Hecksher-Ohlin and the Standard Model

ECES905205 pertemuan 4

2022-09-12

Last time

Different in tech create comparative advantage:

Ricardian: pure specialization, everybody happy.

Specific factor: winner and loser, but overall optimal.

same tech -> not trade

Or is it?

Intro H-O Model

Even if countries has the same tech/opportunity cost, difference in relative abundance of resources can still drive trade.

Here, we also show how different relative factor intensity drives trade.

Also will discuss factor price equalization and income distribution.

Two Factor H-O model

- 2 countries: Home and foreign

- 2 mobile factor i: kapital (K) and labor (L)

- 2 sectors j: cloth (C) dan Food (F)

- Countries has different total K and L

- Industries have different relative intensity.

Production

ai,j are the number of factor i used by industry j to make 1 unit of good j.

- e.g.: aKC= the amount of K used to make 1 m of cloth.

We still have diminishing return like specific factor model.

- MPL will decrease as L increase if K is not added.

This time though, we can add K, unlike specific factor model.

long run model: capital and labor can move between sectors.

- all labor paid w, all capital paid r.

H-O model

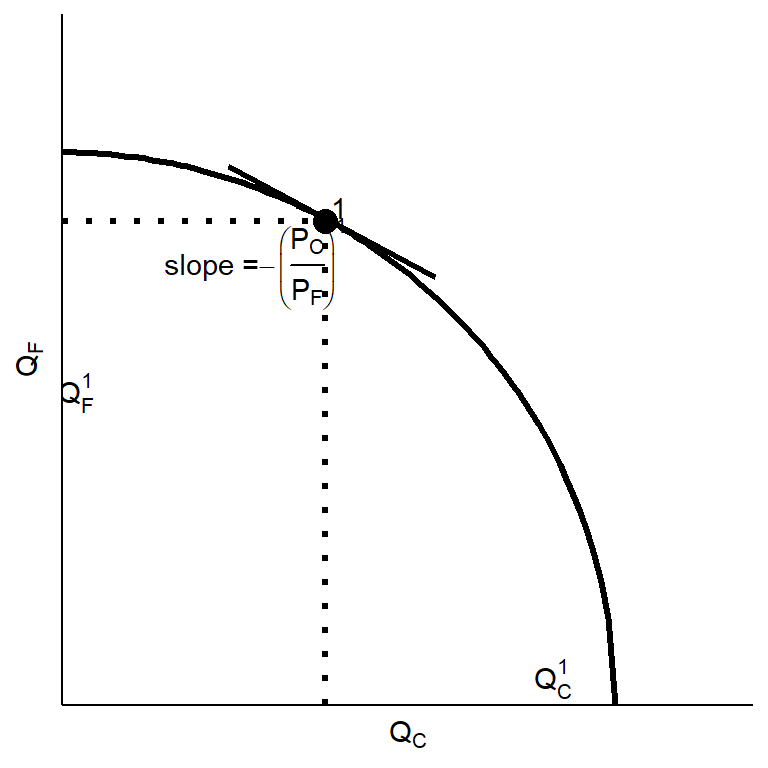

Without substitution, the production possibilities will be a minimum of 2 straight lines. (see appendix)

- Production is conducted at the tangency between PPF and price ratio −PCPF, like specific factr model.

- Similarly, the price ratio equates the opportunity cost for production.

- Remember, Opprtunity cost of making Qj increases as we make more Qj

Mixing inputs

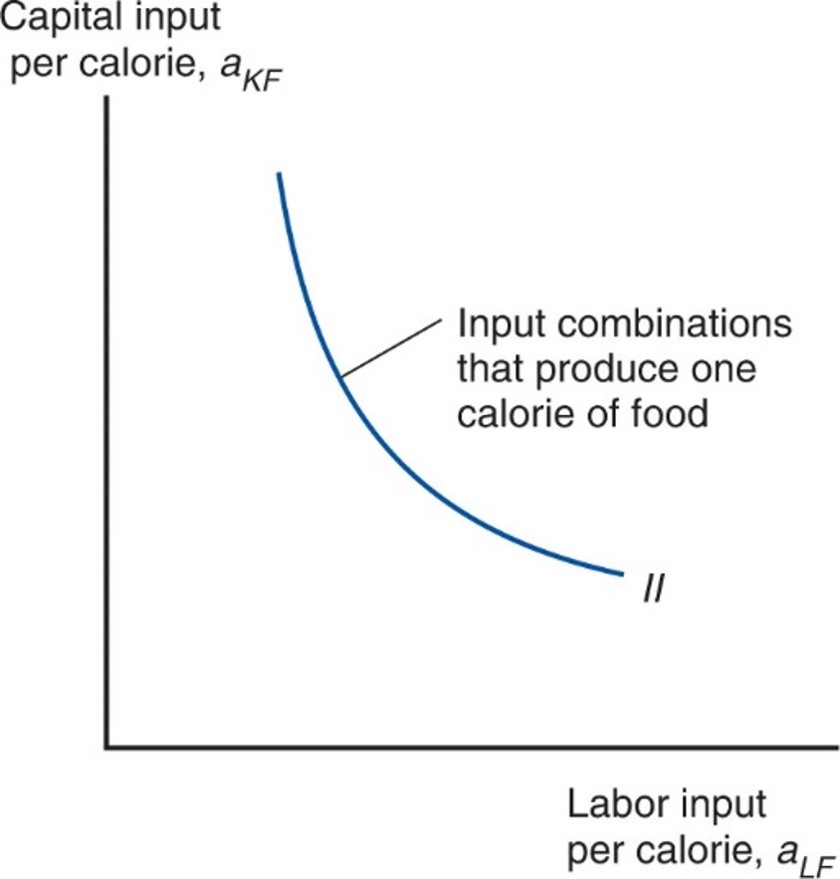

Producers may choose different amounts of factors of production used to make cloth or food.

Their choice depends on the wage, w, paid to labor and the rental rate, r, paid when renting capital.

As the wage w increases relative to the rental rate r, producers use less labor and more capital in the production of both food and cloth.

- They can do this because substitutability and factor movement.

Input mix

a farmer can produce a calorie of food with less capital if he or she uses more labor.

Think of the Indonesian farmers vs western farmers: Hired labor is around 3.5% of total cost in the US, while it is 47% in Indonesia!

Their choice depends on the wage, w, paid to labor and the rental rate, r, paid when renting capital.

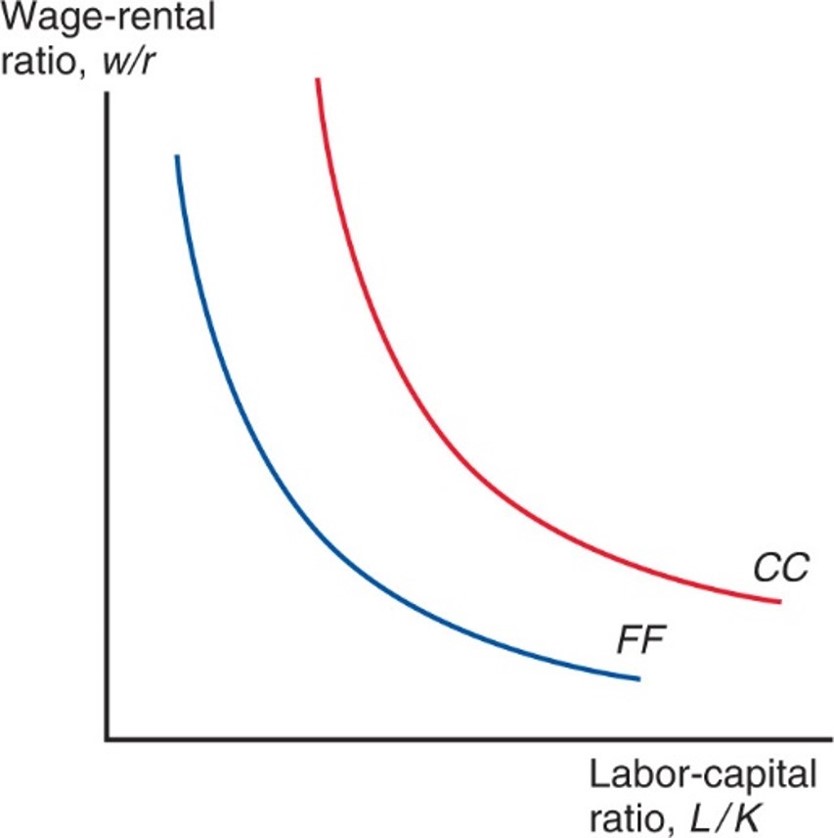

Factor intensity

- Say C is a relatively labor intensive industry:

aLCaKC>aLFaKFLCKC>LFKF

- Relative factor demand curve for cloth CC lies outside that for food FF.

Reminder micro

- Production and price ratio: remember your lagrange approach:

- MRS = price ratio.

∂Q∂K∂Q∂L=rw→LK=ω(wr) MPLMPK∝LK∝wr∝PCPF

Prices

In competitive markets, the price of a good should equal its cost of production, which depends on the factor prices.

How changes in the wage and rent affect the cost of producing a good depends on the mix of factors used.

- An increase in the rental rate of capital should affect the price of food more than the price of cloth since food is the capital intensive industry.

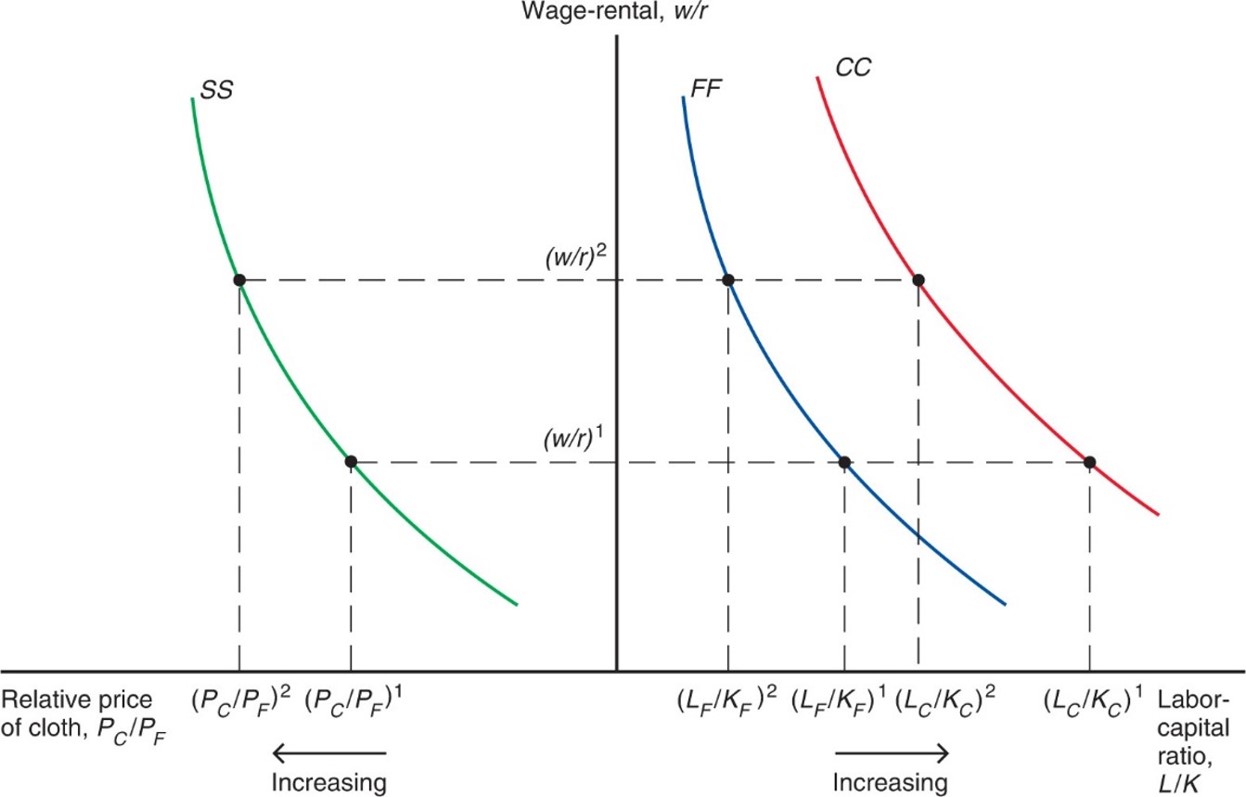

Changes in wr are tied to changes in PCPC

Stolper-Samuelson Theorem

if the relative price of a good increases, then the real factor price used intensively in the production of that good increases, while the real price of the other factor decreases.

- Any change in the relative price of goods alters the distribution of income.

Stolper-Samuelson Thm

If the relative price of cloth rises, the wage-rental ratio must rise. This will cause the labor-capital ratio used in the production of both goods to drop.

Factor & goods prices

An increase in the relative price of cloth PCPF is predicted to:

raise income of workers relative to the capitalists, wr

raise the ratio of capital to labor services KL used in both industries.

raise the real income (purchasing power) of workers and lower the real income of capital owners.

Rybczynski Theorem

If you hold output prices constant as the amount of a factor of production increases, then the supply of the good that uses this factor intensively increases and the supply of the other good decreases.

- Assume an increase of labor (bonus demografi) so that LK↑

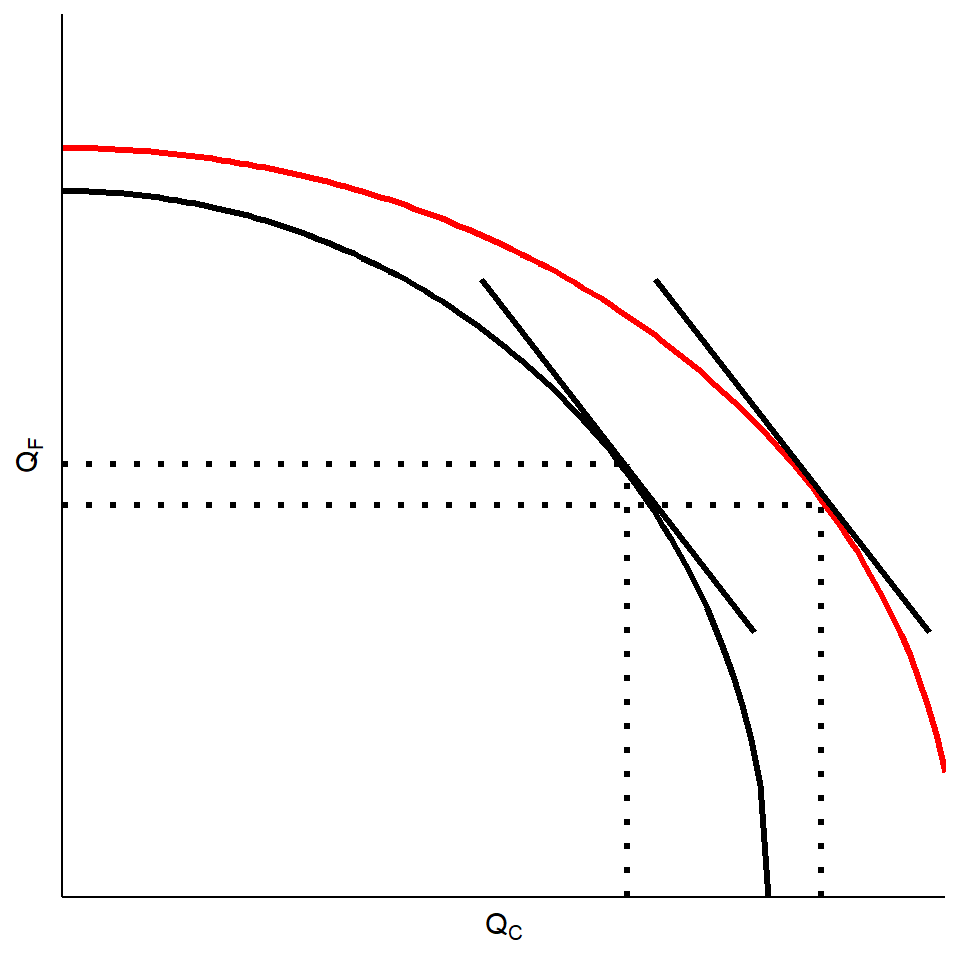

- PPF will grow but biased toward C

- If PCPF doesn’t change, the ratio f labor to capital used in both sectors remains constant.

- To expand, cloth sector will absorb labor AND capital from F.

PPF

- cloth-biased growth of PPF.

Resources and output

An economy with high LK produces high output of cloth relative to food.

if LK>L∗K∗ then home will be more efficient in making C.

home will be relatively efficient at producing cloth

Trade in HO

The countries are assumed to have the same technology and the same tastes.

With the same technology, each economy has a comparative advantage in producing the good that relatively intensively uses the factors of production in which the country is relatively well endowed.

With the same tastes, the two countries will consume cloth to food in the same ratio when faced with the same relative price of cloth under free trade.

Trade in HO

Since cloth is relatively labor intensive, at each relative price of cloth to food, Home will produce a higher ratio of cloth to food than Foreign.

Home will have a larger relative supply of cloth to food than Foreign.

Like the Ricardian model, the Heckscher-Ohlin model predicts a convergence of relative prices with trade.

With trade, the relative price of cloth rises in the relatively labor abundant (home) country and falls in the relatively labor scarce (foreign) country.

Trade in HO

Relative prices and the pattern of trade: In Home, the rise in the relative price of cloth leads to a rise in the relative production of cloth and a fall in relative consumption of cloth.

- Home becomes an exporter of cloth and an importer of food.

The decline in the relative price of cloth in Foreign leads it to become an importer of cloth and an exporter of food.

HO Theorem

Heckscher-Ohlin theorem: The country that is abundant in a factor exports the good whose production is intensive in that factor.

This result generalizes to a correlation:

Countries tend to export goods whose production is intensive in factors with which the countries are abundantly endowed.

see Alan Deardorff “the general validity of the Hecksher-Ohlin theorem.”

Trade and income

Changes in relative prices can affect the earnings of labor and capital.

A rise in the price of cloth raises the purchasing power of labor in terms of both goods while lowering the purchasing power of capital in terms of both goods.

A rise in the price of food has the reverse effect.

Trade and income

Thus, international trade can affect the distribution of income, even in the long run:

Owners of a country’s abundant factors gain from trade, but owners of a country’s scarce factors lose.

Factors of production that are used intensively by the import-competing industry are hurt by the opening of trade—regardless of the industry in which they are employed.

Distribusi pendapatan

Di home, perdagangan sangat menguntungkan bagi buruh karena mereka bisa ekspor (PC>P∗C) dan bisa konsumsi makanan dengan harga lebih murah (PF>P∗F)

Sebaliknya, di foreign, trade menguntungkan pemilik kapital.

Owners of a country’s abundant factors gain from trade, but owners of a country’s scarce factors lose

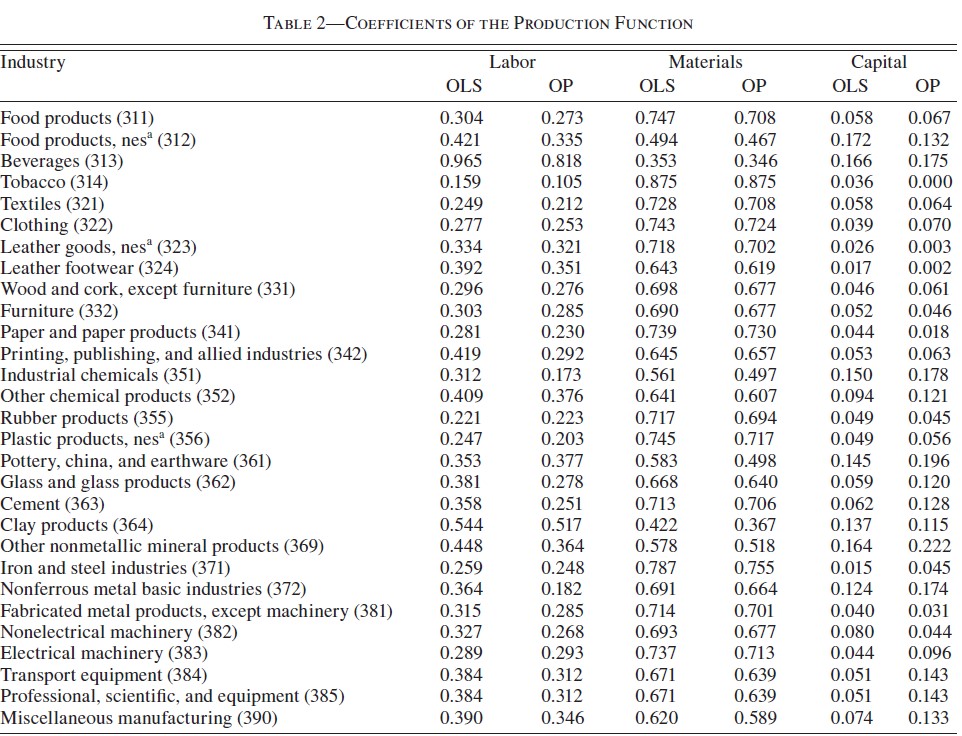

factor intensity in Indonesia (Amiti and Konings 2007 “Trade Liberalization, Intermediate Inputs, and Productivity: Evidence from Indonesia”)

Trade and income

- Changes in income distribution occur with every economic change, not only international trade.

- Changes in technology, changes in consumer preferences, exhaustion of resources and discovery of new ones all affect income distribution.

- Economists put most of the blame on technological change and the resulting premium paid on education as the major cause of increasing income inequality in the United States.

- It would be better to compensate the losers from trade (or any economic change) than prohibit trade.

- The economy as a whole does benefit from trade.

North-south inequality

The Heckscher-Ohlin model predicts that owners of relatively abundant factors will gain from trade and owners of relatively scarce factors will lose from trade.

- Little evidence supporting this prediction exists.

According to the model, a change in the distribution of income occurs through changes in output prices, but there is no evidence of a change in the prices of skill-intensive goods relative to prices of unskilled-intensive goods.

North-south inequality

According to the model, wages of unskilled workers should increase in unskilled labor abundant countries relative to wages of skilled labor, but in some cases the reverse has occurred.

The majority view of trade economists is that the villain is not trade but rather new production technologies that put a greater emphasis on worker skills (such as the widespread introduction of computers and other advanced technologies in the workplace).

Skill-biased

Trade likely has been an indirect contributor to increases in wage inequality, by accelerating the process of technological change.

Firms that begin to export may upgrade to more skill-intensive production technologies.

Trade liberalization can then generate widespread technological change by inducing a large proportion of firms to make such technology-upgrade choices.

Breaking up the production process across countries can increase the relative demand for skilled workers in developed countries similar to skill-biased technological change.

Capital-skill complementarity

Technological change often takes the form of new and better machines (capital) that displace unskilled workers but still require skilled workers.

- This generates higher returns for both capital and skilled workers while depressing the returns to unskilled workers.

Increased automation can explain the observed worldwide increases in both wage inequality and the returns to capital, as well as the within-sector increases in the employment share of (relatively skilled) non-production workers.

Factor price equalization

Unlike the Ricardian model, the Heckscher-Ohlin model predicts that factor prices will be equalized among countries that trade.

Free trade equalizes relative output prices.

Due to the connection between output prices and factor prices, factor prices are also equalized.

Trade increases the demand of goods produced by relatively abundant factors, indirectly increasing the demand of these factors, raising the prices of the relatively abundant factors.

Factor price equalization

In the real world, factor prices are not equal across countries.

The model assumes that trading countries produce the same goods, but countries may produce different goods if their factor ratios radically differ.

The model also assumes that trading countries have the same technology, but different technologies could affect the productivities of factors and therefore the wages/rates paid to these factors.

factor price eq

Because the Heckscher-Ohlin model predicts that factor prices will be equalized across trading countries, it also predicts that factors of production will produce and export a certain quantity goods until factor prices are equalized.

- In other words, a predicted value of services from factors of production will be embodied in a predicted volume of trade between countries.

factor price eq

But because factor prices are not equalized across countries, the predicted volume of trade is much larger than actually occurs.

- A result of “missing trade” discovered by Daniel Trefler.

The reason for this “missing trade” appears to be the assumption of identical technology among countries.

Technology affects the productivity of workers and therefore the value of labor services.

A country with high technology and a high value of labor services would not necessarily import a lot from a country with low technology and a low value of labor services.

HO empirics

An important study by Donald Davis and David Weinstein showed that if relax the assumption of common technologies, along with assumptions underlying factor price equalization (countries produce the same goods and costless trade equalizes prices of goods):

- then the predictions for the direction and volume of the factor content of trade line-up well with empirical evidence and ultimately generate a good fit.

Difficulty finding support for the predictions of the “pure” Heckscher-Ohlin model can be blamed on some of the assumptions made.

HO empirics

Contrast the exports of labor-abundant, skill-scarce nations in the developing world with the exports of skill-abundant, labor-scarce (rich) nations.

The exports of the three developing countries to the United States are concentrated in sectors with the lowest skill intensity.

The exports of the three skill abundant countries to the United States are concentrated in sectors with higher skill intensity.

Summary

HO assume difference in factr abundance still promotes trade even if the technology is the same.

changes in relative prices changes distribution of income, benefiting factor which used intensively by industry with increased price.

Changes in factor abundance also changes production and income distribution.

Empirical support of the Heckscher-Ohlin model is weak except for cases involving trade between high-income countries and low/middle- income countries or when technology differences are included.

Appendix

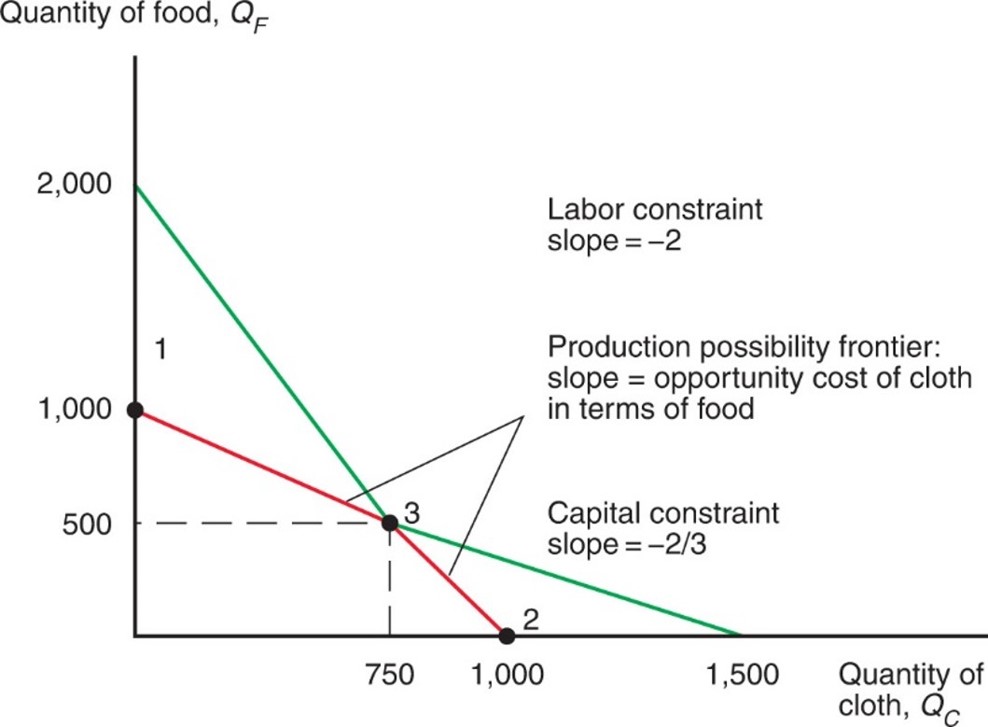

Production w/o subs

Production constraint will be similar with Ricardian economy, except this time we have 2 constraints: Labor (L, same as ricardian), and Capital (K).

let aij be the amount of factor i used to produce 1 unit of product j, while K and L are constant.

aKCQC+aKFQF≤KaLCQC+aLFQF≤L

No subs

Suppose use a fixed mix of capital and labor in each sector.

aKC=2, capital used to produce one yard of cloth

aLC=2, labor used to produce one yard of cloth

aKF=3, capital used to produce one calorie of food

aLF=1, labor used to produce one calorie of food

L=2000 while K=3000.

No subs

Constraint on capital that capital used cannot exceed supply for the numerical example:

2QC+3QF≤3000

Constraint on labor that labor used cannot exceed labor supply:

2QC+QF≤2000

No subs

If capital cannot be substituted for labor or vice versa, the production possibility frontier in the factor-proportions model would be defined by two resource constraints: The economy can’t use more than the available supply of labor (2,000 work-hours) or capital (3,000 machine-hours). So the production possibility frontier is defined by the red line in this figure.

No subs

The opportunity cost of producing one more yard of cloth, in terms of food, is not constant:

low (23) when the economy produces low amount of cloth relative to food.

high (2 in the example) when the economy produces high amount of cloth relative to food.

Why? Because when the economy devotes more resources towards production of one good, the marginal productivity of those resources tends to be low so that the opportunity cost is high.

No subs

The above P P F equations do not allow substitution of capital for labor in production.

- Unit factor requirements (aij) are constant along each line segment of the P P F.

If producers can substitute one input for another in the production process, then the P P F is curved (bowed).

Opportunity cost of cloth increases as producers make more cloth.

similar as specific factor model.