ASEAN production network

KPAT

Invalid Date

Today

A reminder on the Global Value Chain.

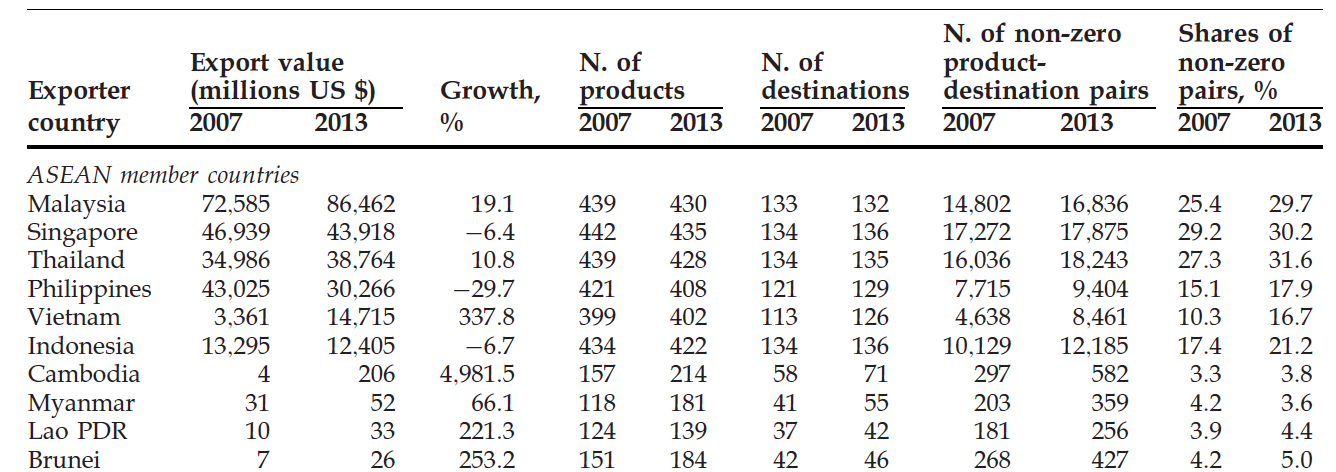

Production network pattern in ASEAN.

Increasing importance of China in the region.

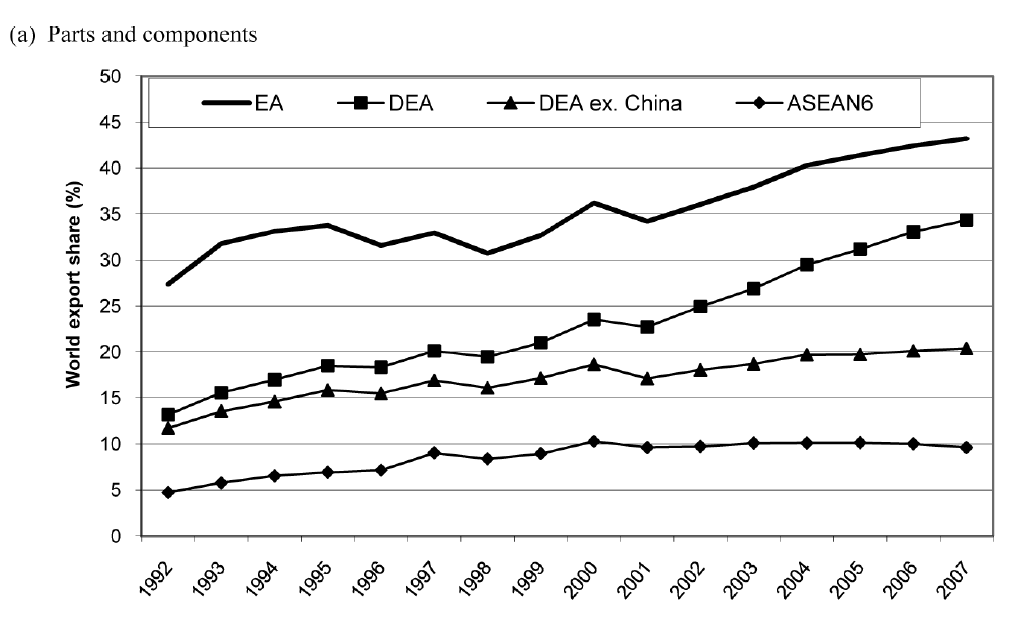

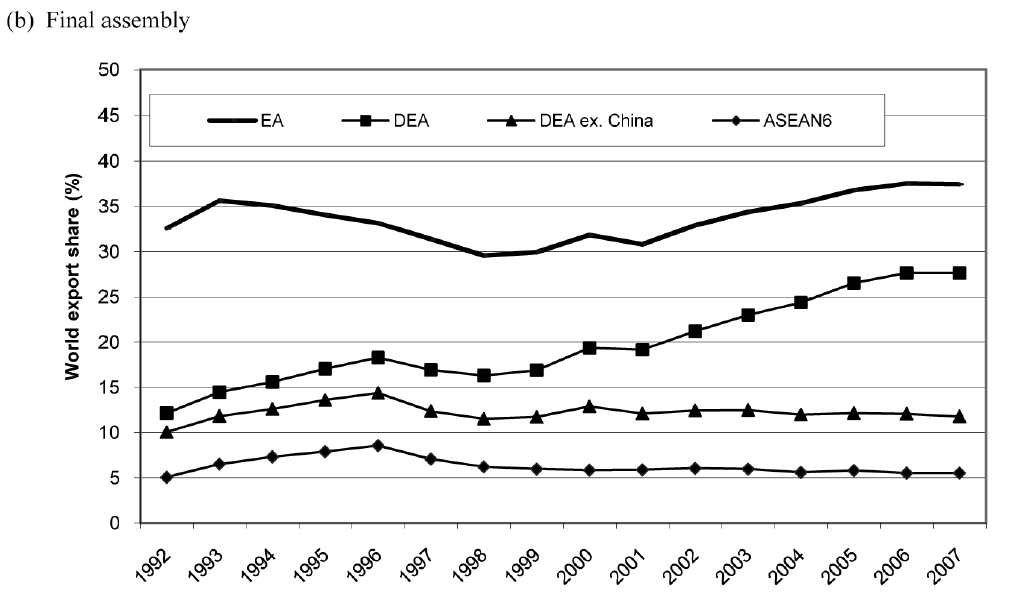

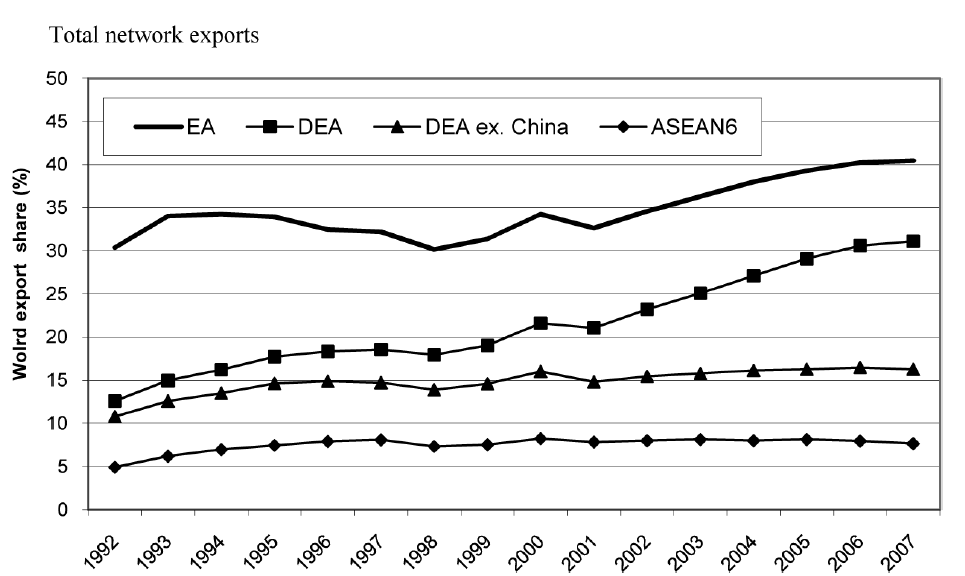

Some stats

East Asian non-oil exports recorded 3-fold increase between 69/70 - 90/07: from 11% of global non-oil exports to 33%.

Japan dominated the 60s and 70s (60% of total east asian exports). This figure drops significantly to 20% in the late 00s.

China has been the main story, but also other regions.

Asian exports are 92% manufacturing goods.

Some stats

Source: Athukorala 2011

Some stats

Source: Athukorala 2011

Some stats

Source: Athukorala 2011

The flying geese

Flying geese model coined by Akamatsu (1961, maybe earlier): Production moves from the lead to rearguard countries, starting with labor-intensive industries.

The Lead geese is Japan

Second tier are South Korea, Singapore, Tainwan and Hong Kong.

Third tier is Thailand, Malaysia, Indonesia

Rearguard: China, Vietnam, etc.

The flying geese

At the beginning, Japan grew faster in Asia (somewhere in the early 1900s to the 1960s)

At some point, Japan wage level became too expensive, and it sources labor-intensive industries to the second tier of the flock.

The second tier grew, then outsource its labor-intensive to the third tier. The second tier then develop its own innovation as well.

At it keeps on happening untul the rearguard.

GVC changed this model slightly in the 80s

Framework

In East Asia, the second unbundling concept has been central to their development strategy.

Kimura (2017) identifies 4 concepts:

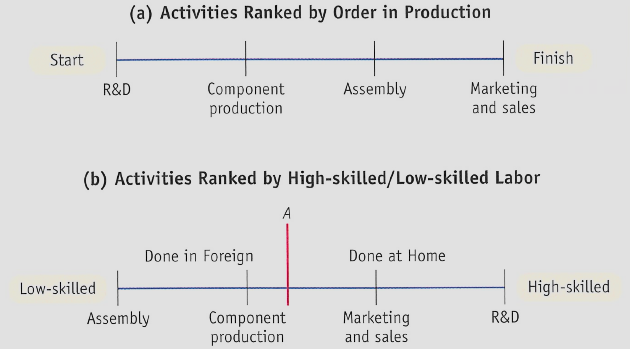

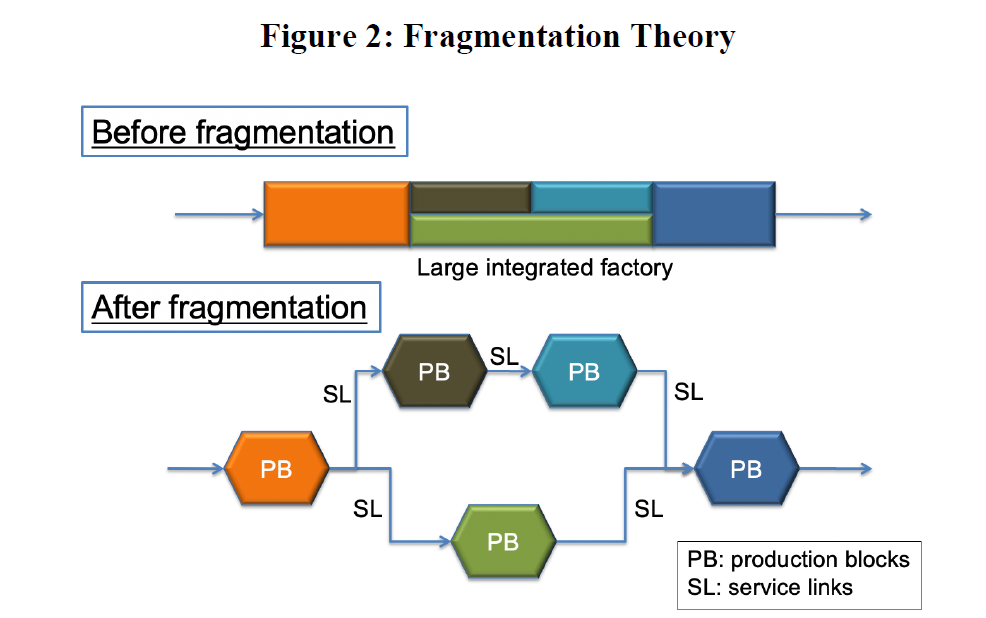

Fragmentation theory (aka. the global value chain)

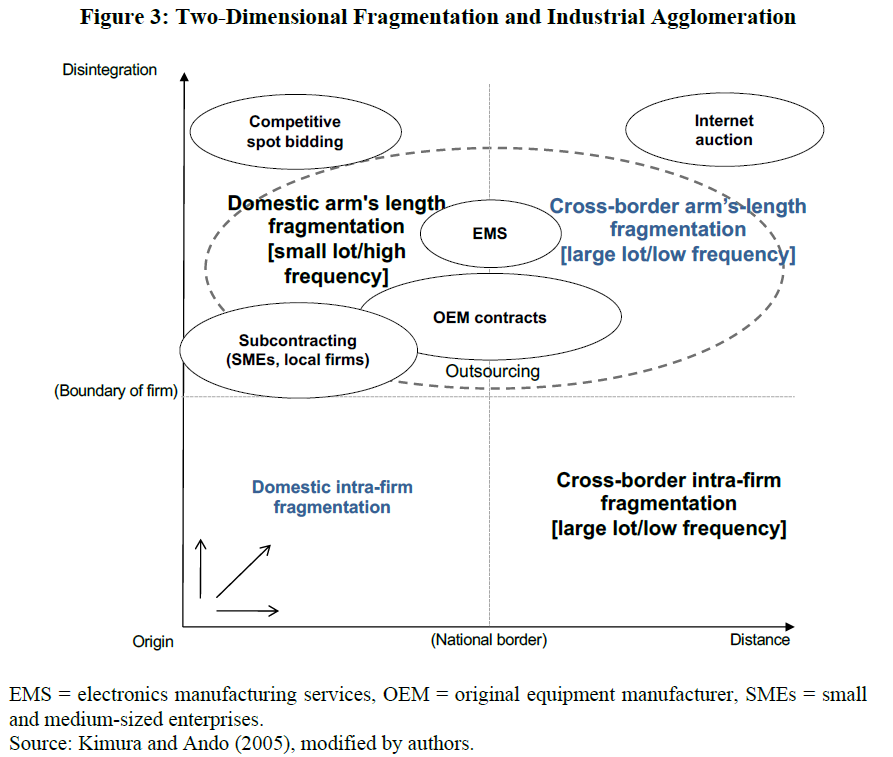

Two-dimensional fragmentation

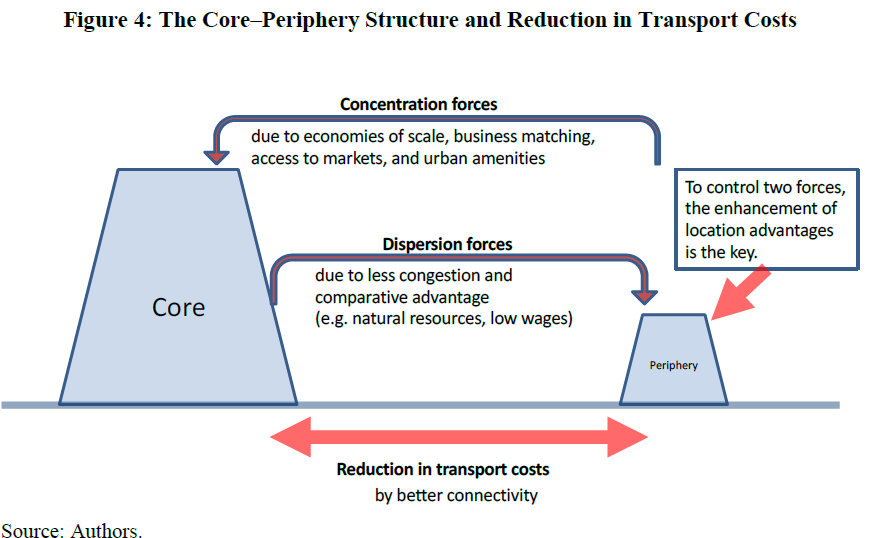

New economic geography

Trade in value added (TiVA)

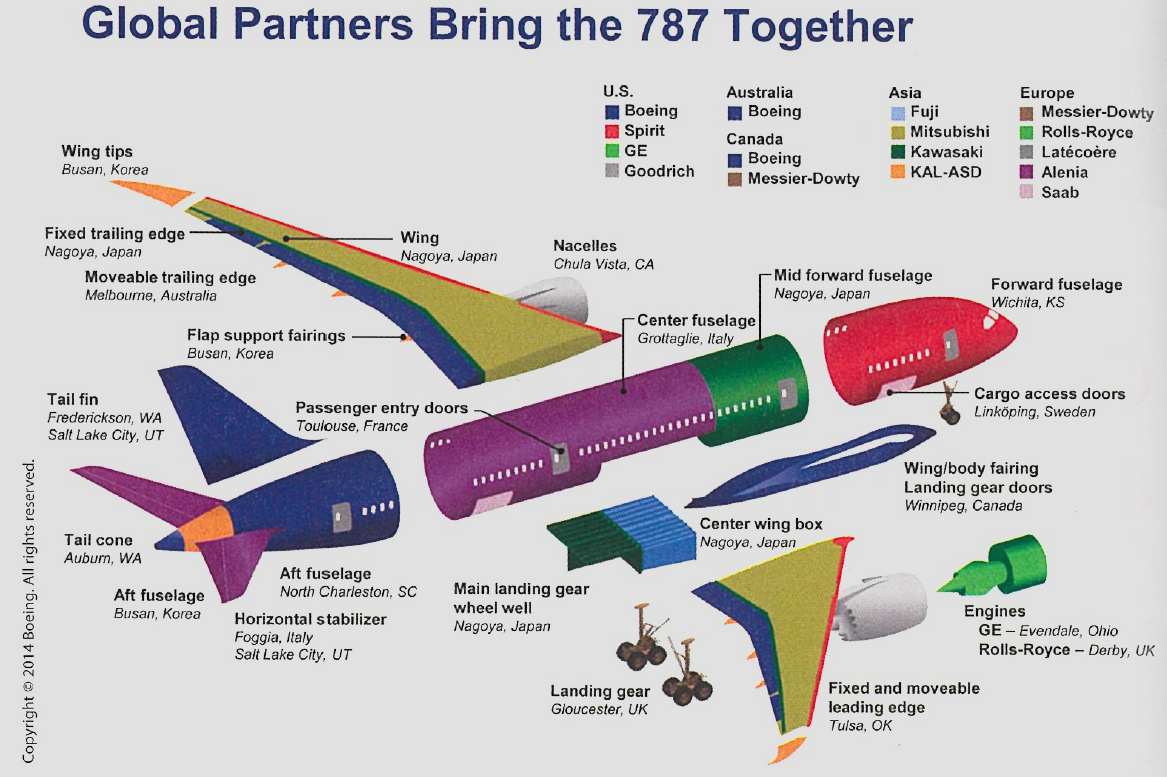

Global Value Chain

Typical Global Value Chain (GVC) of an airplane industry

GVC

large reduction of trade cost mean firms can engage in trades in intermediate inputs.

Activities of a production process can be separated and move into countries with comparative advantage in those sectors.

This changes the calculation of industrial policy: free flow of goods is actually important for firms to marginally exploit its advantage

Labor-abundant countries like Vietnam can participate in the value chain of high-tech products by doing the assembly while import tech-heavy components from abroad.

Backward participation like this is crucial for an industry to learn and upgrade.

GVC

Illustration of a high-tech country’s participation in the GVC

GVC

Source: Kimura 2021

GVC

The prototype of such model in ASEAN was the Penang export processing zone (EPZ) in the 70s to early 80s.

The EPZ manufactured semiconductors with 100% imported components for 100% foreign market (i.e., 100% import and 100% export)

Hong Kong and China relationship on garment and light industries, where HK firms operates in China, utilizing the rules of origins and wage difference.

The important piece (tech owner) is still the head of the geese.

2D Fragmentation

in the firm’s perspective, there are 2 important considerations:

Geograpihcal distance: the farther, the costlier fragmentation becomes.

Control: how much tasks actually gets outsourced

Longer-distance transaction tends to be intra-firm, while closer tasks are usually outsourced.

The close-distance transactions is the backbone of agglomeration in developing countries.

2D Fragmentation

Source: Kimura 2021

Agglomeration

If developing countries want to move up the value-chain, local firms must be able to participate in the value chain.

It often comes through supplying lead firms (typically MNC FDI).

The lead firm often provides schematics and know-how for the SMEs. Out of numbers of them, some may learn and upgrade.

China largely succeed in utilizing this strategy (Chor, Manova, Yu 2021)

Core-periphery

external economies of scale suggests that concentrating a large industry in one place benefit the world by reducing the cost for all.

- This is called concentration forces e.g., scale, matching, market access.

However, comparative advantage of certain tasks create an incentives to move some tasks to a periphery economy

- Dispersion forces e.g., less congestion, low trade cost, wage differences.

nickel is a great example for this model.

Core-periphery

Source: Kimura 2021

TiVA

Using international input–output tables, allows us to measure the domestic/foreign value-added ratios embodied in each country’s production and exports.

This allows us to calculate the upstream–downstream position of each country’s industries.

Although the input–output analysis itself is an old quantitative technique, the TiVA framework enables us to visualise the overall picture of GVCs.

Some stats

Source: Kimura 2017

East Asia network

East Asia’s production network relies mostly on electrical machinery, particularly semi-conductor devices.

This is true for both components and final products.

Automotive is quite the opposite: only 4.7% in East Asia but around 33% in the Americas.

2 posible reasons: protectionism and low value-to-weight ratio.

Chinese role

According to the ASEAN Statistical yearbook 2021, China in 2020:

Largest source of import (23.5% of total ASEAN imports)

Second largest destination of exports (15.7% of total ASEAN exports)

5% of total FDI in the region

More than 22% of total visitors in 2019, the largest.

Chinese role

Trade with China is massive

China-East Asia trade flow accounts for nearly 90% of exports and imports in total manufacturing.

Increased imports of components from East Asia from 18% to 44% of total component imports from 94/95 to 06/07.

Chinese exports to East Asia drop from 55.8% to 33.7%.

“component bias”: China’s component import is increasing, while exporting final goods more to the world.

Chinese diplomacy

Success in economic reform & fast growth in the 1990s instils confidence in the Chinese government in its external relations.

“China’s foreign policy is transforming from inward-looking, mainly concerned about its own development, to outwardlooking, concerned both about its own development and the development of the world.” (Wang Yizhou in 2004).

Zhu Rongji proposed CAFTA (China-ASEAN Free Trade Agreement) in 2001, which was enforced in 2010.

Against the US

Decoupling thesis: after the Asian Financial Crisis in 97/98, Asia will decouple with the west.

IMF and western conditional debt irks many political figures in East Asia.

This “Chinese appeal” was deemed crucial for China to propose the CAFTA.

Conclusion

Manufacturing in ASEAN is closely related to the giants in the region.

GVC and core-periphery models create a unique network where big firms in the region leads.

ASEAN was supposed to be the next-layer Geese, but China increasingly become important as a production base for the lead to supply the world.

Innovative Local firms are important, which ASEAN lack.

Remains to be seen how US-China would affect.

Further study

Earlier studies were focusing on machinery, automotive and electronics.

- Green goods and services are increasingly important.

IO table has been improved and certainly can be useful for your thesis.

You can certainly update figures in this lecture, especially amid various global challenges.

References

Athukorala, P. (2011). Production Networks and Trade Patterns in East Asia: Regionalization or Globalization? Asian Economic Papers, 10(1).

Chor, D., Manova, K., & Yu, Z. (2021). Growing like China: Firm performance and global production line position. Journal of International Economics, 130, 103445. https://doi.org/https://doi.org/10.1016/j.jinteco.2021.103445

George, A., Li, C., Lim, J. Z., & Xie, T. (2021). From SARS to COVID-19: The evolving role of China-ASEAN production network. Economic Modelling, 101, 105510. https://doi.org/https://doi.org/10.1016/j.econmod.2021.105510

Kimura, F., & Narjoko, D. (2021). Reorganisation of production. In F. Kimura, S. Thangavelu, C. Findlay, & M. Pangestu (Eds.), Global Value Chain, Cities, and Urban Amenities: Implications for Trade and Investment Liberalization in East Asia and ASEAN (pp. 366-389). Edward Elgar.

Men, J. (2007). The Construction of the China–ASEAN Free Trade Area: A Study of China’s Active Involvement. Global Society, 21(2), 249-268. https://doi.org/10.1080/13600820701201954

Obashi, A., & Kimura, F. (2017). Deepening and Widening of Production Networks in ASEAN. Asian Economic Papers, 16(1).