Unbundling and the global value chain

ECES905205 meeting 7

2024-03-21

So far

we have discusses extra-industry trade, where countries are buying and selling different goods (e.g., cloth exporter and food exporter)

- can be driven by difference in technology or factor abundance.

In industries with significant fixed cost, we also see that intra-industry trade benefits.

- gains come from economies of scale, number of brands, and improvement of average productivity.

Today

Today we discuss the concept of offshoring.

We also unpack the concept of unbundling stages of production.

Intro

Offshoring

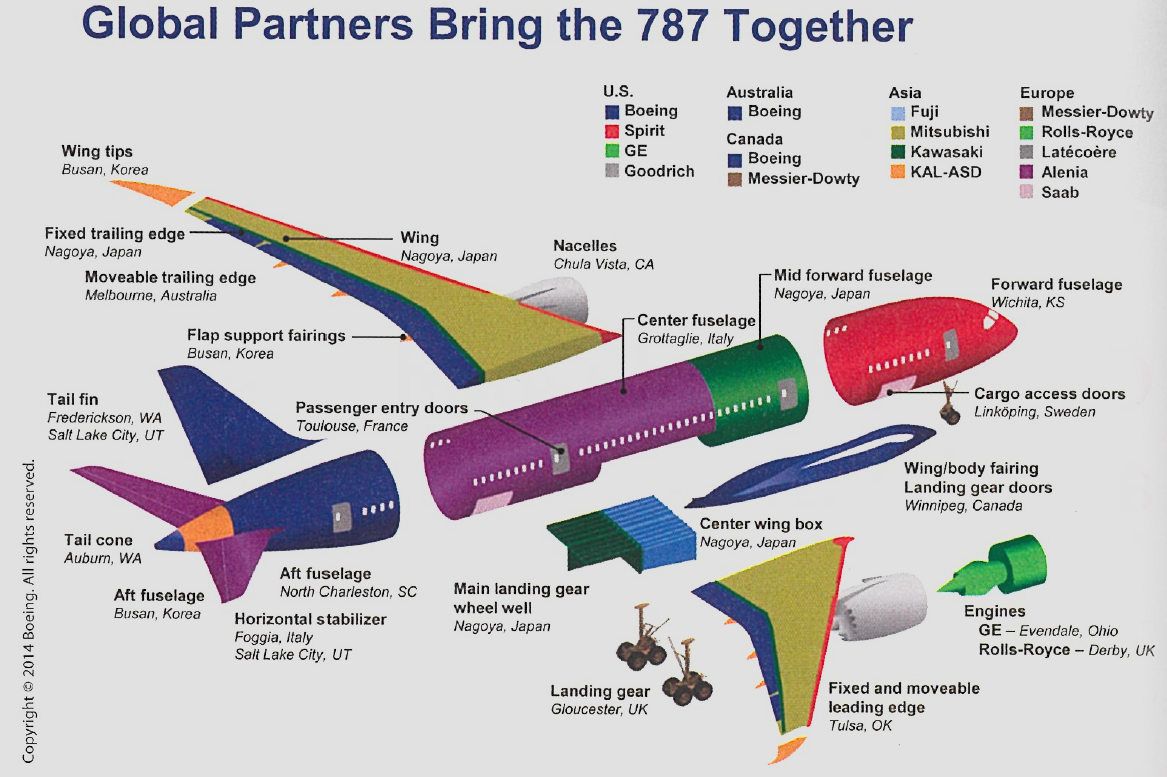

The provision of a service or the production of various parts of a good in different countries that are then used or assembled into a final good in another location is called foreign outsourcing.

- sometimes called offshoring.

Offshoring is a typoe of international trade that differs from the type we see in Ricardian and H-O models where goods traded are final goods.

Offshoring is trade in intermediate inputs, which can sometimes crosses several borders before turned into a final good.

Offshoring

At its core, offshoring has the same reasoning as our standard trade model:

- A firm in a country is better of sourcing part of their production in countries with comparative advantage in that good.

In essence, offshoring breaks down a final good into several intermediate goods (and services).

- these goods embed different factor intensities.

Unbundling

To understand offshoring better, we utilise the theory of product unbundling, coined by Richard Baldwin.

So far, our model assume a trivial trade cost. which is of course far from true in the real world.

However, trade cost is indeed dropping in various speed.

Decreasing cost of trade is what causes economic undbundling.

Cost of trade

trade cost / cost of moving goods leads to the first unbundling.

communivation costs / cost of moving ideas leads to the second unbundling

Face-to-face costs / cost of moving people leads to the third unbundling.

First unbundling

Happened in around 1820, the brittain industrial revolution

- aka the steam revolution -> steam ship, steam rail, containerization, telegram/telephone.

Also the Pax Brittanica, a relatively peace time after Napoleonic war.

Characterized by low trade cost, but high communication costs and face-to-face costs.

First unbundling

also called old globalization.

With high trade cost, all countries must produce their own goods and services because moving goods are expensive.

The first unbundling is basically unbundle production and consumption: various goods can be produced abroad.

Production clustered locally (to reduce communcation costs), but market are global (goods can be moved to different countries relatively cheaply)

- also, remember internal economies of scale?

Old globalization

High communication costs meant Northern (aka rich countries) innovation stayed in the north.

There is a knowhow imbalance, where all the knowledge is accumulated in the place of productions (remember external economies of scale?)

Second unbundling

Happened after 1990 thanks to ICT revolution (basically the internet).

Characterized by low cost of trade and communication cost, but still high face-to-face costs.

Now firms can organize production easily. Location of ideas can be different from the manufacturing.

2nd unbundling: unbundling process of production / production value chain.

Second unbundling

The second unbundling creates hyperglobalization, where globalization happens on the process of production.

- This is offshoring. Also called the global value chain (GVC) phenomenon.

To ensure offshored production meshed seamlessly, G7 firms offshored knowhow with the jobs.

This creates a comparative advantage, hence trade opportunities from high-tech value chain and low-wage one.

With lower value outsourced (hence gets cheaper with lower wage), the trade cost become worth it.

Modeling the offshoring

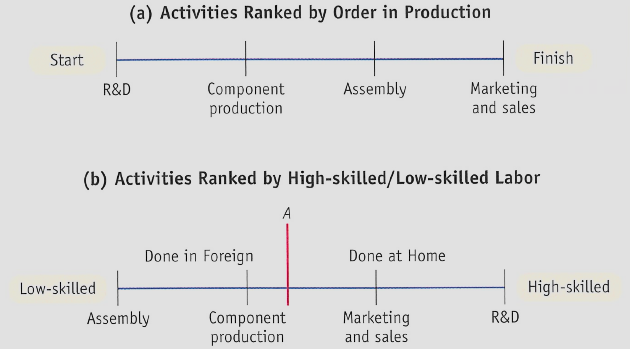

For any given final product, we unbundle its process of production. We first list these process from start to finish.

For example, to make an aeroplane, you need to start with research and development (R&D), produce components, assemble them, and then do marketing and sales as well as customer service.

We then rearrange the list in terms of value: from lower value to higher value.

- e.g., start with assembly, end with R&D.

Modeling the offshoring

Offshoring model

panel (a) is the unbundle list based on production process, while panel (b) is the rearranging from lower value to higher value.

In the panel (b), there exists a point A where we can slice/unbundle the production process: a low-value process (left of A), and a high-value process (right of A).

Suppose Home country is a high-tech country, then it’s better for home to outsource the left bundle abroad.

Offshoring model

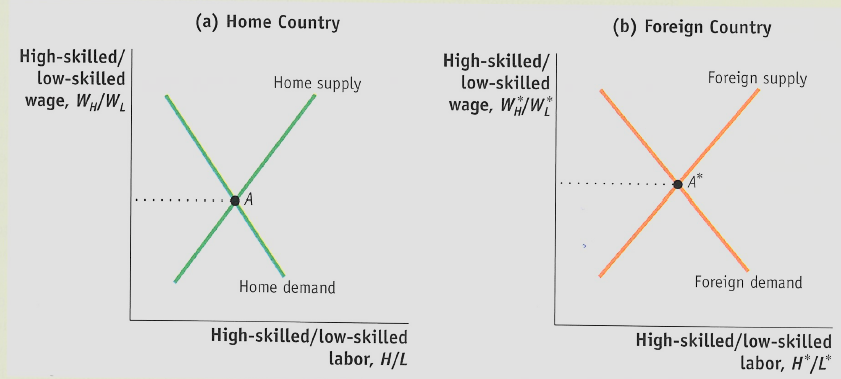

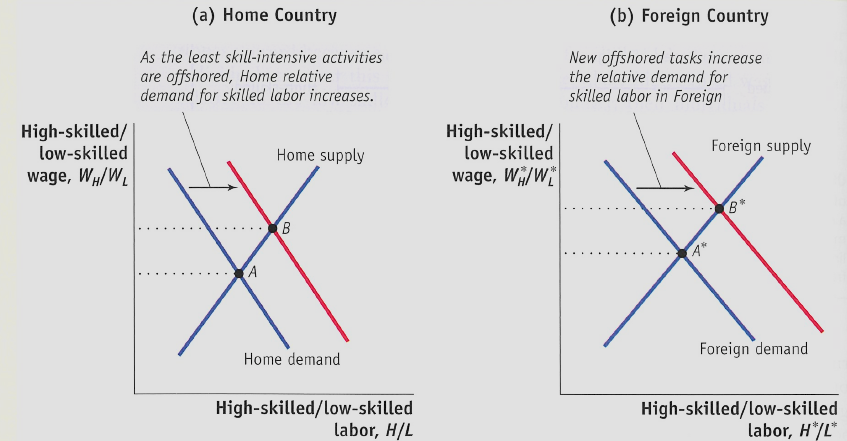

Think of a HO model, but instead of having a labor/capital ratio, we have high skilled/low skilled labor \(\frac{H}{L}\).

Let G7 countries represented by a region called Home, while China is foreign. We assume that

\[ \frac{H}{L} > \frac{H^*}{L^*} \]

Offshoring model

- Goes without saying that wage of high-skilled labor relative to low-skilled labor is lower in Home

\[ \frac{W_H}{W_L}<\frac{W_H^*}{W_L^*} \]

Meaning, Home has comparative advantage in producing high value production which use high-skilled labor intensively.

Of course foreign thus have comparative advantage in producing lower value production, which Home country offshore.

Offshoring

This is the second unbundling: we unbundle process of production into two: high-value bundle and low-value bundle.

Two countries with different labor profile then trade these bundles.

Just like Standard Trade Model (STM), we can model this with a relative wage vs relative labor demand graph.

Offshoring

Relative labor market

High-skilled labor relative to low-skilled ones are abundant at Home, thus \(\frac{W_H}{W_L}\) equilibrium is low.

\(\frac{W_H}{W_L}<\frac{W_H^*}{W_L^*}\), thus this create an arbirtage.

Just like H-O model, trade would benefits H in Home and L* in foreign, while L and H* suffers.

Lower trade cost

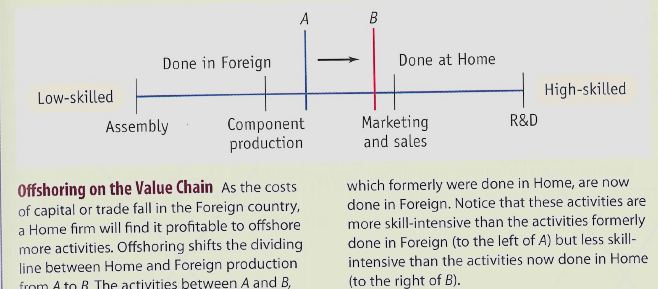

An even lower trade cost may reduce operating cost at Foreign.

This means, offshoring become even cheaper: Home may increase its offshoring, moving more process of production abroad.

If this happens, demand for L goes down (because more low-skilled jobs are offshored), thus \(\frac{H}{L} \uparrow\)

Foreign gets more job, thus \(\frac{H*}{L*} \downarrow\)

Lower trade cost

Lower trade cost

Second unbundling

The new ‘hi-tech-low-wage’ mix shifted manufacturing & knowhow massively to a handful of developing nations.

The result is the great convergence between 1990-2014:

Developed countries are catching up, enlarging their pie share in the global GDP.

While G7 economies relatively reduced in the global GDP share.

Consequences

New globalization (aka the second undbundling) breaks monopoly that G7 labour had on G7 knowhow. Now G7 firms can pick other labor in other countries basically.

New globalization affects economies with finer resolution: it used to be that countries compete on the final product level, now on the manufacturing stage and job level.

Impact of the new globalization is now more sudden, individual, unpredictable and uncontrollable.

Consequences

production that used to be happened all in one country is now become an international trade.

Trade policy affects not just final product, but also granularry

Predictable trade policy become even more important because changes in one chain of value affects the overall production.

National competitiveness is now become regional competitiveness.

Consequences

Developing countries now don’t have to start to build final good from the ground-up. They can join the value chain / production network.

Vietnam is one of the largest smartphone exporter. It does not have to know how to make the whole smartphone, but starting from the assembly.

China also started with assembly and then become more upstream

G7 competitiveness now relies on offshoring. Cannot compete without one.

The third unbundling

Third unbundling is a relatively new phenomenon: happens when face-to-face cost reduce.

The industry 4.0: face-to-face cost reduces thanks to telepresence and telerobotics. Data transfer, human-machine and machine-machine interface allows it to happen.

Telerobotics: example, a doctor can provide his/her service through robots, lecturers can do zoom class, etc.

It remains to be seen its consequences.

Rebundling?

De-globalization phenomena may moves us back a little bit, where countries are on the move to re-introduce measures which increase trade costs (tariffs, non-tariffs, WTO dead).

Will unbundled production be re-bundle?