| Variables | TFP |

|---|---|

| tariff | -0.371*** |

| SPS | -0.381 |

| TBT | 0.074 |

| Pre-shipment inspection | 0.16 |

| licensing | -0.896*** |

| price control | -10,221 |

| competition | -2.204* |

| export-related | -0.291 |

| dummy FDI | 0.061 |

Seminar Ekonomi Internasional

The heterogeneous impact of tariff and NTMs on Total Factor Productivity of Indonesian firms

Depok, 30 Oktober 2023

I Made Krisna Gupta

Tentang Penulis

Master dari UI-VU Amsterdam di bidang ekonomi

S3 di Australian National University

Senior Fellow di CIPS Indonesia

Staff pengajar di Politeknik APP Jakarta

Social links:

resume di imedkrisna.github.io

Blog di krisna.or.id

twitter di @imedkrisna

Fokus penelitian

larangan ekspor nikel dan industrialisasi EV.

Omnibus Law dan Sovereign Wealth Fund.

tarif dan NTM terhadap impor, kesejahteraan, dan produktivitas.

Kompetisi dan keseimbangan harga di industri makanan.

Kebijakan perdagangan, industrialisasi, dan dampak lingkungan.

Hari ini

Tentang paper terbaru saya.

research process from problem setting, objectives, novel value, hypothesis, methodology, testing, results and conclusions.

Some tips

Q & A about this paper, writing in general, or econ in general is all fine!

Tentang penelitian ini

- Penilitian ini bermaksud mengevaluasi dampak dari berbagai jenis hambatan perdagangan terhadap produktivitas industri.

- Ditemukan bahwa hambatan impor mengurangi produktivitas industri secara heterogen.

- Dampak lartas impor berlawanan dari tujuannya.

- Diterima di Bulletin of Indonesian Economic Studies, versi working paper di ACDE working paper repository.

- Kode replikasi ada di github tapi datanya ga ada

Pendahuluan

Indonesia sedang mengejar pertumbuhan ekonomi yang terfokus pada pertumbuhan manufaktur.

Di era Global Value Chain (GVC), mengimpor nilai tambah melalui backward linkage adalah strategi yang baik (World Bank, 2020):

- Akses terhadap bahan baku yang murah dan berkualitas (Amiti dan Konings, 2007; Bas dan Straus-Kahn, 2014; Castellani dan Fassio, 2019; Ing, Yu dan Zhang, 2019)

- Mempercepat inovasi dan meningkatkan produktivitas (Fernandez dan Farole, 2018; Pane dan Patunru, 2019)

- Meningkatkan kemampuan ekspor ke pasar global yang lebih cuan (An dan Maskus, 2009; Cadot et al., 2013; Fugazza, Olarreaga dan Ugarte, 2017)

Pendahuluan

Tren proteksionisme

- Didorong paham merkantilis dan kekhawatiran akan defisit neraca pembayaran.

- Tarif secara umum meningkat, juga dengan hambatan non tarif (Munadi, 2019)

- Proteksionisme berantai:

- jagung ⇒ ayam

- kain ⇒ baju

Pendahuluan

Penilitian ini bermaksud mengevaluasi dampak dari berbagai jenis hambatan perdagangan terhadap produktivitas industri.

Ditemukan bahwa tarif terhadap barang yang diimpor oleh perusahaan mengurangi produktivitas perusahaan tersebut.

Diantara kebijakan non-tarif, trade licensing dan kuota memiliki pengaruh yang buruk terhadap produktivitas.

Dampak yang heterogen: Perusahaan kecil terdampak lebih serius daripada yang besar.

Approach

Indonesia wants to grow its manufacturing capacity using various intervention (a.k.a. the infant industry argument).

- I am interested in trade barriers e.g., tariff & NTMs

Basically, how policy → industrial growth.

Policy definition is straightforward: tariff and non-tariff (this one’s a bit harder)

how to measure industrial performance? In this paper, TFP is used.

Data

- 1.512 perusahaan dari 2008-2012

- Survey Industri (SI)

- output, jumlah pekerja, asing/domestik

- Data bea cukai:

- impor dengan firm identifier

- Tariff didapat dari berbagai Peraturan Menteri Keuangan dan situs rekan FTA

- NTMs dari UNCTAD TRAINS,

- 7 kategori umum didominasi SPS dan TBT.

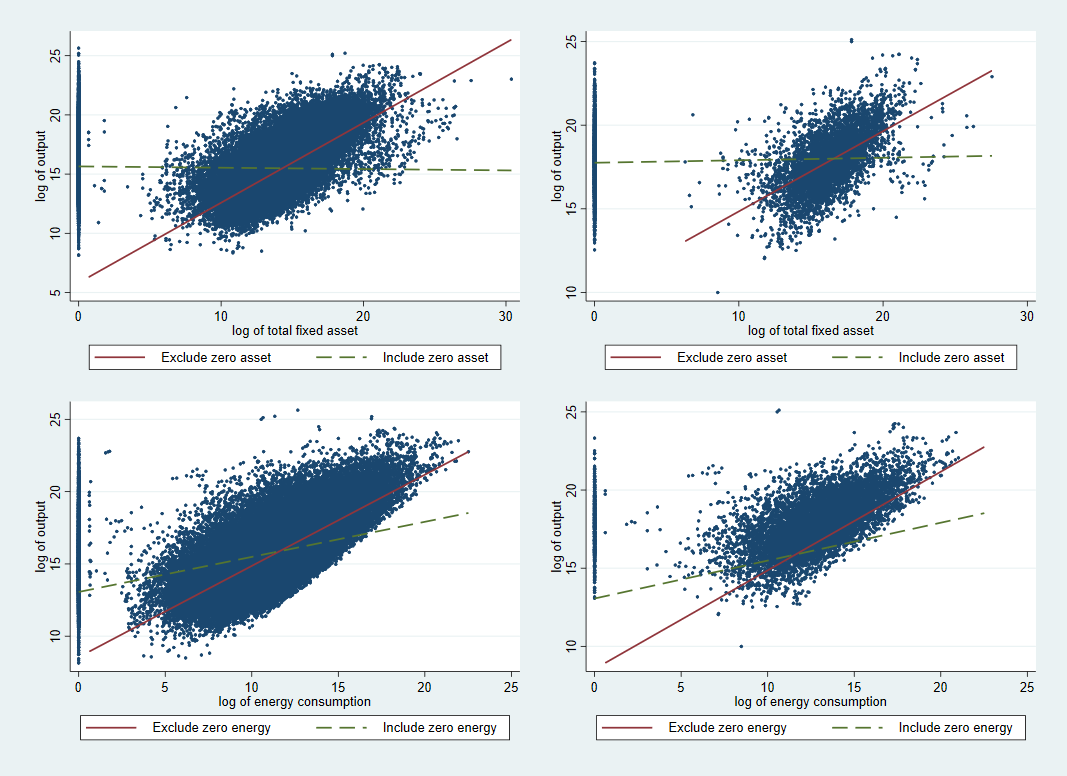

Permasalahan data SI

Vial (2006) dan Marquez-Ramos (2020):

- Datanya banyak yang missing

- Missing data tidak random

- Response rate semakin rendah

zero reports sangat berpengaruh.

Metode: regresi TFP

- Diasumsikan bahwa perusahaan memiliki fungsi produksi cobb-douglass:

Yit=ALβlitKβkitMβmitNβnit (1) - transformasi log:

yit=β0+βllit+βkkit+βmmit+βnnit+μit (2)

Problem endogenitas

Ada informasi asimetris di mana kapital dan material bersifat endogen.

- μit tidak acak, violate OLS assumption

investasi dan material digunakan sebagai instrumen untuk eror yang tidak random.

- missing data menambah pelik permasalahan ini

Eror yang tidak random mengikuti first-order Markov process (Levinsohn dan Petrin, 2003)

Di Stata, command

levpetdapat digunakan. Sekarang adaprodest.

Regresi TFP

- Pertama, estimasi parameter dengan algoritma Levinsohn-Petrin1:

yit=β0+βllit+βnnit+ϕ(mit,kit)+μ∗it (3)

- kemudian prediksi TFP dengan estimated parameters dari step sebelumnya:

TFPit=yit−ˆβllit+ˆβnnit+ˆβmmit+ˆβkkit (4)

Trade policy variable

- Tarif diambil secara semi-manual:

- ada 7 PMK yang mengover 2008-2012 meliputi 10 ribu tariff lines

- Dengan data asal negara, kita dapat mengasosiasikan setiap transaksi dengan tarif yang cocok.

- semua tarif diagregasi per perusahaan.

- NTM juga merupakan agregasi per perusahaan.

Cθit=∑TPθscitVθscit∑Vθscit (5)

Regresi final

- Dengan TFP dan variabel kebijakan perdagangan dengan index firm-year, digunakan TWFE untuk melihat dampak tarif dan non-tarif ke TFP:

tfpit=γ0+∑θγθcθit+∑θδθcθit∗lit+FOit+αi+ISICi+ηit (6)

- parameter δ menunjukan variasi heterogenitas dampak kebijakan perdagangan ke TFP.

Hasil Regresi

| Variables | TFP |

|---|---|

| tariff.l | 0.068*** |

| SPS.l | 0.062 |

| TBT.l | 0.013 |

| Pre-shipment inspection.l | -0.043 |

| licensing.l | 0.147*** |

| price control.l | 1,666 |

| competition.l | 0.413** |

| export-related.l | 0.075 |

| foreign ownership | 0.024* |

Tarif impor, perijinan impor, dan keistimewaan BUMN:

- berdampak negatif pada produktivitas.

- Semakin besar firms, dampak semakin kecil.

Dampak ke tenaga kerja

| Variables | OLS | TWFE |

|---|---|---|

| tariff | -0.260*** | -1.368*** |

| SPS | -0.176 | -1.650*** |

| TBT | 0.064 | 0.452* |

| Pre-shipment | 0.066 | 1.997*** |

| licensing | -0.818*** | -4.455*** |

| Price-control | 14,832*** | 6,015 |

| competition | -0.999 | -2.788*** |

| Export-related | -0.246 | -0.617* |

| foreign dummy | 0.028 | 0.091* |

| Variables | OLS | TWFE |

|---|---|---|

| tariff*l | 0.043*** | 0.251*** |

| SPS*l | 0.021 | 0.288*** |

| TBT*l | -0.008 | -0.095** |

| Pre-shipment*l | -0.008 | -0.345*** |

| licensing*l | 0.140*** | 0.809*** |

| Price-control*l | -2,312*** | -802 |

| competition*l | 0.207 | 0.360** |

| Export-related*l | 0.042 | 0.132** |

| % foreign | -0.009 | -0.007 |

Hasil dari tarif impor dan PI cukup robust.

Secara umum, tarif dan PI berkontribusi mengurangi pertumbuhan penyerapan tenaga kerja.

- perusahaan kecil lebih volatile.

Diskusi kebijakan

Penelitian ini memperkaya bukti bahwa restriksi perdagangan justru mengurangi produktivitas manufaktur.

GVC memperbesar dampak restriksi perdagangan.

- Kebijakan perdagangan semakin penting untuk transisi ekonomi menuju manufacture-based.

Perubahan kebijakan perdagangan berdampak besar ke perusahaan kecil.

- Potensi meningkatnya konsentrasi di industri domestik.

Diskusi kebijakan

- Membatasi impor demi surplus neraca perdagangan malah berakibat sebaliknya:

- Perusahaan yang kesulitan akses bahan baku akan kehilangan pasar ekspor.

- Perusahaan domestik akan mengandalkan pasar domestik ⇒ perlu mark-up extra ⇒ minta proteksi hilir.

- tools moneter lebih efektif untuk manage neraca pembayaran (Irwin, 2022).

- Pemerintah harus senantiasa koordinasi dengan BI.

Other novelties

Shows difference between WITS tariff (widely used by researchers) vs scrapped tariff.

Adds to the compilation of problems with SI data.

Shows heterogeneous effects & fit in the heterogeneous & superstar firms literature.

Shows the importance of imported input, fits the new industrial policy literature.

Caveats

TFP mungkin merefleksikan market power.

- Mungkin dampaknya tidak begitu besar di penelitian ini.

Eksportir dan importir sangat berbeda dengan perusahaan lain.

Data yang tidak sempurna.

- banyak masalah di SI.

- data bea cukai sangat terbatas.

Research process

Gali literatur terkini

- kuliah = head start

- gunakan keyword yang tepat

- Kuliah tamu saya di UI tentang literature review

Pahami teori dan mekanisme, derivasi jika perlu

Simpulkan literatur, temukan gap, kenali kontribusi kita, lalu buat hipotesis.

Siapkan mekanisme identifikasi bukti dan kebijakan.

Mengolah data

Waktu paling banyak habis di sini.

Memahami apakah data yg diperlukan ada semua

- ga ada? Ganti approach.

Data Indonesia umumnya tidak machine friendly

- tapi ada aja udah syukur.

Siapkan dokumentasi yang jelas.

Your supervisor

sering-sering tanya ke pembimbing anda.

jangan pasif. pembimbing anda pasti sibuk. Anda yang harus tau mau tanya apa.

Kalau bimbingan jangan kelamaan. mendingan bimbingan sering tapi progres minim daripada dateng-dateng udah bab 5. Dijamin salah semua.

gak perlu terlalu takut dengan seminar dan sidang. yang penting menguasai.

References

Márquez-Ramos, L. (2020). A Survey of Papers Using Indonesian Firm-Level Data: Research Questions and Insights for Novel Policy-Relevant Research in Economics. Bulletin of Indonesian Economic Studies, 1-49. https://doi.org/10.1080/00074918.2020.1862410

Vial, V. (2006). New estimates of total factor productivity growth in indonesian manufacturing. Bulletin of Indonesian Economic Studies, 42(3), 357-369. https://doi.org/10.1080/00074910601053227

Amiti, Mary, and Jozef Konings. 2007. “Trade Liberalization, Intermediate Inputs, and Productivity: Evidence from Indonesia.” The American Economic Review 97 (5): 1611-1638. https://doi.org/10.1257/000282807783219733

An, Galina, and Keith E. Maskus. 2009. “The Impacts of Alignment with Global Product Standards on Exports of Firms in Developing Countries.” World Economy 32 (4): 552-574. https://doi.org/10.1111/j.1467-9701.2008.01150.x

Bas, Maria, and Vanessa Strauss-Kahn. 2014. “Does importing more inputs raise exports? Firm level evidence from France.” Review of World Economics 150 (2): 35.

Cadot, Olivier, Alan Asprilla, Julien Gourdon, Christian Knebel, and Ralf Peters. 2015. Deep Regional Integration and Non-Tariff Measures: A Methodology for Data Analysis. United Nations (New York and Geneva: United Nations)

Castellani, Davide, and Claudio Fassio. 2019. “From new imported inputs to new exported products. Firm-level evidence from Sweden.” Research Policy 48 (1): 322-338. https://doi.org/10.1016/j.respol.2018.08.021

Fugazza, Marco, Marcello Olarreaga, and Christian Ugarte. 2017. “On the heterogeneous effects of non-tariff measures: Panel evidence from Peruvian firms.” UNCTAD Blue Series Papers 77. https://ideas.repec.org/p/unc/blupap/77.html

Ing, Lili Yan, Miaojie Yu, and Rui Zhang. 2019. “the evoltion of export quality: China and Indonesia.” In World Trade Evolution: Growth, Productivity and Employment, edited by Lili Yan Ing and Miaojie Yu. Abingdon, New York: Routledge.

Levinsohn, James, and Amil Petrin. 2003. “Estimating Production Functions Using Inputs to Control for Unobservables.” The Review of economic studies 70 (2): 317-341. https://doi.org/10.1111/1467-937x.00246

Munadi, Ernawati. 2019. Indonesian non-tariff measures: updates and insights. Economic Research Institute for ASEAN and East Asia (Jakarta: Economic Research Institute for ASEAN and East Asia).

Pierola, Martha Denisse, Ana Margarida Fernandes, and Thomas Farole. 2018. “The role of imports for exporter performance in Peru.” The World Economy 41 (2): 550-572. https://doi.org/10.1111/twec.12524

Pane, Deasy, and Arianto Patunru. 2019. “Does export performance improve firm performance? Evidence from Indonesia.” Working Papers in Trade and Development 05

World Bank. 2020. World Development Report 2020 : Trading for Development in the Age of Global Value Chains. Washington, DC: World Bank.

Irwin, D. A. (2022). The Trade Reform Wave of 1985-1995. National Bureau of Economic Research Working Paper Series, No. 29973. https://doi.org/10.3386/w29973

Beberapa summary statistics

Firms’ Characteristics

Table 1. Firms’ characteristics, 2008-2012

| Characteristics | All_SI | Non_customs | Customs_only |

|---|---|---|---|

| foreign ownership (%) | 8.15 | 5.96 | 34.77 |

| foreign ownership (%) | (26.17) | (22.60) | (45.06) |

| fraction of output exported (%) | 0.23 | 0.21 | 0.4 |

| fraction of output exported | (37.52) | (0.37) | (0.42) |

| fraction of input imported (%) | 0.08 | 0.07 | 0.31 |

| fraction of input imported (%) | (0.24) | (0.21) | (0.38) |

| no. of labour employed | 191.07 | 162.75 | 535.44 |

| no. of labour employed | (711.73) | (602.46) | (1,457.65) |

| capital stock (Million IDR) | 198 | 194 | 250 |

| capital stock (Million IDR) | (44,800.00) | (46,500) | (10,400) |

| total intermediate input (Million IDR) | 50.8 | 41 | 170 |

| total intermediate input (Million IDR) | (617.00) | (515) | (1,330) |

| total output (Million IDR) | 90.3 | 73.3 | 296 |

| total output (Million IDR) | (958.00) | (861) | (1,740) |

| total value added (Million IDR) | 38.5 | 31.6 | 123 |

| total value added (Million IDR) | (455.00) | (414) | (789) |

| value added per labour (IDR) | 137,987.10 | 126,074 | 282,857 |

| value added per labour (IDR) | (2,515,300.00) | (2,600,177) | (1,012,159) |

| No. of observation | 117,598 | 108,662 | 8,915 |

Non-Tariff Measures

Table 2. Mean (St.Dev) of each NTM for all HS-6-digits

| NTM | Codes | N2008 | N2009 | N2010 | N2011 | N2012 | Examples |

|---|---|---|---|---|---|---|---|

| Sanitary & Phytosanitary (SPS) | A | 1.715 | 2.337 | 2.222 | 2.255 | 2.774 | Authorization requirements |

| Sanitary & Phytosanitary (SPS) | A | (2.644) | (4.018) | (3.950) | (4.054) | (5.128) | Quarantine requirements |

| Technical Barrier to Trade (TBT) | B | 0.481 | 0.455 | 0.641 | 0.682 | 0.663 | Testing requirements |

| Technical Barrier to Trade (TBT) | B | (0.962) | (0.978) | (1.334) | (1.361) | (1.352) | labeling requirements |

| Pre-shipment inspections and other formalities | C | 0.562 | 0.466 | 0.443 | 0.462 | 0.776 | pre-shipment inspection |

| Pre-shipment inspections and other formalities | C | (1.202) | (1.081) | (1.059) | (1.046) | (1.075) | only trough specific ports |

| Non-automatic licensing, quotas, QC, etc | E | 0.623 | 0.56 | 0.605 | 0.618 | 0.594 | licensing |

| Non-automatic licensing, quotas, QC, etc | E | (0.809) | (0.818) | (0.873) | (0.861) | (0.853) | quota |

| Price-control measures, extra taxes, charges | F | 0 | 0 | 0.015 | 0.014 | 0.016 | customs service fee |

| Price-control measures, extra taxes, charges | F | (0.000) | (0.000) | (0.168) | (0.165) | (0.168) | consumption tax |

| Measures affecting competition | H | 0.019 | 0.052 | 0.05 | 0.048 | 0.046 | Only SOEs |

| Measures affecting competition | H | (0.139) | (0.238) | (0.233) | (0.229) | (0.224) | - |

| Export-related measures | P | 0.901 | 0.704 | 0.708 | 0.683 | 1.172 | export permit |

| Export-related measures | P | (1.172) | (1.132) | (1.109) | (1.098) | (1.465) | export quota |

| observations | - | 1,675 | 2,204 | 2,318 | 2,400 | 2,510 | - |

Simple average of tariffs from 2008-2012

Table 3. Tariff from MoF regulations (left) compared to WITS (right)

| Kind | T2008 | T2009 | T2010 | T2011 | T2012 |

|---|---|---|---|---|---|

| MFN | 7.049 | 7.612 | 6.928 | 6.975 | 6.96 |

| MFN | (12.213) | (12.536) | (8.037) | (7.231) | (7.145) |

| ASEAN | 2.478 | 2.49 | 0.15 | 0.15 | 0.15 |

| ASEAN | (11.094) | (11.206) | (4.559) | (4.559) | (4.559) |

| China | 7.049 | 3.819 | 2.193 | 2.208 | 1.941 |

| China | (12.213) | (12.673) | (7.941) | (7.941) | (7.927) |

| South Korea | 7.049 | 2.624 | 1.912 | 1.912 | 1.542 |

| South Korea | (12.213) | (12.265) | (7.131) | (7.131) | (7.102) |

| India | 7.049 | 7.612 | 6.394 | 5.874 | 5.341 |

| India | (12.213) | (12.536) | (7.809) | (7.517) | (7.322) |

| Japan | 6.11 | 4.639 | 3.274 | 2.618 | 2.23 |

| Japan | (11.967) | (12.356) | (7.353) | (7.114) | (6.487) |

| ANZ | 7.049 | 6.446 | 2.948 | 2.278 | 1.545 |

| ANZ | (12.213) | (11.922) | (6.765) | (6.318) | (6.065) |

| Kind | T2008 | T2009 | T2010 | T2011 | T2012 |

|---|---|---|---|---|---|

| MFN | 7.762 | 7.595 | 7.564 | 7.051 | 7.053 |

| MFN | (12.631) | (12.456) | (12.412) | (7.015) | (7.016) |

| ASEAN | - | 1.84 | 1.843 | 0.152 | 0.152 |

| ASEAN | - | (11.079) | (11.067) | (4.285) | (4.287) |

| China | - | 3.665 | 2.743 | 1.85 | 1.579 |

| China | - | (12.342) | (12.392) | (6.853) | (6.823) |

| South Korea | - | 2.564 | 2.56 | 1.698 | 1.326 |

| South Korea | - | (12.087) | (12.084) | (6.395) | (6.349) |

| India | - | - | - | 5.409 | 4.991 |

| India | - | - | - | (6.726) | (6.620) |

| Japan | - | - | - | - | - |

| Japan | - | - | - | - | - |

| ANZ | - | - | - | - | - |

| ANZ | - | - | - | - | - |

Coverage ratio

- Table 5 shows simple mean (a) and coverage ratios (b)

- Import licenses and quotas are more important than SPS and TBT

- Coverage ratios vs simple mean:

- no visual difference on tariff

- firms import more goods with NTMs

Table 5a. Simple average

| Variable | Mean | St.Dev. | Min | Max |

|---|---|---|---|---|

| Tariff | 3.503 | 4.971 | 0 | 150 |

| SPS (A) | 0.108 | 0.718 | 0 | 29 |

| TBT (B) | 0.140 | 0.663 | 0 | 13 |

| Pre-shipment inspection (C) | 0.028 | 0.214 | 0 | 5 |

| Licensing, quota, etc (E) | 0.321 | 0.550 | 0 | 6 |

| Price control etc (F) | 0.000 | 0.008 | 0 | 2 |

| Competition measures (H) | 0.007 | 0.083 | 0 | 2 |

| Export-related (P) | 0.063 | 0.376 | 0 | 7 |

Table 5b. Coverage Ratio

| Variable | Mean | St.Dev. | Min | Max |

|---|---|---|---|---|

| Tariff Coverage Ratio (T) | 3.420 | 5.646 | 0 | 150 |

| Coverage ratio A | 0.246 | 0.931 | 0 | 19 |

| Coverage ratio B | 0.202 | 0.478 | 0 | 9 |

| Coverage ratio C | 0.059 | 0.237 | 0 | 4 |

| Coverage ratio E | 0.337 | 0.468 | 0 | 6 |

| Coverage ratio F | 0.000 | 0.001 | 0 | 0 |

| Coverage ratio H | 0.014 | 0.083 | 0 | 1 |

| Coverage ratio P | 0.110 | 0.353 | 0 | 7 |