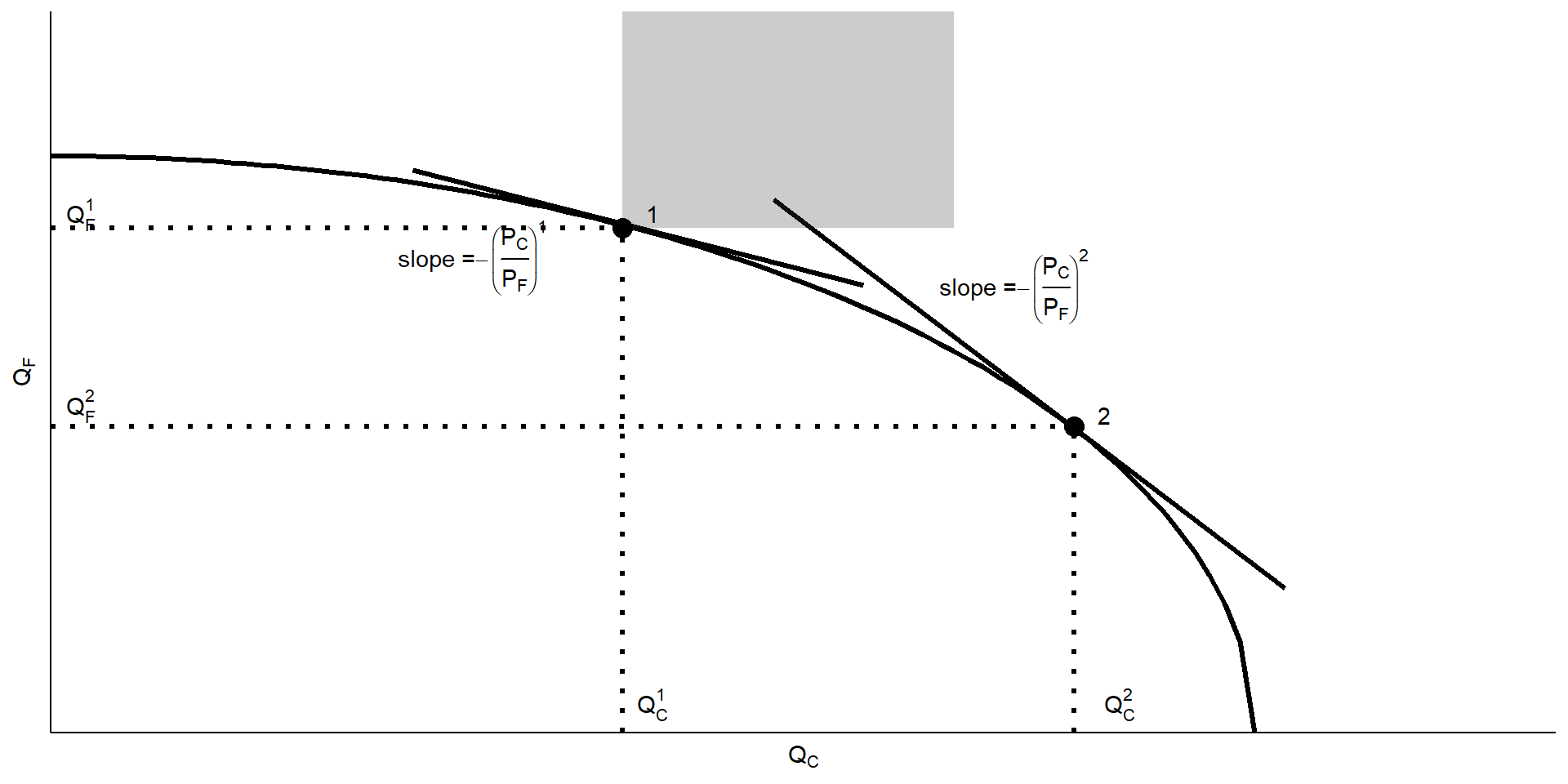

Gains from trade

semua daerah abu-abu adalah better set

Gains from trade

Understand that trade allows for bundles of options.

There’s always better allocation with trade.

If there’s always a better allocation, then the gain for gainers is larger than the loss for losers.

- Meaning, compensation transfer is possible.

Protectionist politics

International trade shifts the relative price of cloth to food, so factor prices change.

Trade benefits the factor that is specific to the export sector of each country, but hurts the factor that is specific to the import-competing sectors.

Trade has ambiguous effects on mobile factors.

Protectionist politics

Trade benefits a country by expanding choices.

Possible to redistribute income so that everyone gains from trade. Those who gain from trade could compensate those who lose and still be better off themselves.

That everyone could gain from trade does not mean that they actually do—redistribution usually hard to implement.

Protectionist politics

Trade often produces losers as well as winners.

Optimal trade policy must weigh one group’s gain against another’s loss.

Some groups may need special treatment because they are already relatively poor (e.g., Indonesian farmers).

Protectionist politics

Typically, those who gain from trade are a much less concentrated, informed, and organized group than those who lose.

- Example: consumers of food and rail services tend to be less influential than farmers and SOEs.

Governments can provide a “safety net” of income support to cushion the losses to groups hurt by trade (or other changes).

Protectionist politics

Most economists strongly favor “free” trade.

it is efficient, even if we include mitigation policies.

- subsidies, prakerja, etc financed with taxes paid by “winning” sectors.

changes in prices and welfare happens all the time, even without trade.

- Pandemic favors WFH jobs, data favors people who know how to crunch them, etc.

Trade & jobs

Trade shifts jobs from import-competing to export sector.

- Process not instantaneous—some workers will be unemployed as they look for new jobs.

How much unemployment can be traced back to trade?

- In the US, From 2001 to 2010, only about 2% of involuntary displacements stemmed from import competition or plants moved overseas.

- Results is rather mixed in Indonesia1

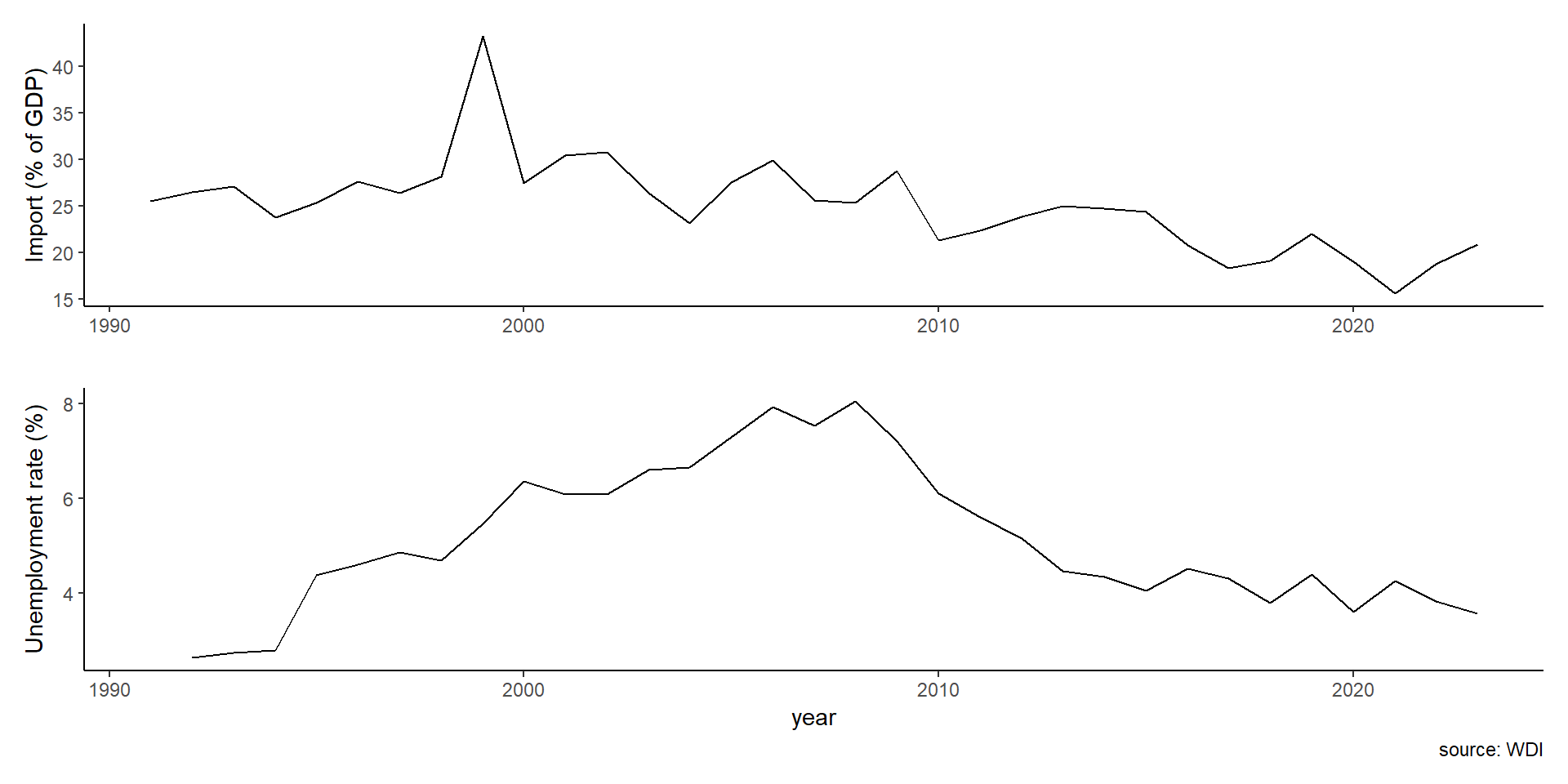

Unemployment vs import

Trump Trade War

Substantial political pressure to protect import-competing sectors, even if leads to aggregate losses.

- Trade protection usually limited to a few hard-hit sectors.

The Trump administration enacted a vast set of tariffs on solar panels, washing machines, steel, aluminium, and an expanding list of manufactured good produced in China.

Many of the protected sectors contained a high proportion of intermediate goods imported by U.S. producers, harming jobs in these downstream sectors.

Retaliation by trading partners had a negative impact on employment by U.S. exporters.