FDI in ASEAN and emerging issues in FDI

Meeting 12

May 27, 2024

Today

FDI in the ASEAN is in a the microscope amid China v USA trade ‘cold war’.

Taken from ASEAN Investment Report 2023 which can be accessed here

Global trends

Global FDI flows in 2022 declined by 12 per cent to $1.3 trillion, after nosediving in 2020 and rebounding in 2021.

Why: The multitude of crises and challenges on the global stage – the war in Ukraine, high food and energy prices, risks of recession and debt pressures in many countries.

FDI project activity in the first quarter of 2023 shows that investors are uncertain and risk averse:

- 2023Q1:The number of international project finance deals in the first quarter of 2023 was down significantly

- greenfield project announcements and cross-border M&A activity also slowed.

FDI

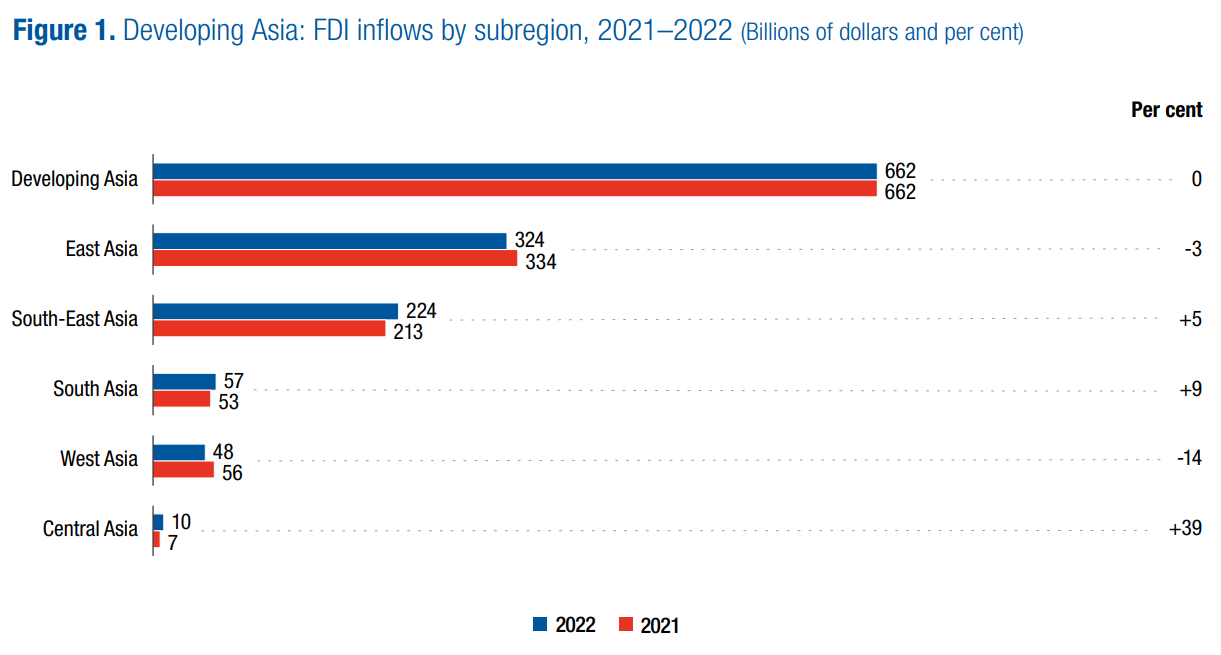

FDI flows to developing Asia remained flat at $662 billion (figure 1). This region remained the largest recipient of FDI, accounting for half of global inflows.

In East Asia, FDI decreased by 3 per cent to $324 billion in 2022. Flows to China rose by 5 per cent, to a record $189 billion.

The increase was concentrated in manufacturing and high-tech industries (mainly electronics and communication equipment) and came mostly from European MNEs.

Flows to South-East Asia increased by 5.5 per cent to $224 billion – also the highest level ever recorded.

In South Asia, FDI flows rose by 9 per cent to $57 billion

FDI flow

FDI inflow

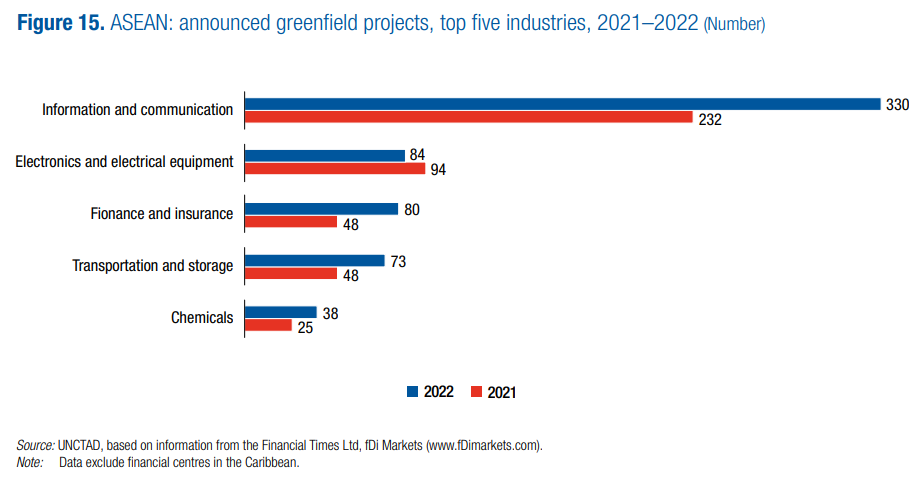

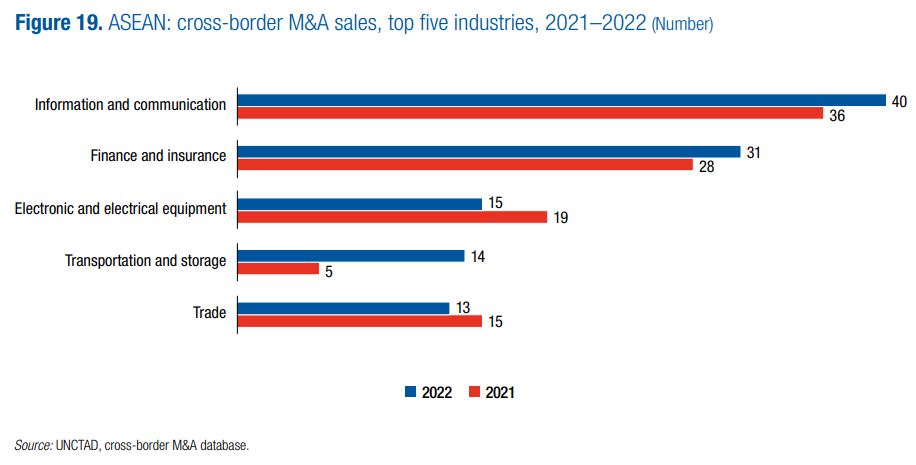

ASEAN registered higher numbers of greenfield project announcements, international project finance deals and cross-border M&As.

ASEAN FDI inflows in 2022 exceeded flows to China for the second consecutive year

FDI Inflow

ASEAN FDI

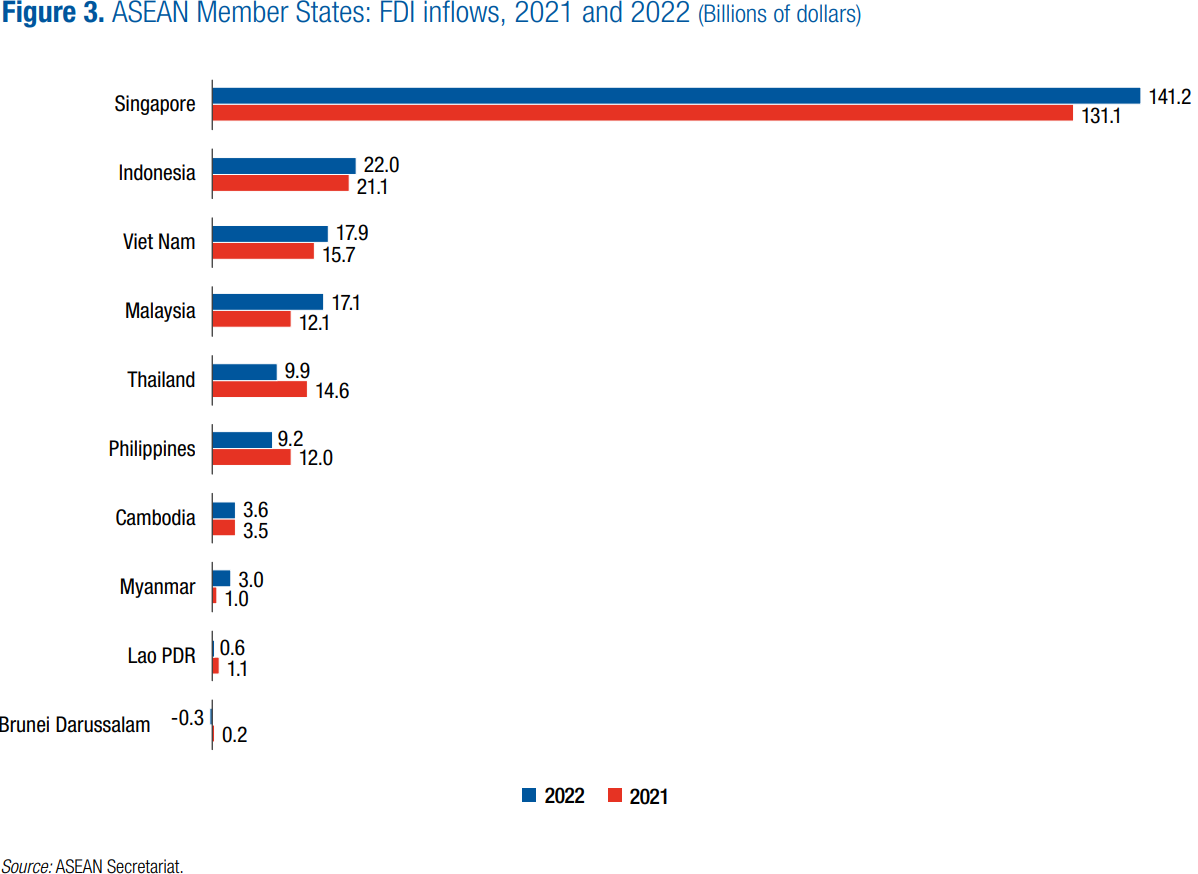

Six Member States recorded higher inflows in 2022 than in 2021.

Singapore witnessed the highest absolute increase in value, accounting for more than 60 per cent of FDI in the region.

Malaysia and Myanmar recorded the highest percentage growth.

FDI hit record levels in three Member States (Malaysia, Singapore and Viet Nam)

Cambodia’s and Indonesia’s growth was flat but levels of investment remained high

FDI in ASEAN

Reasons

Rising investment across different modalities (project types), showing increasingly favourable investor sentiment for the region.

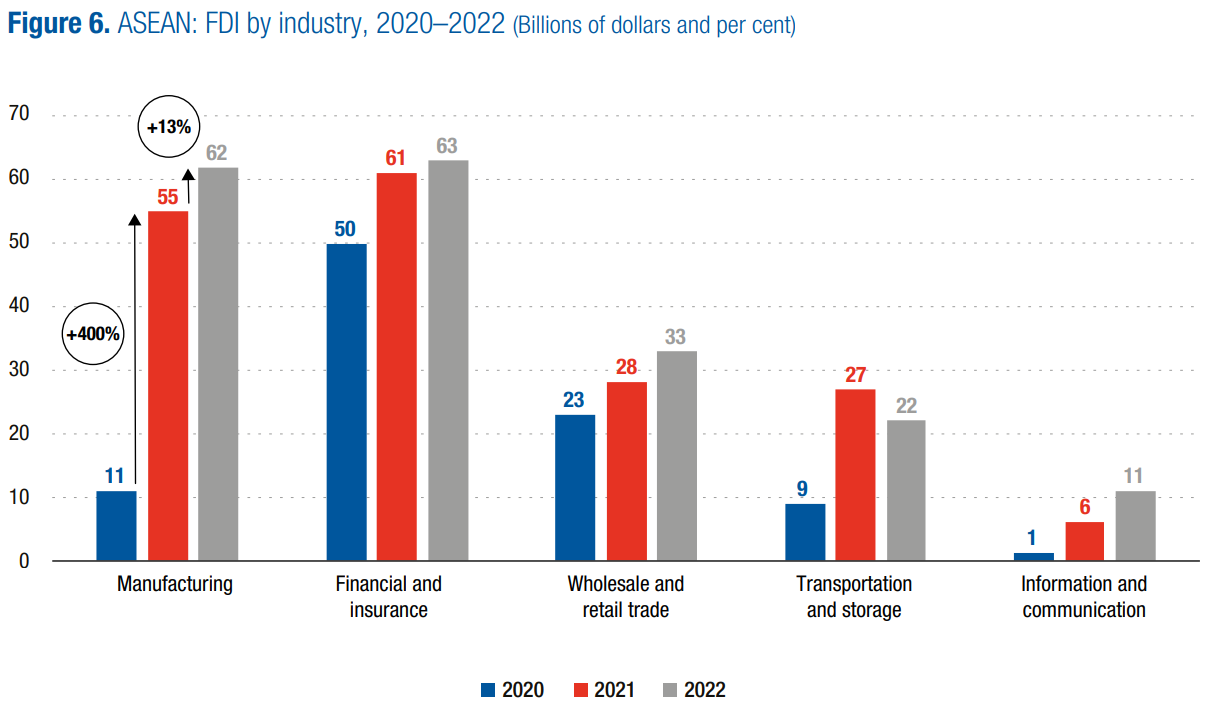

Record FDI in manufacturing, attesting to the region’s strong rebound from the pandemic and its industrial vibrance.

Corporate investment strategies focusing on capacity expansion to build supply chain facilities, to bolster supply chain networks and to establish a stronger regional foothold.

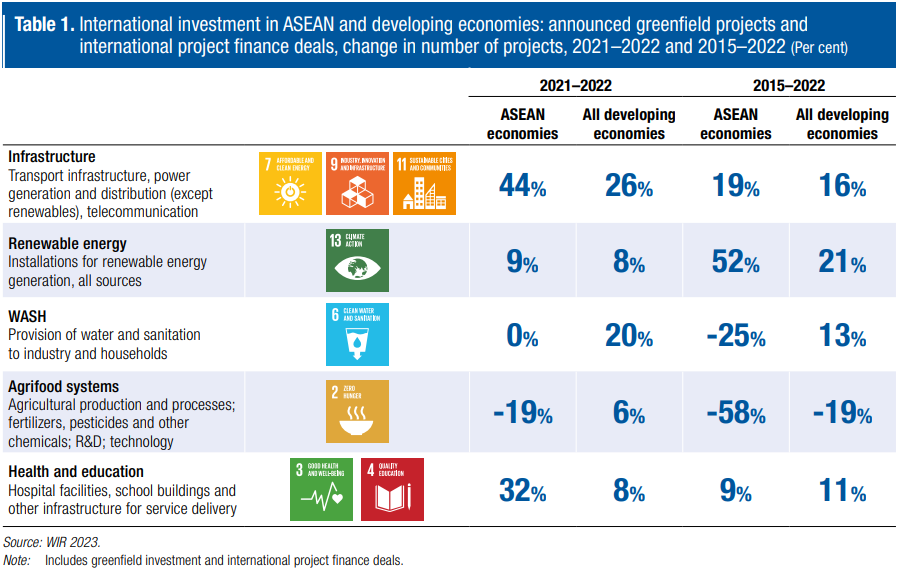

Increased investment in the energy transition, infrastructure and the digital economy.

Significant investor interest from several source countries.

FDI in ASEAN

Industries that received significant investment in 2021 (e.g. EVs, electronics, data centres, the digital economy) continued to receive new, expanded and upgraded investment in 2022.

Geopolitical tensions and supply chain challenges remained an important influencing factor for diversification and relocation activities, with ASEAN a major beneficiary.

FDI in ASEAN

FDI by source

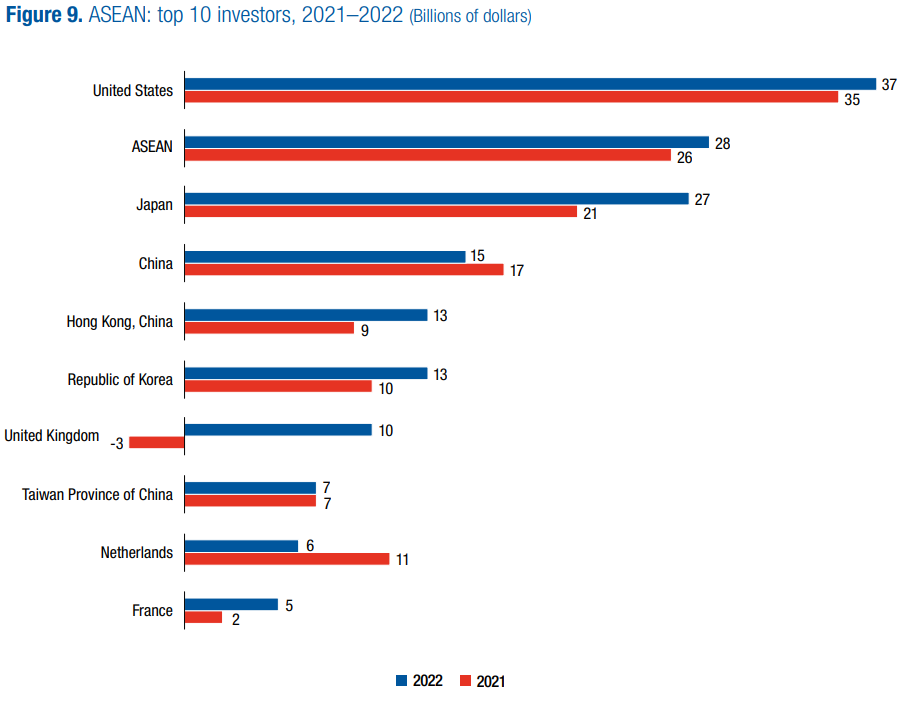

FDI from the top 10 sources accounted for 71 per cent of investment in ASEAN, up from 63 per cent in 2021

US remained the largest investor in the region, mainly in chips and finance.

Japan is second, particularly in automotive and storage (88% of this industry is from JPN).

Chinese companies remained active in infrastructure projects, EV-related activities and the digital economy, and were the largest investors in Cambodia, the Laos & Myanmar.

FDI by Source

Intra-ASEAN

Intra-ASEAN FDI

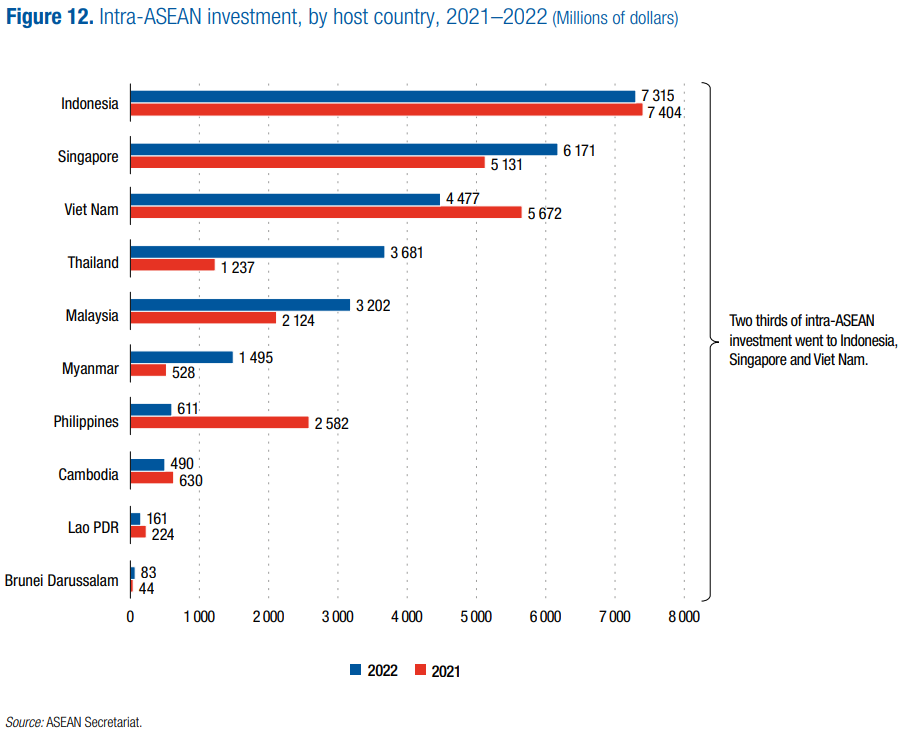

The three major destinations for intra-ASEAN investment (Indonesia, Singapore and Viet Nam, in that order) accounted for more than 66 per cent of intraregional investment in 2022.

Singapore, Thailand and Malaysia were the three largest regional investors; together they accounted for more than 90 per cent of intraregional flows.

This indicates a high concentration in the source of intraregional investment and the limited capacity of firms from other Member States to regionalize.

Key challenges to internationalization include limited access to finance; knowledge, information and know-how gaps; and difficulties in identifying investment opportunities.

Intra-ASEAN FDI

Measuring intra-ASEAN investment by value can be misleading. SMEs can provide a potential source of intraregional investment as these enterprises tend to internationalize to neighbouring countries to grow, rather than venture further afield.

It is important to distinguish intraregional investment by ASEAN companies from investment by MNE subsidiaries based in ASEAN.

Investment conducted by MNEs in the region often flows through holding companies or special-purpose vehicles.

Policy options

Strengthen institutional connectivity. Establish a regular forum for cooperation between inward-outward FDI agencies, including between investment promotion agencies

Promote regional cooperation on regionalization of SMEs. Issues include measures and mechanisms to facilitate access to finance and access to information, establish dedicated institutional support, facilitate investment, establish SME regionalization alliances

Establish a task force of alliances of stakeholders.

Leverage the ASEAN Working Group on Statistics.Task the group with compiling and reporting detailed statistics on intraregional investment.

Greenfield

International project finance

Merger & Acquisition

Challenges

Global FDI flows in 2023 are expected to fall further. This declining trend could affect the investment momentum to the region.

Rising interest rates could lead to higher costs of finance. This could slow down investment and international project finance activities.

The forthcoming international tax reform will have significant implications for FDI policies, including SEZ development. It will affect the use of tax incentives to promote FDI

Opportunities

RCEP single market is attractive for GVC & market.

Energy transition tech, semiconductors and e-commerce is still very strong in the region.

International supply chain can only move to SEA.

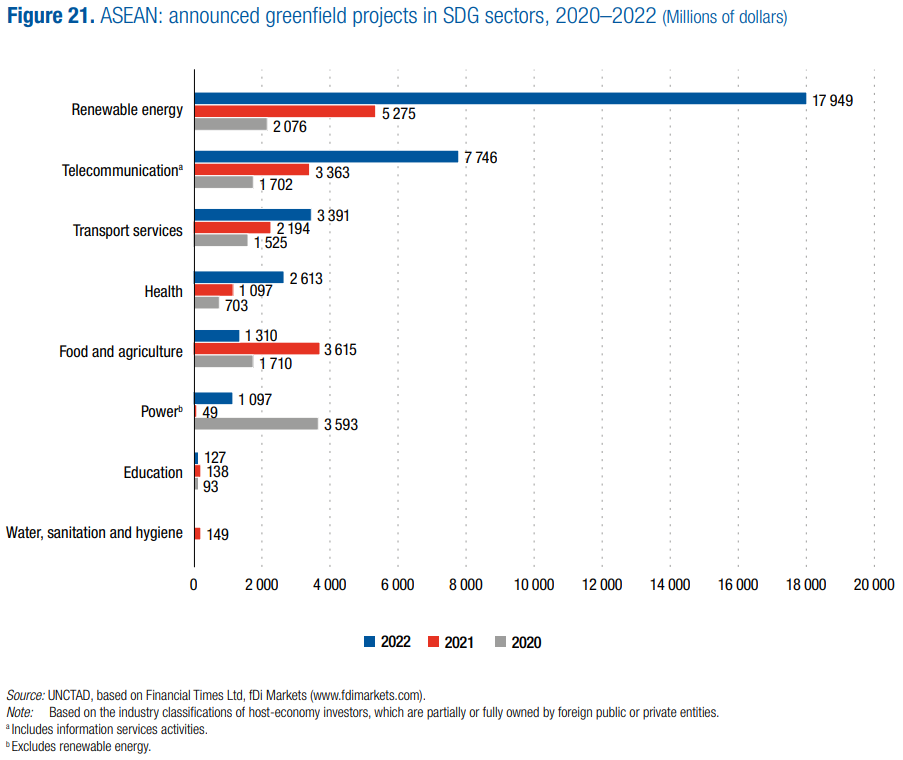

SDGs investment

SDGs investment

FDI favorable policies

From 2013 to 2022, more than one third of the FDI-favourable measures related to opening new sectors or activities to foreign investment. In 2021–2022, for instance:

Vietnam allowed complete foreign investment in insurance and set implementation guidelines for the 2020 Law on Investment, which includes a restrictive list for market access for foreign investors.

The Philippines permitted full foreign investment in renewables and revised its negative list by removing manufacture, repair, storage and distribution of products requiring clearance from the Department of National Defence.

Foreign ownership restrictions in SMEs and trading enterprises were also relaxed. Wholly foreign ownership of public services, such as telecommunication, airlines, shipping and railways was allowed.

Incentives

Cambodia enacted a Law on Investment that provides incentives for investment in 19 sectors, including high-tech industries and projects targeting innovation, research and development, digital infrastructure and high value added manufacturing.

Thailand reduced import tariffs for four major investment projects and introduced a personal income tax waiver for specific foreign taxpayers, including high-income earners, retirees and foreigners working remotely from Thailand.

Institutional reform

Cambodia updated its Law on Investment to streamline administrative processes and introduced the “Cambodia My 2nd Home” visa programme targeting foreign investors with investment capital of at least $100,000 who own real estate in the country.

Indonesia established a Ministry of Investment to facilitate the ease of doing business in the country. Through Presidential Regulation No. 49 of 2021, the government also reduced the number of business sectors that are subject to certain investment requirements.

Myanmar offered currency conversion exemptions for some FDI projects.

Thailand set criteria for high-income earners: those who invest at least $500,000 in government bonds or assets in the form of FDI are considered investors eligible for long-term residence visas.

Issue 1: global tax reform

the G20-OECD BEPS projects proposed a global minimum tax of 15 per cent on the profits of the largest MNEs.

They also proposed taxing foreign-made profits to avoid profit-shifting.

The implimentation will:

be complicated, prolly beyond the capacity of most ASEAN government.

limit the use of Special Economic Zones and tax expenditure in general.

SEZ

ASEAN has more than 1,600 zones of different categories and sizes from small ones to megazones encompassing a few contiguous provinces or states.

Most have been developed to attract FDI by granting tax incentives.

SEZs could still be developed by using non-tax measures, including offering competitive electricity charges from renewable energy sources, promoting green SEZs and providing efficient and connected physical and digital infrastructure.

Issue 2: GVC restructuring

Geopolitical tensions and pandemic-induced supply chain disruptions are key drivers of the recent wave of international supply chain restructuring, as are rising costs.

Investors are diversifying production locations to mitigate future risks, and the ASEAN region is a major beneficiary of this relocation trend.

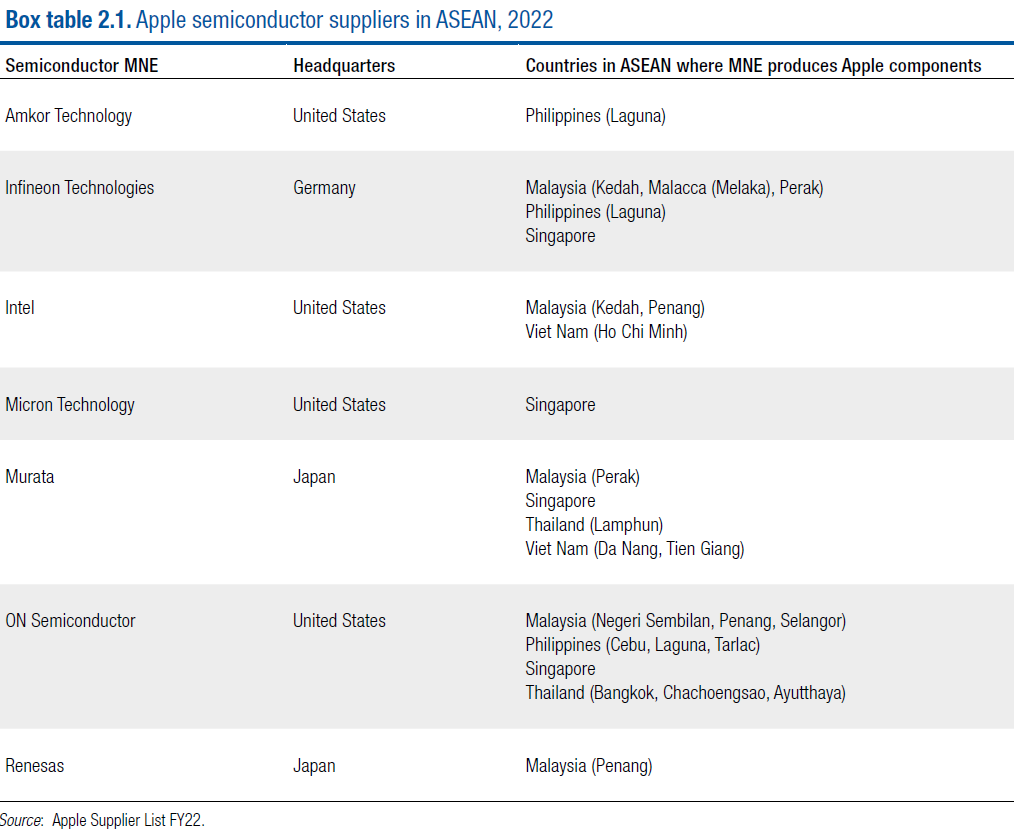

Away from China

Apple (US) in 2019 urged key suppliers such as Foxconn, Pegatron and Wistron (all Taiwan) to explore shifting some production to countries in ASEAN for reasons of supply chain diversification.

These suppliers, along with others such as Goertek (China), established facilities in ASEAN as part of their international supply chain restructuring.

Away from China

Pegatron increased its presence in Viet Nam since 2020 for computer, communication equipment and electronic component manufacturing.

Foxconn expanded in the same host country and other countries in the region. It partially moved the IPAD production to Viet Nam and started construction of a factory in 2020.

Away from China

BOE Technology is building two additional plants in Vietnam.

Apple, along with suppliers Luxshare Precision Industry (China) and Foxconn, started producing Apple watches in Vietnam in 2021.

Foxconn also set up an Apple MacBook production line and Quanta Computer (Taiwan Province of China) is constructing a factory in northern Viet Nam for notebook components in 2022.

Samsung and Intel also large in Vietnam. Recently Intel increase its FDI to Malaysia.

Apple goes ASEAN

Policy options {m}

The role of lead firms and their anchor suppliers complements ASEAN Member States efforts to attract FDI.

Lead firms and anchor firms play an active role in helping to build the region’s supporting industries and in further improving the investment environment as they develop their supply chain ecosystems and strengthen regional production network systems.

Active FDI promotion is warranted for the next few years, with efforts to engage with investors and to promote targeted investment opportunities as more MNEs plan their restructuring of international supply chains.

Restrictions

Myanmar established a committee to monitor foreign currency transactions.

The Philippines created an FDI review mechanism for strategic industries such as those related to the military, cyberinfrastructure and pipeline transportation, and for activities that might jeopardize national security or public safety

UAS

You are tasked to work on an article with ASEAN member countries as a focus.

You can choose to write an issue with ASEAN Member States/Institutions or a variety of issues within a single ASEAN Member State except Indonesia.

Issues include but are not limited to economic/social development, climate change and green transition, industrial policy, digitalization, sovereignty, aerospace, etc.

Rules

- Write a docx or pdf document.

- Use English.

- Write around 2000-3000 words (10% tolerance), not including references and tables/figures.

- Use APA7 for reference if you can, but you can certainly use other reference rules.

- You need a good intro, body, and conclusion sections at the very least.

- I need to see backups for every statement you say, either someone else’s articles, or data. Your own data exploration is preferred.

- Don’t forget to cite papers and data. If I cannot find your source, I will penalize them heavily. Of course you can use articles we used during our meetings.

Rubrik

| No | Point | weigth |

|---|---|---|

| 1 | Introduction | 30% |

| 2 | Main ideas / arguments | 20% |

| 3 | Backups | 40% |

| 4 | English | 10% |

Rubrik

Good context setup/building, Why the issue is important, a glance of what readers can expect from the article, your main points should be here. Good conclusion complement good intro

Your originality, your main stance / thesis given situations you set in the intro. How it ties the issue together.

How good / relevant your backups are to arguments you provide. I will weight data a bit more than articles, but try to mix the two. Even better if you use both.

Your typical TOEFL stuff. This isn’t TOEFL writing test so i will weight it very low.

Submission

Check your EMAS

Deadline is 8 June 2024 23:59

Feel free to work together or contact me if you have questions. I usually can be quite flexible on some stuff.

If I like your article I might ask you to co-write it into a 800words article at EAF, Conversation or newspaper. Of course if you’re confident you can do it yourself.

Till later